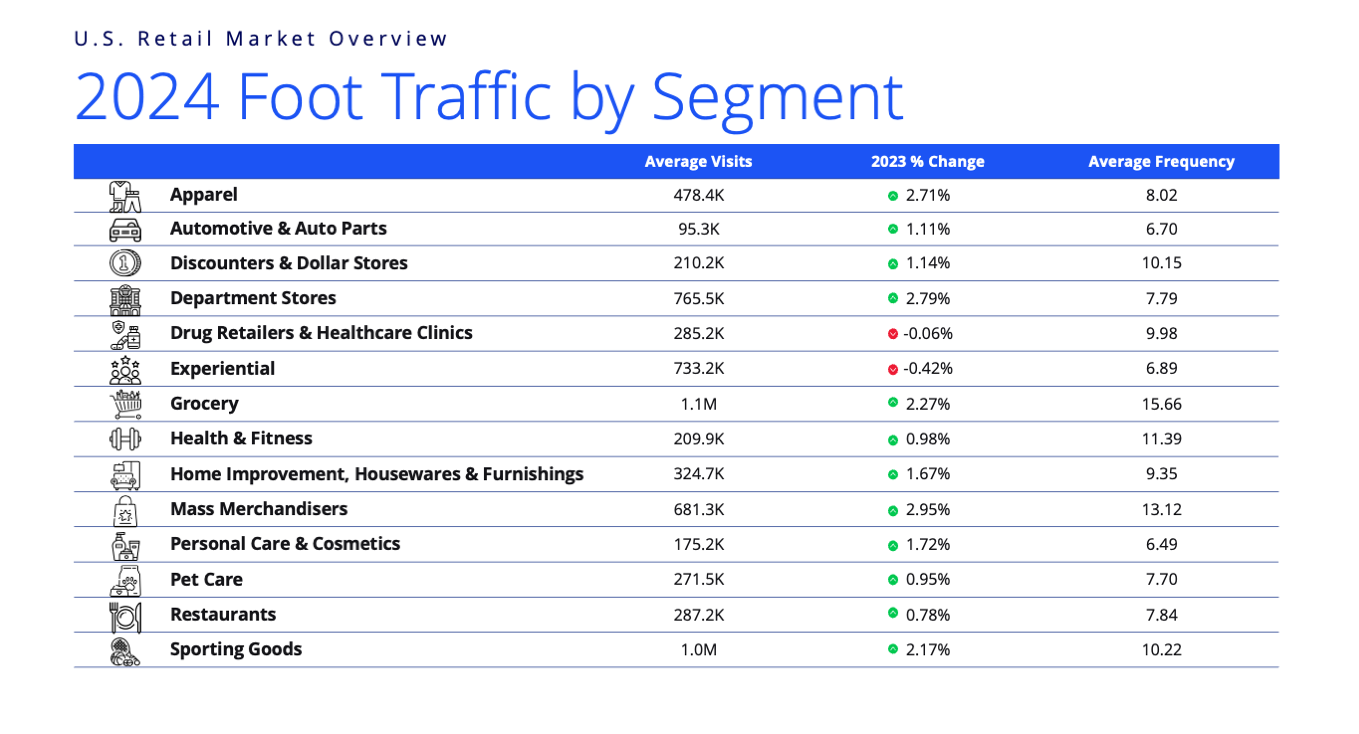

In 2024, the retail landscape continued to evolve, with some sectors demonstrating remarkable resilience amid economic uncertainties. Grocery, sporting goods, and mass merchandise emerged as the continuing top performers in foot traffic for the second year in a row, reflecting shifting consumer priorities toward convenience, health-consciousness, and value-driven shopping experiences.

Category Insights

Merchandising

Retailers like Walmart, Target, and Costco (and, yes, Amazon) saw a strong rebound as consumers favored the convenience of one-stop shopping for a wide range of products. Costco was the only retailer to increase dwell time between H1 2021 and H1 2024, likely due to its bulk shopping model and in-store experience, with U.S. visitors spending an average of 37.3 minutes in stores, exceeding Walmart (31.8 minutes) and Target (28.7 minutes), according to Placer.ai. While consumers value efficiency, they are still willing to spend more time in stores that offer a compelling mix of value, selection, and an engaging shopping environment. Recent tariffs imposed on imports from Canada, Mexico, and China as major retailers are expected to face rising operational costs, leading to price hikes on groceries, electronics, and household items, and consumers should prepare for higher prices.

Sporting Goods

The U.S. sporting goods market was expected to reach $115.8 billion by the end of 2024, with retailers facing declining sales and increased competition despite strong consumer interest. Foot traffic rose by 2.17% over 2023, driven by demand for athletic apparel, home workout gear, and recreational equipment. eCommerce is projected to grow 7.3% annually, reaching $53 billion by 2028. Post-pandemic health awareness remains high, with 70% of Americans prioritizing wellness and 60% using social media for fitness and nutrition inspiration.

Grocery

In 2024, grocery stores experienced a surge in community engagement, welcoming over 1 million customers and achieving a 2.27% increase in foot traffic. Shoppers increasingly embraced hybrid shopping experiences, blending in-store visits with digital tools like store apps and price comparison platforms. This shift in consumer behavior mobilized strategic expansions across the grocery segment. Aldi maintained its aggressive growth trajectory, opening 23 new stores in 2024 and upgrading infrastructure toward its 1,500-location goal. Publix ventured into new territory, making its Kentucky debut with stores in Louisville and Lexington. Meanwhile, Whole Foods tested innovative formats, launching its “Daily Shop” mini-market concept in Manhattan’s Upper East Side. The smaller footprint store, focused on grab-and-go essentials for urban shoppers, is a prototype for planned expansions in Washington, D.C., and beyond.

Restaurants

While dining out remains a popular activity, the slight increase in foot traffic for restaurants in 2024 is only 0.78% compared to the previous year, reflecting a minor uptick but no significant surge. Dining out has dwindled as people become more selective, likely due to economic concerns or changing lifestyle habits. Quick-service restaurants (QSRs) are experiencing the smallest decline in visits with their more affordable convenience options, and are expected to see the highest spending in 2025, with an estimated $323.7 billion. People prioritize cost-effective choices, which explains why QSRs continue to attract steady traffic despite the decline.

Outliers

Among the lowest-ranking categories for foot traffic in 2024, automotive retail, personal care, and discount dollar stores saw a modest 1.3% average increase, lagging behind other sectors. The decrease in dwell time in 2024 is likely linked to the decline of underperforming discount stores like Dollar General and Family Dollar. Additionally, the rise of e-commerce—particularly in personal care and automotive products—has reduced the need for in-store visits as consumers increasingly opt for online shopping and subscription services. AutoZone, for instance, is expanding its distribution center network to support its growing e-commerce, with plans to open 200 stores across the U.S. As we move into 2025, the retail landscape continues to transform. Emerging technologies and changing consumer preferences will likely accelerate the integration of digital and physical shopping experiences. Retailers who anticipate these shifts will be best positioned to thrive in an increasingly dynamic market.

Anjee Solanki

Anjee Solanki

Nicole Larson

Nicole Larson