The Chicago region has one of the most diverse economies on the globe. According to World Business Chicago, it is the third-largest area in the country and has a population base of 9.7 million. Chicago employs over 4.6 million people, with a gross metropolitan product (GMP) of more than $630 billion; this number is expected to rise by up to 3.0% by the end of 2016. The area’s big box industrial market serves this base, and consists of 285 facilities 300,000 square feet or larger with ceiling heights of 28’ clear or higher, totaling 160 million square feet. These big box buildings continue to be the main driving force behind the impressive pace witnessed in the Chicago industrial market.

Despite positive net absorption for the 14th consecutive quarter, the vacancy rate among modern big box facilities 300,000 square feet and larger in Chicago’s industrial market increased by 14 basis points during the second quarter to 7.51%. This was due to the completion of three vacant speculative developments and several new vacancies being introduced in second-generation space adding more than 3.4 million square feet of vacant space to the market. Although the vacancy rate increased, it remains 180 basis points below the 9.31% rate recorded one year ago. Net absorption among big box buildings during the second quarter of 2016 totaled 3.6 million square feet. Big box activity represented 68.3% of the 5.3 million square feet of net absorption recorded among all buildings in Chicago’s industrial market.

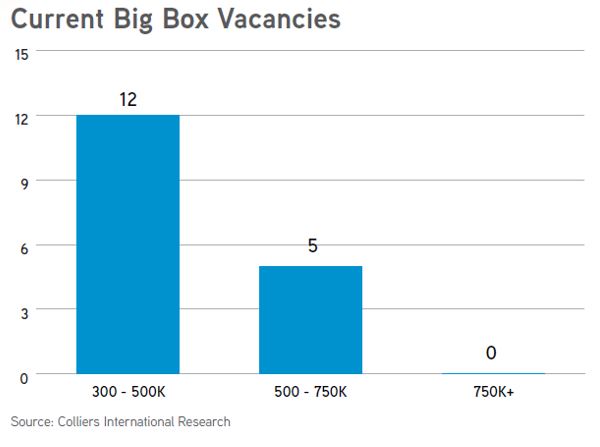

Users looking for big box spaces 500,000 square feet or larger, only have five options throughout the Chicago industrial market. There are currently no vacancies 750,000 square feet or larger. However, this will soon change as several projects are underway or planned that will result in several additional options for both size ranges.

New leasing volume among big box facilities totaled 2.9 million square feet during the second quarter, nearly identical to the new leasing activity recorded during the first quarter. The two largest new leases of the quarter were completed by e-commerce giant, Amazon.com. The online retailer leased the 767,161-square-foot building at 1125 Remington Boulevard in Romeoville and the 746,772-square-foot speculative facility recently completed at 201 Emerald Drive in Joliet’s Laraway Crossings Business Park. Other noteworthy big box leases included a 720,000-square-foot lease in Wilmington’s RidgePort Logistics Center by breakfast cereal producer MOM Brands Company (recently acquired by Post Holdings) and a 453,568-square-foot lease of 1120-1140 Remington Boulevard in Romeoville’s Windham Industrial Center by furniture retailer the Room Place. The I-55 Corridor submarket represented 67% of the new big box leasing activity recorded during the second quarter.

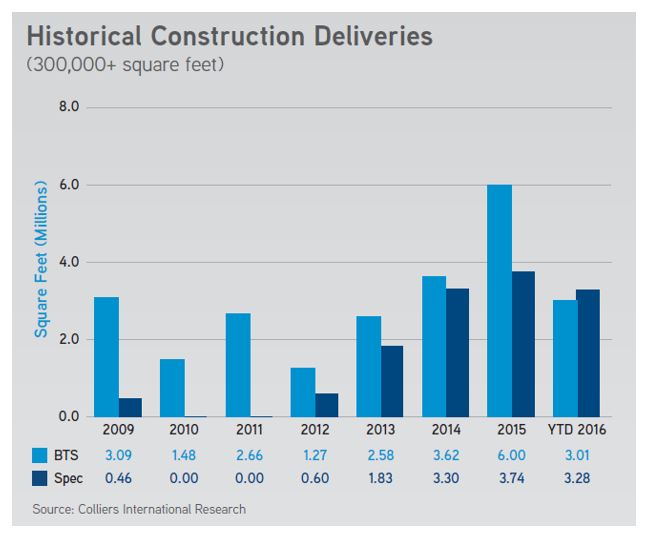

Six big box construction projects were completed during the second quarter, totaling nearly 3.7 million square feet. Four of these projects were built on a speculative basis and only one was leased upon delivery to Amazon.com. A total of 11 big box construction projects were started during the second quarter, bringing the total ongoing projects to 20. There are currently 11.7 million square feet of big box construction projects underway in the market, of which 13 projects, representing 52.9% of the ongoing construction activity, are being built on a speculative basis. The remaining seven developments totaling 5.5 million square feet are build-to-suit projects or building additions.

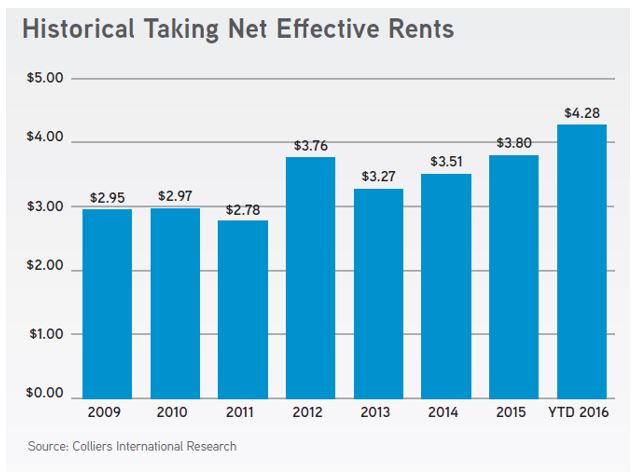

The average net effective taking rent for big box spaces was $4.28 per-square-foot net during the first quarter of 2016, a slight increase when compared to the $4.23 per-square-foot average net effective rate recorded in the first quarter. This average figure can vary quarter to quarter depending on how many big box leases are signed and where they are located in the market, as certain submarkets demand higher rental rates than others.

For Colliers | Chicago’s most up-to-date market analyses please visit the research section of our website.

Craig Hurvitz is vice president of market research at Colliers International | Chicago and leads the Industrial Advisory Group’s market research initiative. Craig is responsible for managing and maintaining the industrial properties database, which includes property sales and leases, tenant information and comparable transactions. He has a deep understanding of the Chicago-area industrial real estate market and provides in-depth analyses, reports and market trends that are referenced by a diverse group of clients including landlords, appraisers and developers.

Craig Hurvitz

Craig Hurvitz

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen