This series has explored the macro shifts underway in the global economic landscape, with a particular focus on the resurgence of manufacturing and the evolving dynamics in commercial real estate. In this final installment, I’ll delve into the implications of reshoring and some critical considerations to help corporations and investors strategically position themselves for success in this era of deglobalization.

“Deglobalization is one of the most important trends facing investors today.” – Larry Fink, CEO, BlackRock

Manufacturing Renaissance Presents a Rare, Time-Sensitive Opportunity

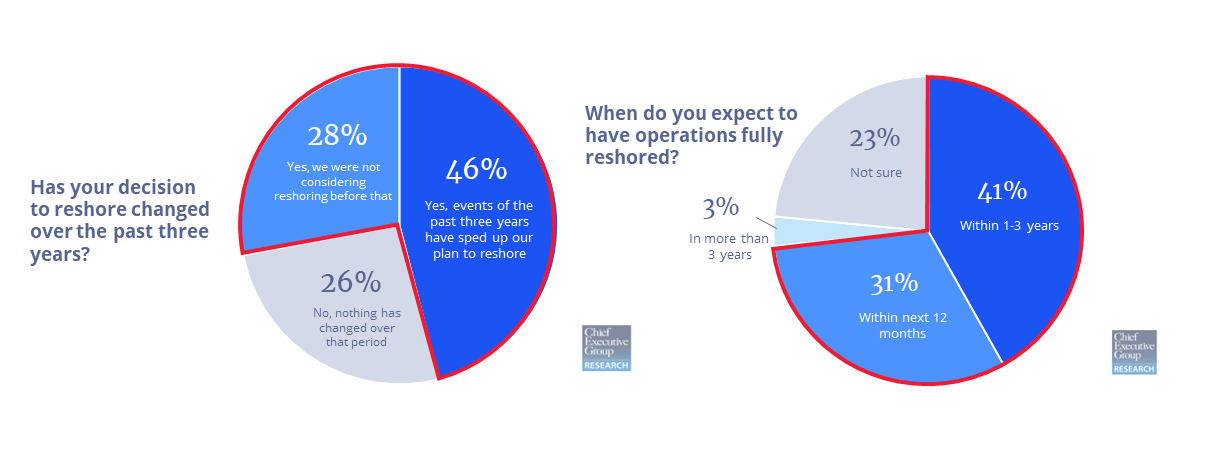

The surge in billion-dollar-plus projects announced in 2022 underscores a monumental shift in the manufacturing sector. A 2023 survey from Chief Executive Group shows that nearly three-quarters (74%) of companies have either decided to reshore or accelerated the process in the last three years. And even more importantly, 72% of CEOs expect their operations to be fully reshored in the next three years, accentuating the need for existing manufacturing assets.

So what’s driving this push to onshore manufacturing? Economic incentives play a pivotal role. Companies are capitalizing on lucrative financial benefits, often tied to producing goods in the U.S. With many incentives set to begin winding down between 2030 and 2032, there is also a higher urgency to act.

The opportunity lies not just in new developments but in repurposing existing manufacturing facilities as they have access to the heavy utility infrastructure traditional, big-box distribution centers lack.

U.S. Ports Navigating the Seas of Change

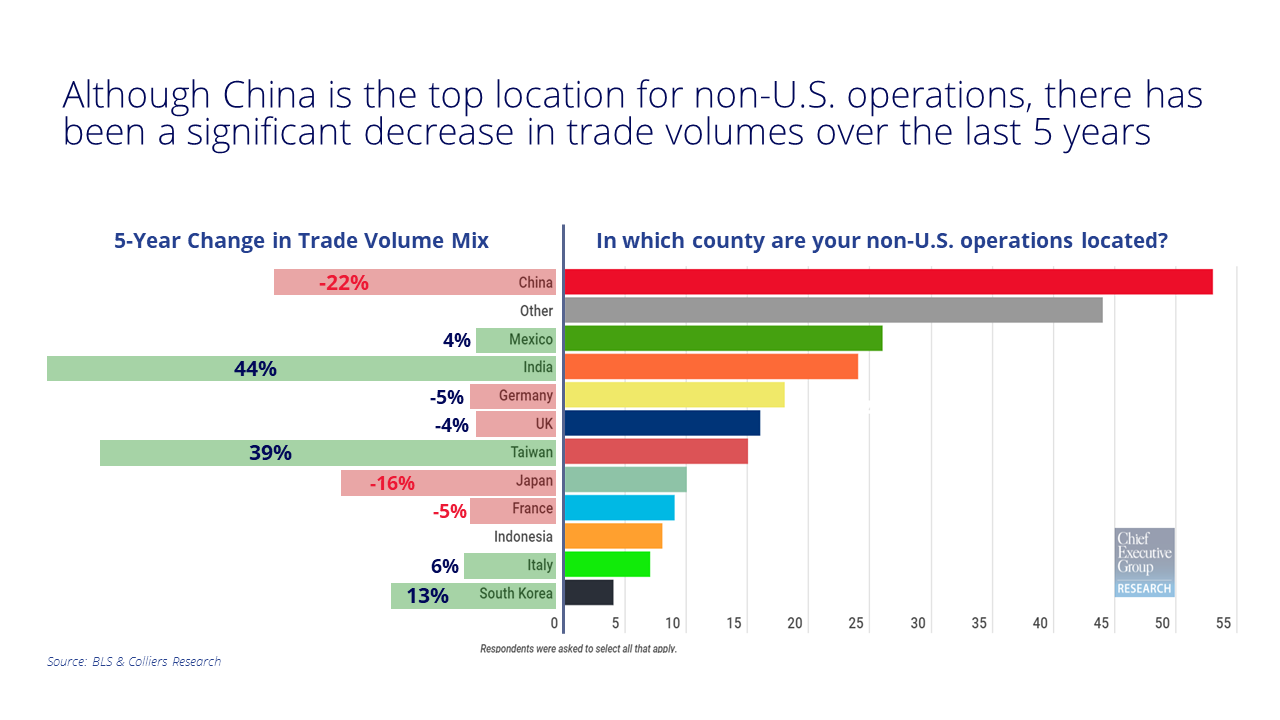

Survey data from Chief Executive Group on non-US operations locations is revealing: While China dominates with over 55% of respondents having operations there, the strength of our trade ties is changing. Total trade volume over the last five years indicates a significant shift in market share as China has dropped from being our primary trading partner to third place, with Canada and Mexico now leading the pack. As China’s market share has declined with the U.S. by 22%, India’s has grown by 44% as it emerges as a significant growth hub, alongside Taiwan, which has also experienced notable expansion.

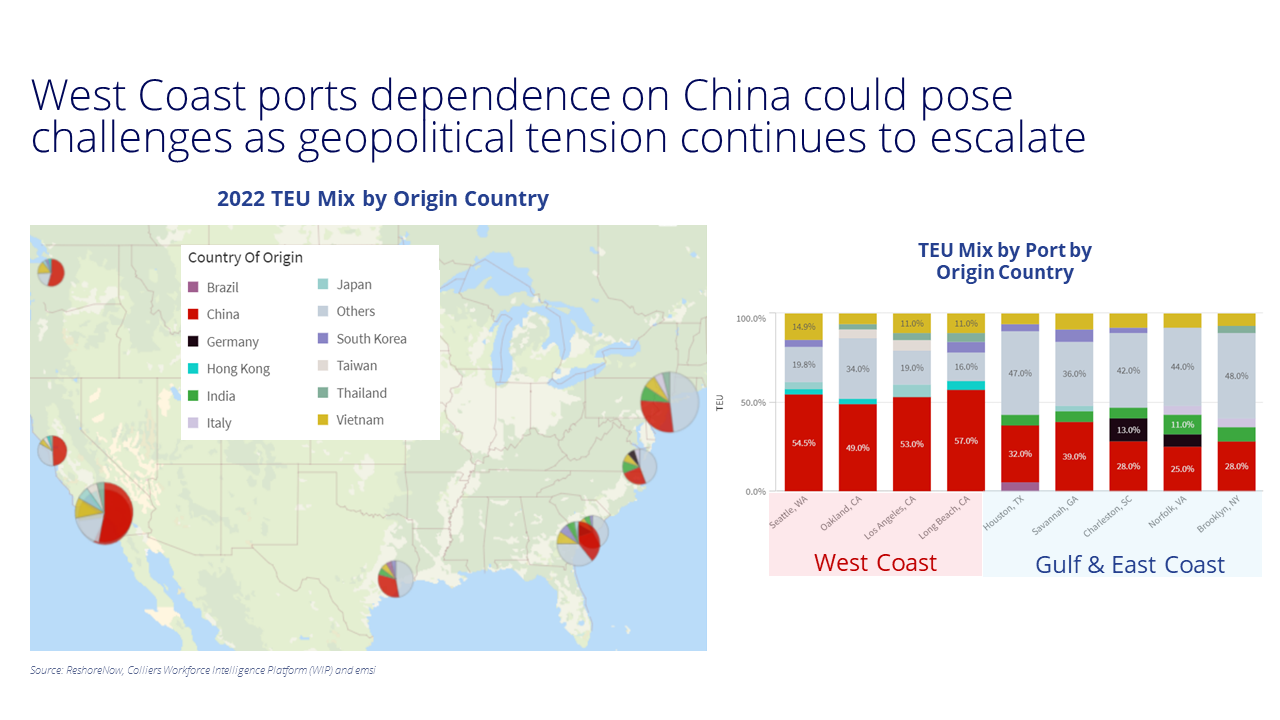

The dependency of port markets on specific trade partners is crucial to understanding future growth. West Coast ports are historically highly reliant on trade with China as they account for 50% of the point of origin across every West Coast port other than Oakland where they make up 49% of the inbound volume. This is a stark contrast to the East Coast and Gulf Coast ports show more diversity in trade partners with only Savannah relying on China for more than one-third of inbound volumes.

As we consider the implications of these shifts, it’s essential to assess not just the current dynamics but the structural changes that may be underway.

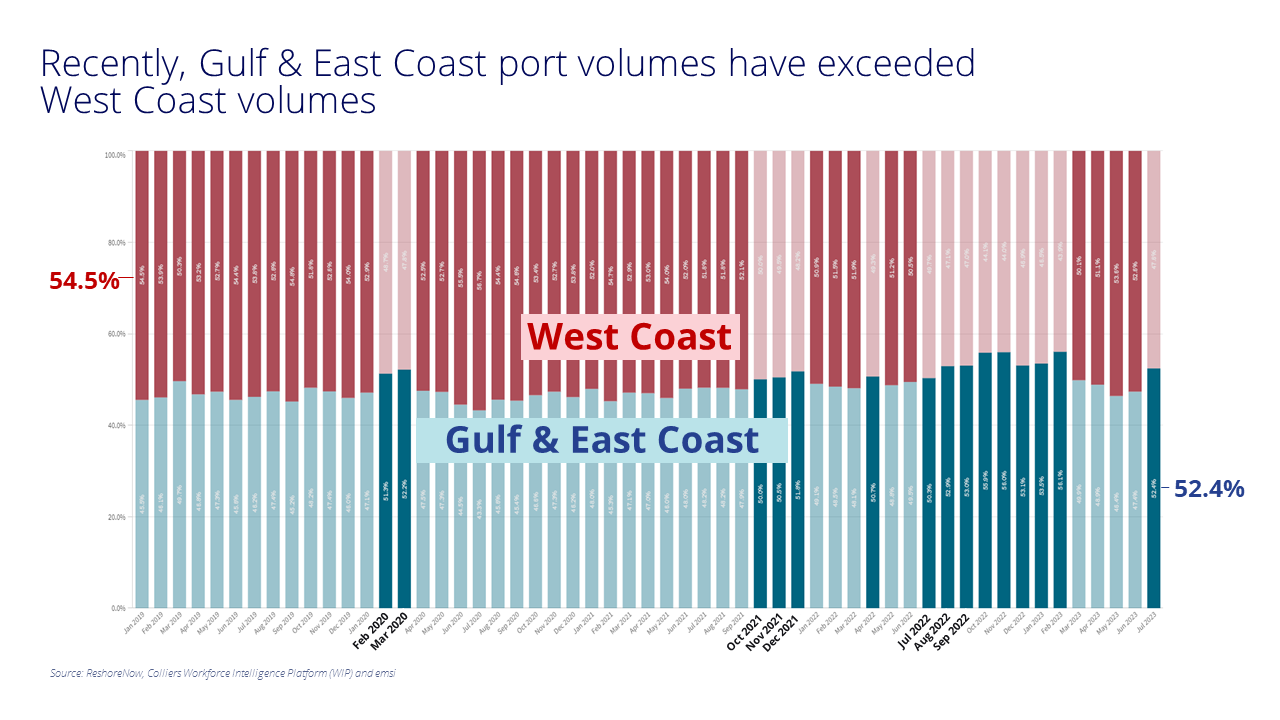

Monthly tracking of port TEUs since January 2019 illustrates the evolving market share between East and West Coast ports. The East Coast’s market share surpassed the West Coast in December 2022, though recent fluctuations beg the question: Is this a structural change or a reaction to temporary factors like trade disputes?

Obstacles to Reshoring Operations

Reshoring operations in the United States face a myriad of obstacles that can impede successful implementation. Atop the list is labor availability and costs. Skilled trades and technical blue-collar talent are increasingly scarce as we have been offshoring these jobs for the last four decades. Yet, access to such talent is critical to effective operations.

Thus, the geographic winners in terms of onshoring jobs are the states with lower-cost, business-friendly operating environments and a historical manufacturing base of skilled talent across the Midwest and Sunbelt.

Looking Ahead

As we close this series, understanding the intricacies of these macro trends across deglobalization, the green transition, labor shortages, higher-for-longer rates, and the impact of AI will be critical to seizing opportunities and mitigating risks. Beyond the bottom line, considerations of risk, affordability, and energy availability will shape the future of real estate decision-making. Colliers’ Location Intelligence practice is leveraging insights around the implications of these macroeconomic shifts to inform decisions and provide corporations and investors a competitive advantage in today’s hyper-dynamic market landscape.

Bret Swango, CFA

Bret Swango, CFA

Craig Hurvitz

Craig Hurvitz Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka