The Chicago metropolitan industrial market continued to thrive during the second quarter. Sixteen construction completions, many sizeable new leases and expansions, and continued consolidation of tenants from multiple warehouses into larger state-of-the-art facilities resulted in net absorption totaling 4.8 million square feet for the quarter. Due to this impressive demand, the industrial vacancy rate decreased by 11 basis points to 6.94%, the first time this rate has dropped below the 7.0% threshold in 15 years.

VACANCY AND SUPPLY

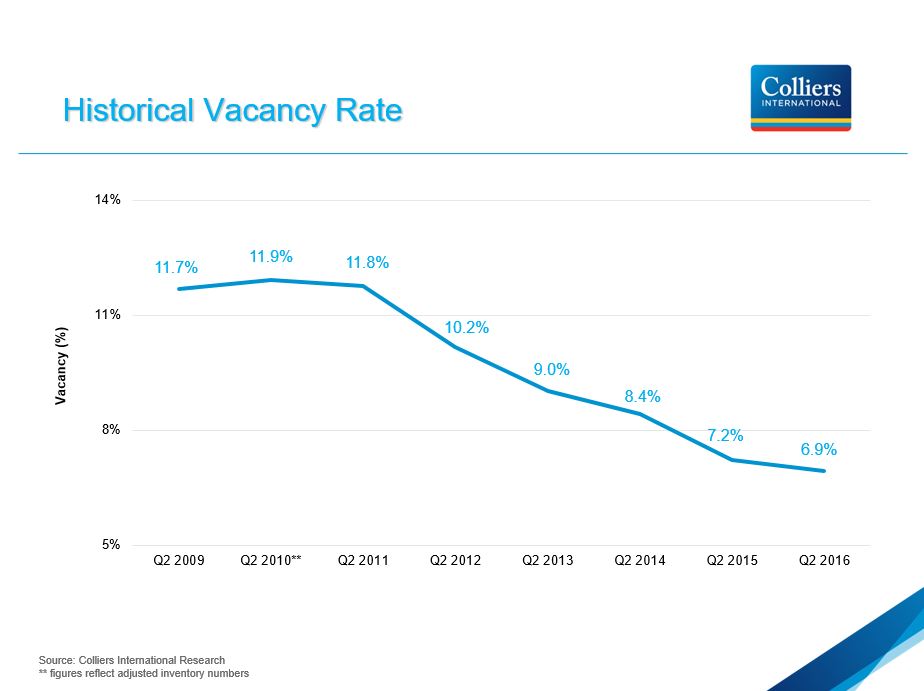

The vacancy rate improved for the second consecutive quarter to 6.94%, an improvement of 11 basis points between April and June, a rate 29 basis points below the 7.23% rate recorded during the second quarter one year ago and 530 basis points below the peak 12.24% rate recorded during the first quarter of 2010. This represents the lowest vacancy rate witnessed in Chicago’s industrial market since the second quarter of 2001, which saw a rate of 6.78%. Demand for space continued to outpace the effects of new speculative construction completions, many of which have been delivered to the market at least partially-vacant.

Vacancy has dropped below 6.0% in nine of the 22 submarkets that make up the Chicago industrial market. The centrally-located O’Hare submarket continues to lead the pack at 4.21% and has witnessed an astounding improvement trend over the past five years, as vacancy decreased from 13.17% during the second quarter of 2011, a correction of 896 basis points. The area benefits from its close proximity to O’Hare International Airport and easy access to multiple interstates and major arteries that serve the entire market. Additionally, construction activity in the infill O’Hare submarket has largely involved the redevelopment of several older, functionally-obsolete buildings into modern distribution facilities.

Despite 8.8 million square feet of new vacancies coming online during the second quarter due to speculative construction completions and vacated second-generation space, new leasing and user sale activity resulted in a reduction of the total vacant supply in the market to 93.4 million square feet, more than 2.7 million square feet less vacant space than was available one year ago.

ABSORPTION

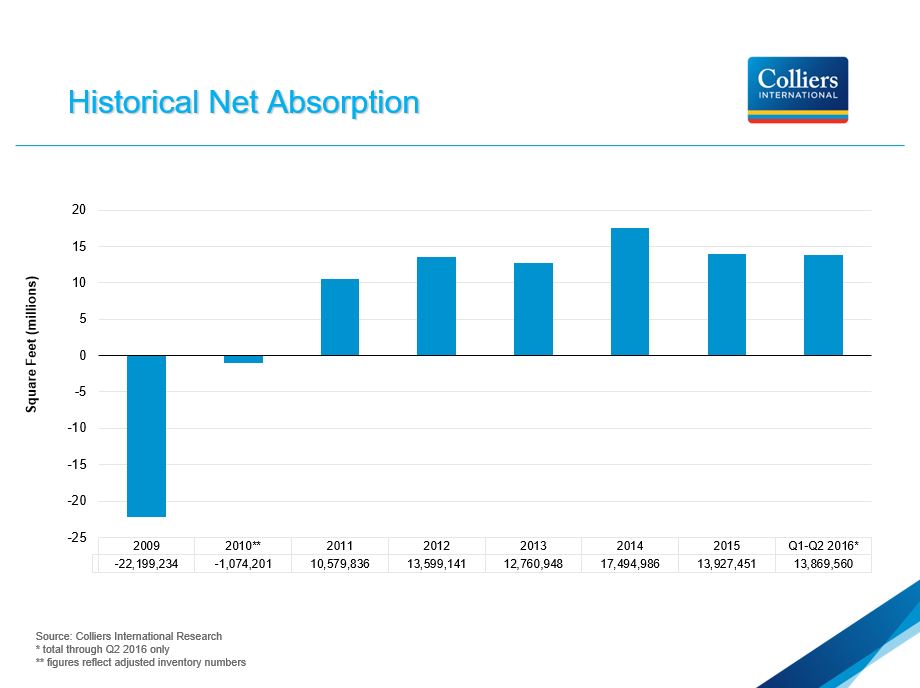

Net absorption totaled 4.8 million square feet during the second quarter, bringing the total net absorption for the first half of 2016 to 13.9 million square feet. This six-month total equals the net absorption tally recorded in Chicago’s industrial market during all four quarters of 2015. The last time net absorption exceeded this amount during a six month period was during the second half of 2011 following multiple quarters of negative net absorption.

Net absorption exceeded 1.0 million square feet in the I-55 Corridor, I-88 Corridor, and I-80/Joliet Corridor during the second quarter, largely due to significant new leasing activity and the completion of several build-to-suit and fully-leased speculative construction projects. Net absorption was negative in the I-290 North submarket during the second quarter, totaling negative 1.1 million square feet, primarily due to the demolition of two large industrial facilities in River Grove and Franklin Park. New industrial developments are expected to soon begin construction on both sites.

LEASING AND SALE ACTIVITY

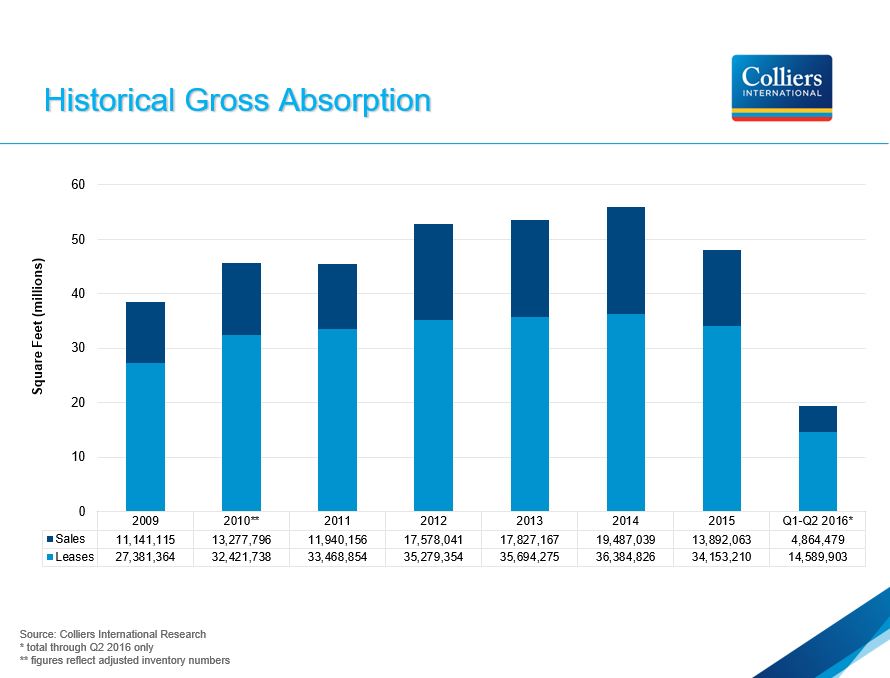

New leases and lease expansions totaled 6.3 million square feet, representing a 24.1% decline when compared to the 8.3 million square feet of new leasing activity recorded during the first quarter of the year.

The two largest new leases signed during the quarter involved e-commerce giant Amazon.com taking additional space in the market. The online retailer leased the 767,161-square-foot warehouse building at 1125 Remington Boulevard in Romeoville formerly occupied by Central American and leased the 746,772-square-foot speculative facility recently developed by Hillwood Development Company at 201 Emerald Drive in Joliet’s Laraway Crossings Business Park. Breakfast cereal producer MOM Brands Company, recently acquired by Post Holdings, leased 720,000 square feet in Wilmington’s RidgePort Logistics Center. The building is currently being expanded by an additional 504,000 square feet by developer Ridge Property Trust.

User sales volume totaled 2.5 million square feet for the quarter, a 3.0% increase over last quarter’s user sales volume. One of the largest user sales of the second quarter involved Napleton Auto Group purchasing the 157,200-square-foot vacant building at 220 Brookshire Court in Naperville formerly occupied by lumber products supplier Weyerhaeuser Company.

CONSTRUCTION ACTIVITY

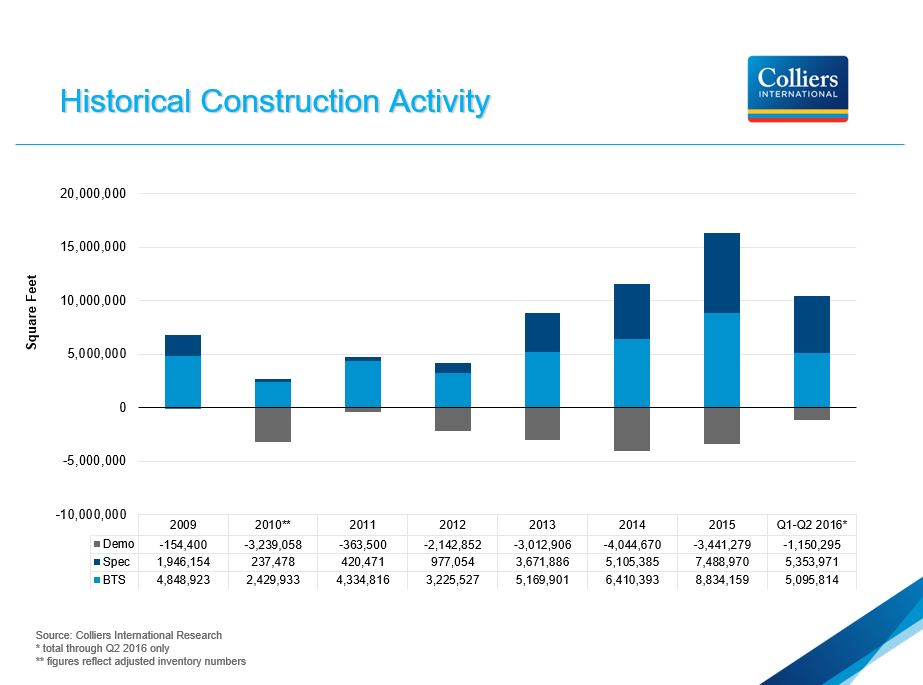

Industrial development activity increased significantly during the second quarter with 29 projects totaling an impressive 9.4 million square feet starting construction between April and June. A total of 16.7 million square feet is currently under construction, a level similar to what was last witnessed in 2007. Speculative development accounts for 9.3 million square feet, or 56% of this total, with build-to-suit projects and building expansions making up the remainder of activity. Only 10.6% of the ongoing speculative development has been pre-leased. The most activity is taking place in the I-80/Joliet Corridor submarket, where 6.2 million square feet of new development is underway, followed by 3.4 million square feet in the I-55 Corridor, 1.2 million square feet in I-290 North, and 1.1 million square feet in the Elgin I-90 submarket.

A total of 16 projects were completed during the second quarter totaling 4.6 million square feet, of which 2.8 million square feet, or 61.4% of the activity, was constructed on a speculative basis. The speculative space that was delivered during the quarter has been 33.1% leased.

For Colliers | Chicago’s most up-to-date market analyses please visit the research section of our website.

Craig Hurvitz is vice president of market research at Colliers International | Chicago and leads the Industrial Advisory Group’s market research initiative. Craig is responsible for managing and maintaining the industrial properties database, which includes property sales and leases, tenant information and comparable transactions. He has a deep understanding of the Chicago-area industrial real estate market and provides in-depth analyses, reports and market trends that are referenced by a diverse group of clients including landlords, appraisers and developers.

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka