An annual mark-to-market exercise identifies cost savings opportunities across a real estate portfolio. Metrics like strike price, market vacancy, and a “landlord’s willingness to negotiate a change now” provide occupiers potential leverage points to use in upcoming negotiations, and optionality for relocation within the marketplace should it be necessary. It also presents the opportunity for a meaningful engagement between business units and corporate real estate organizations to align on business plans moving forward, which can lead to more coordination amongst the teams, greater operational efficiency, and additional cost savings.

Best Practices and Key Metrics

Most mark-to-market exercises are commonly focused on locations with upcoming lease expirations (<12 months of the remaining term). However, we have found this exercise is most beneficial between 18 and 36 months in advance of lease expiration to provide enough time to secure relocation and additional options, should they be required. Along with these locations, best practice dictates taking an “80/20” approach, or, analyzing the 20% of the portfolio that accounts for 80% of the annual cost. Time and energy should be spent on the largest sites which have the biggest impact on the portfolio.

Strike price is the most valuable data point to obtain. This is defined as the agreed-upon price the space under examination would lease for in the current market given the landlord’s position, vacancy in the building, the space’s position within the stack (i.e., floor), and vacancy within the market. Comparing the strike price to a client’s current rental rate unveils immediate potential savings in “Above” market locations. “How likely the landlord is to renegotiate a change now” is typically measured on a scale of 1- 5, with 1 being “very likely” as the building may have significant vacancy and/or cashflow issues and the client is below market, and 5 being “unlikely” as the building has low vacancy, is owned by an institutional landlord, and the tenant is above market. These data points, coupled with “business demand” information, dictate the future strategy of the location – downsize, renew in place, relocate, etc.

Analyzing Results

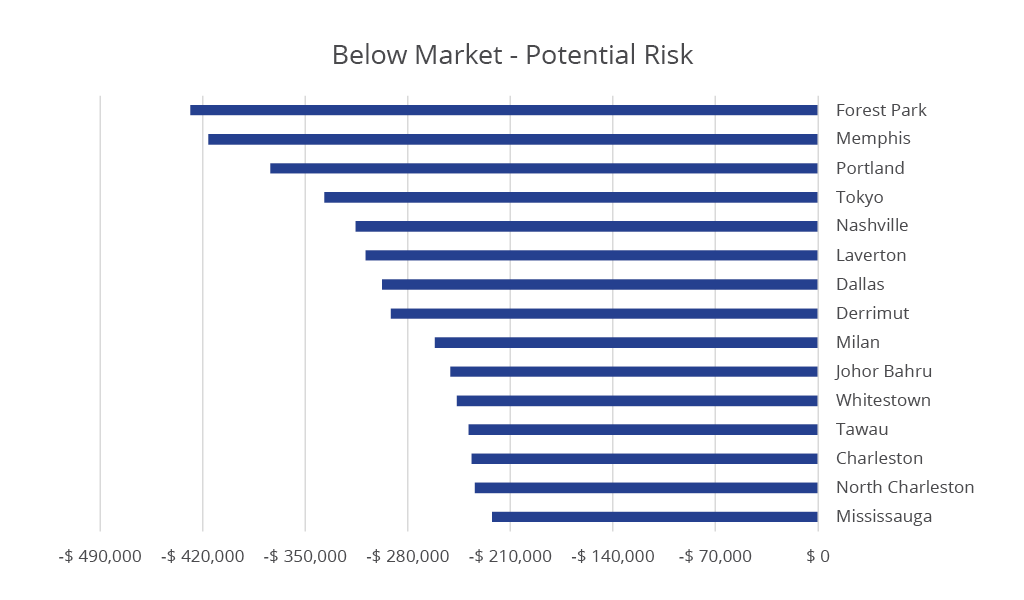

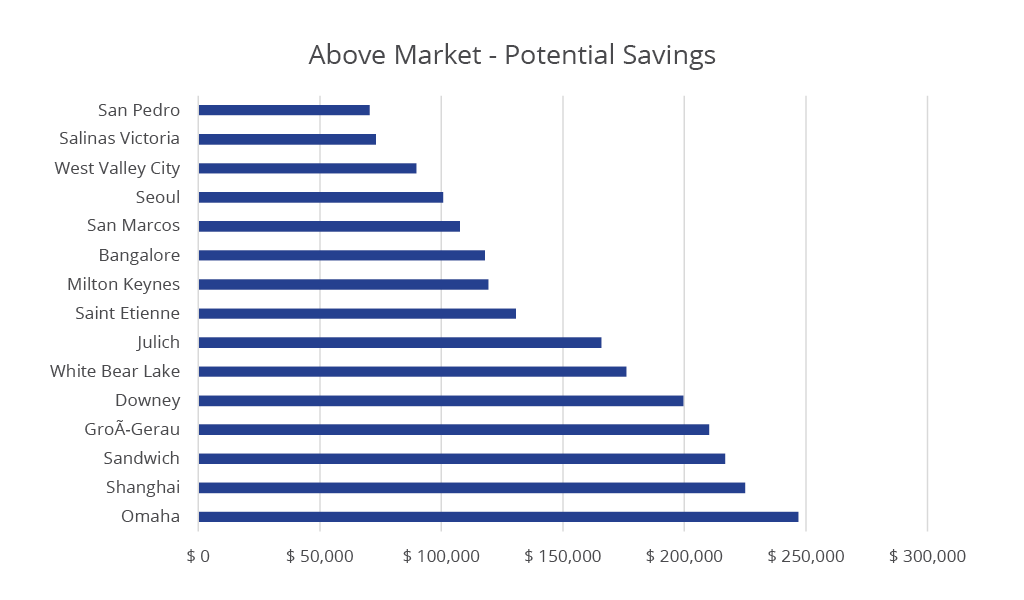

Mark-to-market results fall into three buckets: Above, At, and Below market. While savings opportunities fall in the “Above” market category, “Below” market locations pose the greatest risk of a rent increase upon renewal. Ideally, leases have renewal caps negotiated within them, however, leases that do not require the client’s Finance team to budget for an increase.

Elements to consider for above market locations include the amount of time remaining on the lease, market vacancy, how well the space is liked, and the amount of capital that has been invested into the space. Locations with lease expirations 18 – 36 months out have the best opportunity to relocate as it allows time to survey the market and prepare for a move. Market vacancy rates affect alternative options as markets with low vacancy tend to favor the landlord and keep rates high. Finally, if the business has invested a significant amount to fit-out the space, potential book value write-offs will come into consideration.

Above-market locations that work well for the business or have benefited from substantial capital investments can pursue an aggressive renewal strategy to be brought down to market. A common negotiation strategy is leveraging the potential of relocation as a way to motivate the landlord. This is particularly useful in a high-vacancy market. Whether or not this is successful will depend on factors like the landlord’s size (“mom & pop” versus institutional), the amount of time left on the lease, the quality and location of the building, and market vacancy. Institutional landlords tend to be less amenable to modifying a current lease unless there is high vacancy in the building, and they need to keep the tenant for cash flow and valuation purposes.

Another potential strategy for these sites is executing a “blend & extend”, where the occupier exchanges an extension of the current lease for a rental reduction. A renewal or extension can be a win-win for both tenant and landlords as it prevents the added costs and headache of a move and preserves cashflow. Above-market locations that do not work well for the business and/or are in markets with high vacancy are strong candidates for relocation. The amount of time left on the lease will make a difference – less time equates to fewer options.

Annual Mark-to-Market exercises identify overpriced and underutilized properties and develop strategies to maximize value. While conducting a mark-to-market on an annual basis may seem like a heavy lift, optimizing the real estate portfolio to capture savings often justifies the investment. The exercise also serves as an ideal opportunity to engage with the business and determine go-forward strategies for the portfolio.

Carter Sapp

Carter Sapp

Sheena Gohil

Sheena Gohil Bob Shanahan

Bob Shanahan Dougal Jeppe

Dougal Jeppe Kai Shane

Kai Shane

Bret Swango, CFA

Bret Swango, CFA Michelle Cleverdon

Michelle Cleverdon

Craig Hurvitz

Craig Hurvitz