Recent data showing a dramatic decline in warehouse construction starts has some in the sector worrying about a lack of first-generation industrial space due to limited development activity.

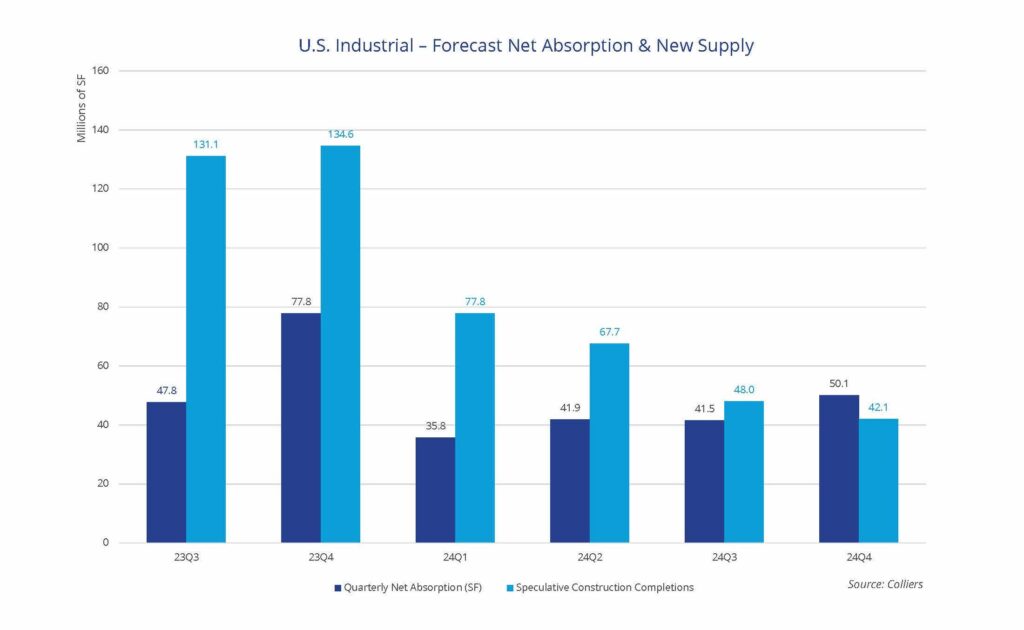

Indeed, the slowdown is noticeable. Total space under construction peaked at 638 million square feet in mid-2023 before falling 17% to 546 million square feet during the third quarter. Completions are projected to peak during the fourth quarter at 180 million square feet, but are forecast to decline by an astounding 71% by the final quarter of 2024 to only 53 million square feet.

However, this will not be bearish for the booming sector’s prospects. On the contrary, the pause in development expected in 2024 is likely just what the doctor ordered.

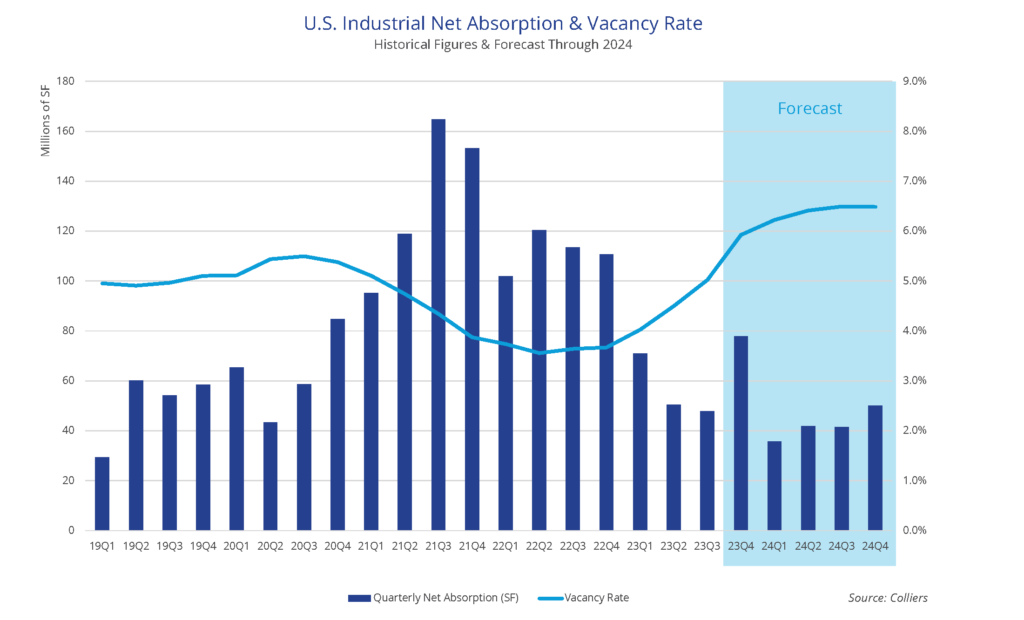

The drop in construction starts is indicative of a healthy market responding quickly and appropriately to slowing demand and higher costs of capital. While vacancy is climbing due to record new supply hitting the market this year and next, it’s forecast to climb to only 6.5% by 2024. That is considered a functional and balanced vacancy rate where industrial users have multiple options to choose from yet the market isn’t oversupplied.

Demand for industrial space isn’t expected to return to the frenzied pace of 2021 or 2022. But it is forecast to remain robust when compared to historical cycles. This is due to continued growth of e-commerce, third-party logistics provider requirements, manufacturing onshoring, cold storage expansion and data center needs.

Typically, this imbalance between supply and demand would be cause for concern throughout the industrial sector, but a quickly contracting construction pipeline combined with a bullish forecast for demand suggests any imbalance will be short-lived and may even be good news for industrial occupiers.

In the near term, the influx of new construction product will provide industrial occupiers with more options to occupy than they have had since before the pandemic. If industrial construction were to continue unabated, some markets and submarkets would see skyrocketing vacancy rates as supply outstripped demand. Instead, balance is likely to return quickly and vacancy rates will stabilize at functionally healthy levels before beginning to fall again.

As the construction pipeline contracts over the coming 18 months, developers will be able to gauge demand for the new product being delivered and determine the best timing to begin the next wave of industrial development.

Understanding where we are today means recalling what we’ve recently been through. Over the past two years, warehouse and distribution sites were built at a pace the market could not have fathomed before COVID. Behind this activity was unprecedented demand for industrial space from occupiers like e-commerce giant Amazon, mega-retailers including Target, Lowe’s, Best Buy, The Home Depot and Kroger, as well as third-party logistics providers supporting numerous clients reorganizing their supply chain strategies and online sales approaches in response to the pandemic.

Demand was so impressive that net absorption — a demand indicator that measures the net change in occupancy — totaled 598 million square feet nationwide in 2021, more than twice the previous record of 290 million square feet recorded during a particularly strong year in 2016. Last year wasn’t far behind with an annual total of 493 million square feet.

As a result, vacancy in industrial buildings plummeted to all-time lows, dipping as low as 3.5% nationwide during the second quarter of 2022. In some key industrial markets like the Inland Empire, the industrial vacancy rate dropped below 1%, resulting in practically no options for industrial tenants to lease.

Industrial developers responded quickly by acquiring land and building warehouses and distribution facilities on a speculative basis as quickly as they could. Supply chain disruptions for construction materials complicated the process, forcing developers to get creative to get the project done. Pre-leasing of speculative projects — sometimes before construction had even begun — became common, even in markets that had never really witnessed pre-leasing in the past. Demand was still more frothy than ever for modern industrial space and tenants were leasing it more quickly than it could be built.

Higher interest rates and economic uncertainty are a couple of factors behind demand normalizing through the first three quarters of 2023. Net absorption has retreated from its record highs, averaging 60 million square feet per quarter so far in 2023 — in line with what the market witnessed prior to 2020. Developers are still as busy as ever, however, delivering the record amount of construction activity started in 2022. Vacancy is climbing in nearly all markets throughout the U.S. as a result, for the first time in years.

This disconnect between supply and demand will continue through the first half of 2024, as record construction completions outpace how quickly tenants can lease the space. The U.S. industrial vacancy rate is forecast to climb from its all-time low of 3.5% in mid-2022 to the 6.5% forecast during the second half of 2024. While the industrial market is being temporarily overbuilt, the good news is that it won’t last.

Craig Hurvitz

Craig Hurvitz

Raul Saavedra

Raul Saavedra

Greg Gosselin

Greg Gosselin