Following a record-setting year in 2020, the U.S. industrial sector managed to do it again and continued its unprecedented growth throughout the year. Despite obstacles presented from all links of the supply chain – port congestion, labor shortage, transportation costs and historically low warehouse vacancy rates – the industrial sector flourished with many occupiers spending top-dollar for much-needed high quality space. E-commerce growth continues to be a driving factor for industrial expansion and 2021’s holiday spending did not disappoint. According to the National Retail Federation, 2021 holiday sales grew 14.4% to a record $886.7 billion, with e-commerce accounting for 11.3% of sales, or $218.9 billion – exceeding earlier estimates of 8.5%. This growth in retail sales bodes well for the coming year, and all expectations point to further demand for warehouse distribution space, especially near already-tight port markets.

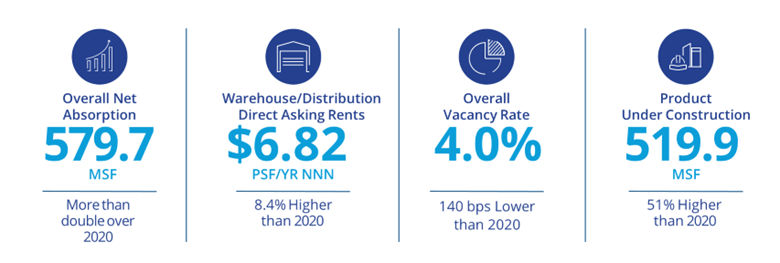

Given the strong consumer demand throughout last year, the U.S. industrial sector continued to post encouraging fundamentals at year-end. Overall net absorption totaled 579.7 million square feet year-to-date, with 163.7 million square feet of occupancy gains recorded in the fourth quarter. These record-setting totals are more than double the previous record of 288.9 million square feet recorded in 2016.

Year-end new supply totaled 370.7 million square feet, 0.8% higher than the 367.9 million square feet recorded at this time last year and the highest year on record. New supply to meet the insatiable demand of the industrial sector is not expected to subside as the industrial construction pipeline remains remarkably active. Nearly 520 million square feet remain under development, approximately 51% more than what was under construction at the end of 2020. The Chicago industrial market delivered the most product in 2021, totaling 30.9 million square feet, while the Dallas-Fort Worth market remains the top market for product under development with 59.3 million square feet underway.

Year-end new supply totaled 370.7 million square feet, 0.8% higher than the 367.9 million square feet recorded at this time last year and the highest year on record. New supply to meet the insatiable demand of the industrial sector is not expected to subside as the industrial construction pipeline remains remarkably active. Nearly 520 million square feet remain under development, approximately 51% more than what was under construction at the end of 2020. The Chicago industrial market delivered the most product in 2021, totaling 30.9 million square feet, while the Dallas-Fort Worth market remains the top market for product under development with 59.3 million square feet underway.

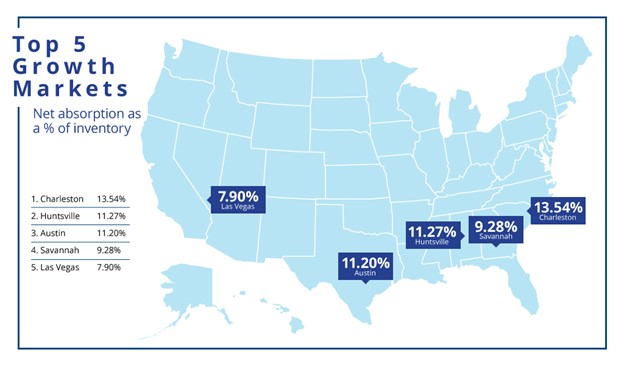

Sixty markets posted year-end occupancy gains greater than 1 million square feet at the end of 2021, with Chicago, Dallas, Atlanta, Inland Empire and Houston leading the way. Just one market, Eastern Idaho, posted negative absorption at the end of the year – a market with just 9.6 million square feet of inventory. The markets experiencing the most activity growth (absorption as a percent of inventory) include emerging markets such as Charleston, Austin, Las Vegas and Savannah. Demand for logistics and distribution space, primarily fueled by e-commerce occupiers, supports the strong growth seen in these cities. The voracious need for modern warehouse space strengthened the industrial sector in unanticipated ways, and the positive momentum experienced in 2021 is expected to continue in the coming year. Although issues that face many ports in the U.S. persist, including capacity concerns, increased freight rates, and lasting port congestion, it’s all the more reason that the modernization of warehousing and technology remains a high priority. The industrial market has proven that it can weather the storm and come out stronger on the other end. With the spectacular closing of 2021, look for higher occupancies and an abundance of high-quality industrial space to be added to the market in 2022.

The voracious need for modern warehouse space strengthened the industrial sector in unanticipated ways, and the positive momentum experienced in 2021 is expected to continue in the coming year. Although issues that face many ports in the U.S. persist, including capacity concerns, increased freight rates, and lasting port congestion, it’s all the more reason that the modernization of warehousing and technology remains a high priority. The industrial market has proven that it can weather the storm and come out stronger on the other end. With the spectacular closing of 2021, look for higher occupancies and an abundance of high-quality industrial space to be added to the market in 2022.

U.S. National Research

U.S. National Research

Raul Saavedra

Raul Saavedra

Mike Spears

Mike Spears Greig Lagomarsino

Greig Lagomarsino Peter Danna

Peter Danna Christopher Sheehan

Christopher Sheehan

Matt Gannon

Matt Gannon Craig Hurvitz

Craig Hurvitz