Houston healthcare providers deploying capital to real estate to expand medical services to a growing population

The effects of the energy downturn on job growth in Houston is obvious as employment has shrunk 0.4 percent year-to-date in the energy capital of the world. Despite the job losses in Houston associated with the oil and gas sector, employment growth in the healthcare sector remains strong. New hospital construction is on the rise, helping to offset declines in construction activity in the office and industrial sectors tied to the energy industry.

Also: Broker and lawyer collaboration in lease negotiations | WeWork raises the bar for workplaces

(CoyDavidson.com)

Houston’s rapid population growth has resulted in an increased demand for medical services not only at the Texas Medical Center but also in the suburbs. Health systems and providers are spending more than $3 billion to expand and construct hospitals, medical office buildings and specialized medical facilities throughout the Houston area.

Plus: Rent is more than just rent | Lease or own my office space?

Large, new hospital projects and renovations totaling millions of square feet have been announced or are underway at the Texas Medical Center and in the Woodlands and other suburban business districts.

(CoyDavidson.com)

New hospital construction and expansion projects:

Texas Medical Center

- Houston Methodist Hospital ($540M; 470,000 SF)

- Memorial Hermann Hospital ($650M; 1,340,000 SF)

- Texas Children’s Hospital ($506M; 640,000 SF)

- MD Anderson ($198M; 185,000 SF)

The Woodlands

- Houston Methodist Hospital ($328M; 470,000 SF)

- Texas Children’s Hospital ($360M; 548,000 SF)

- Memorial Hermann Hospital ($25M; expansion of campus)

- CHI St. Luke’s ($60M; 55,000 SF)

Northwest Houston | Cypress

- Memorial Hermann ($168M; 321,000 SF)

Sugar Land | Southwest

- Houston Methodist ($131M; 130,000 SF)

- Memorial Hermann ($78M; 150,000 SF)

West Houston | Katy

- Memorial Hermann ($70M, 155,555 SF)

- Texas Children’s Hospital ($50M; 75,000 SF)

Pearland

- Memorial Hermann ($80M; 250,000 SF)

Medical office buildings

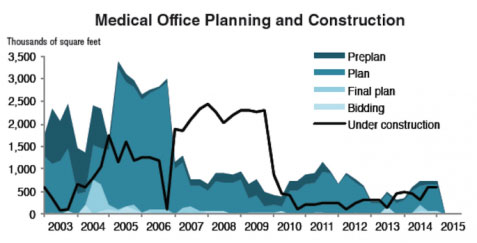

Medical office space under construction has accelerated in 2014 and in the first quarter 2015, from both health systems and third-party developers.

The transition of healthcare delivery is driving new corporate real estate strategies as Health Systems are increasingly building or leasing new outpatient facilities for treating patients outside the hospital campus setting, often in suburban markets away from the main hospital campus.

Larger projects tend to be “on campus” developments, but smaller projects are popping up in high-growth suburban areas all over the Houston metropolitan area.

Houston MOB construction

(Federal Reserve Bank of Dallas)

New medical office buildings under construction

- Houston Methodist Orthopedics & Sports Medicine Center

- CHI St.Luke’s — Springswood Village

- Memorial Hermann Sugar Land Medical Plaza 2

- Memorial Hermann Pearland Medical Plaza 2

- Kelsey Seybold Clinic — Katy

- Integrated Medical Plaza — Webster

- Spring Valley Medical Plaza

- Mason Creek Medical Office Building

While medical office buildings on or near hospital campuses are still very much in demand, primary care clinics, urgent care clinics and freestanding emergency facilities are quickly popping up in fast-growing suburban areas located in shopping centers or on freestanding pad sites throughout the Houston area.

Healthcare arms race

The healthcare industry is going through an enormous transition period due to the Affordable Care Act, advances in technology and the graying of our population. The demand for healthcare real estate is robust in Houston as providers seek to develop and occupy properties that that are best suited to meet the population’s desire for more convenient locations, as well as capture the most desirable patient demographics. The “arms race” for market share is on among Houston’s largest healthcare providers in one of the nation’s fastest growing metropolitan areas, and real estate is the weapon of choice.

Coy Davidson is Senior Vice President of Colliers International in Houston. He publishes The Tenant Advisor blog.

Coy Davidson

Coy Davidson

Marc Shandler

Marc Shandler Josh Cramer

Josh Cramer

Shawn Janus

Shawn Janus