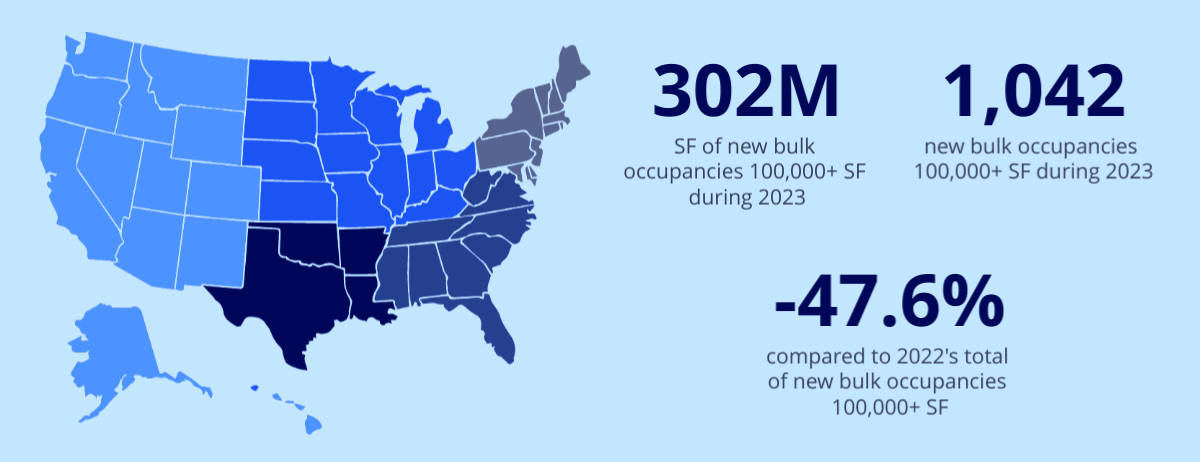

Industrial tenant demand cooled during 2023, particularly in bulk warehouse and distribution space. New occupancies greater than 100,000 square feet totaled 302 million square feet during the year, a 47.6% decrease compared to 2022’s total of 576 million square feet. Tenants took occupancy on a total of 1,042 new leases and user sales in 2023 compared to 1,956 in 2022. The average transaction size for new bulk occupancies was 289,840 square feet, slightly smaller than last year’s average of 294,659 square feet.

New supply set a new bar as developers delivered 607 million square feet of new construction, nearly 85% of which was built on a speculative basis. This new product, combined with the drop in demand and new bulk occupancies in 2023, pushed vacancy higher in every region of the country and in nearly every market nationwide. In some emerging markets, vacancy increased by several hundred basis points during the year, nearing or eclipsing 10%. Following a nearly three-year period of constrained supply and record-low vacancy rates where tenants had few options, this modern product has been welcome, although it will take longer for vacancy to return to historical norms in markets where too much space has been delivered at once and vacancy has climbed into the double digits.

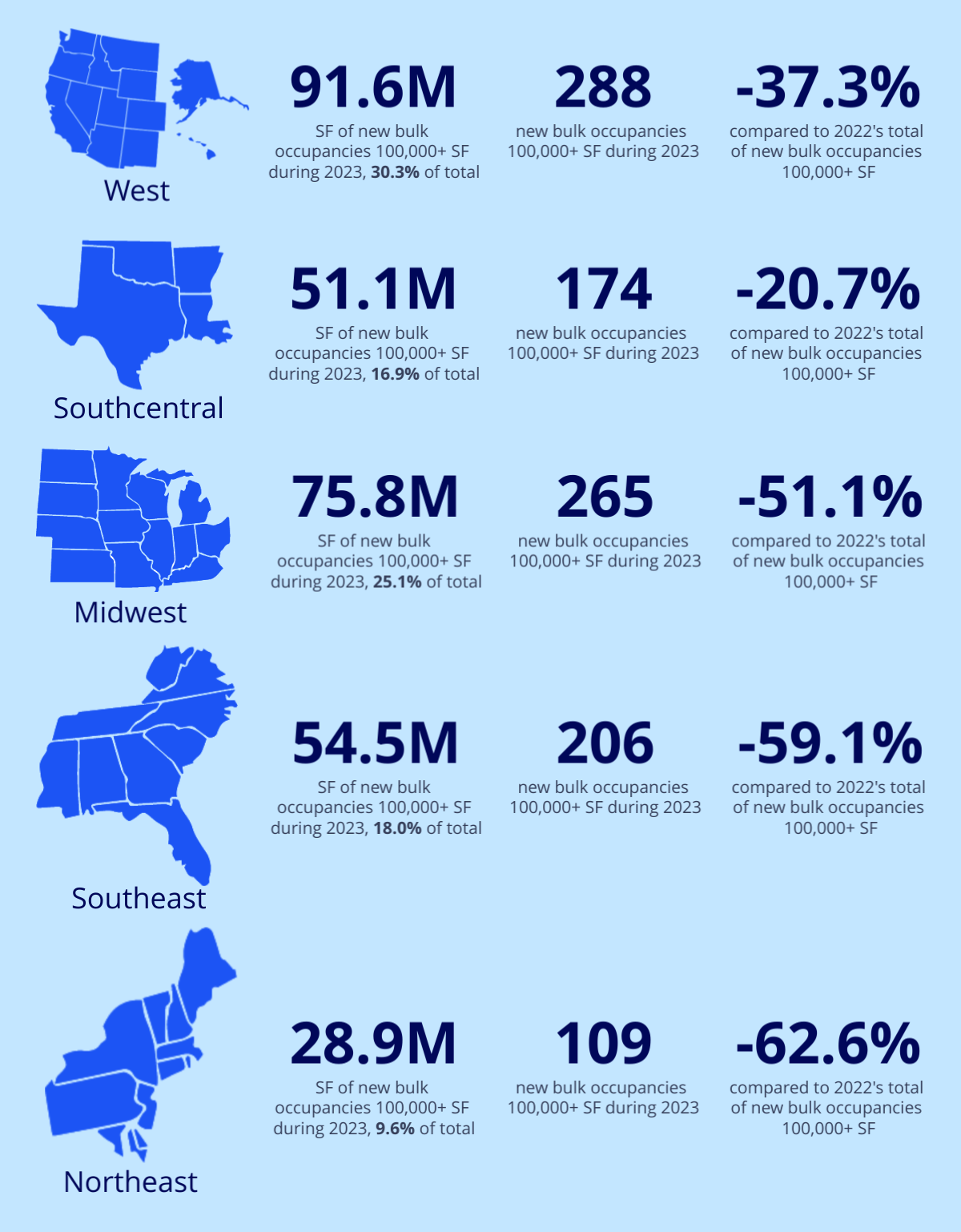

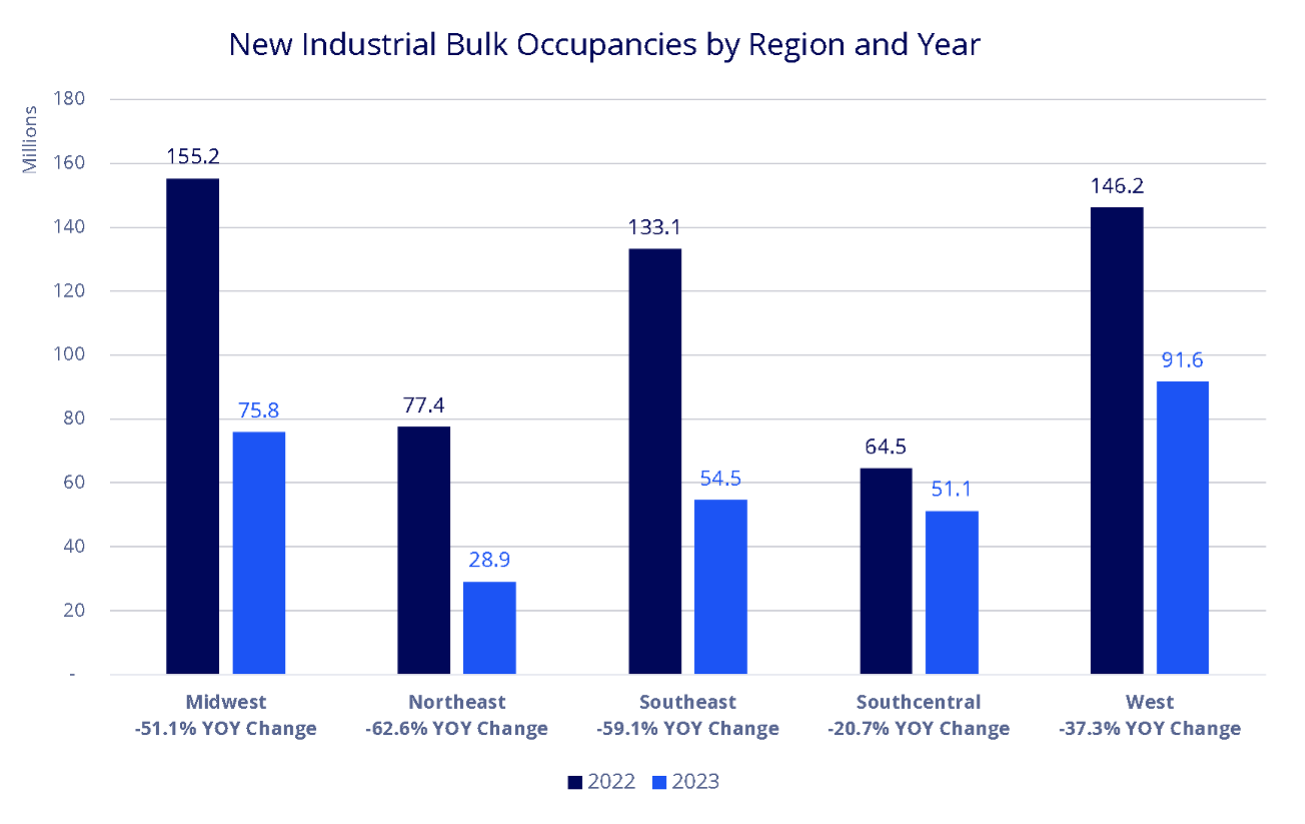

The greatest number of new bulk occupancies during 2023 occurred in the West region, where 288 tenants took occupancy in 100,000 square feet or more during the year, totaling 91.6 million square feet. This was a decrease of 37.3% compared to 2022’s total of 146.2 million square feet. New bulk occupancies dropped by only 20.7% in the Southcentral region (Texas, Oklahoma, Arkansas and Louisiana), where they totaled 51.1 million square feet during the year. The greatest drop in new bulk occupancies took place in the Northeast region, where they totaled 28.9 million square feet during the year, a decrease of 62.6% compared to 2022.

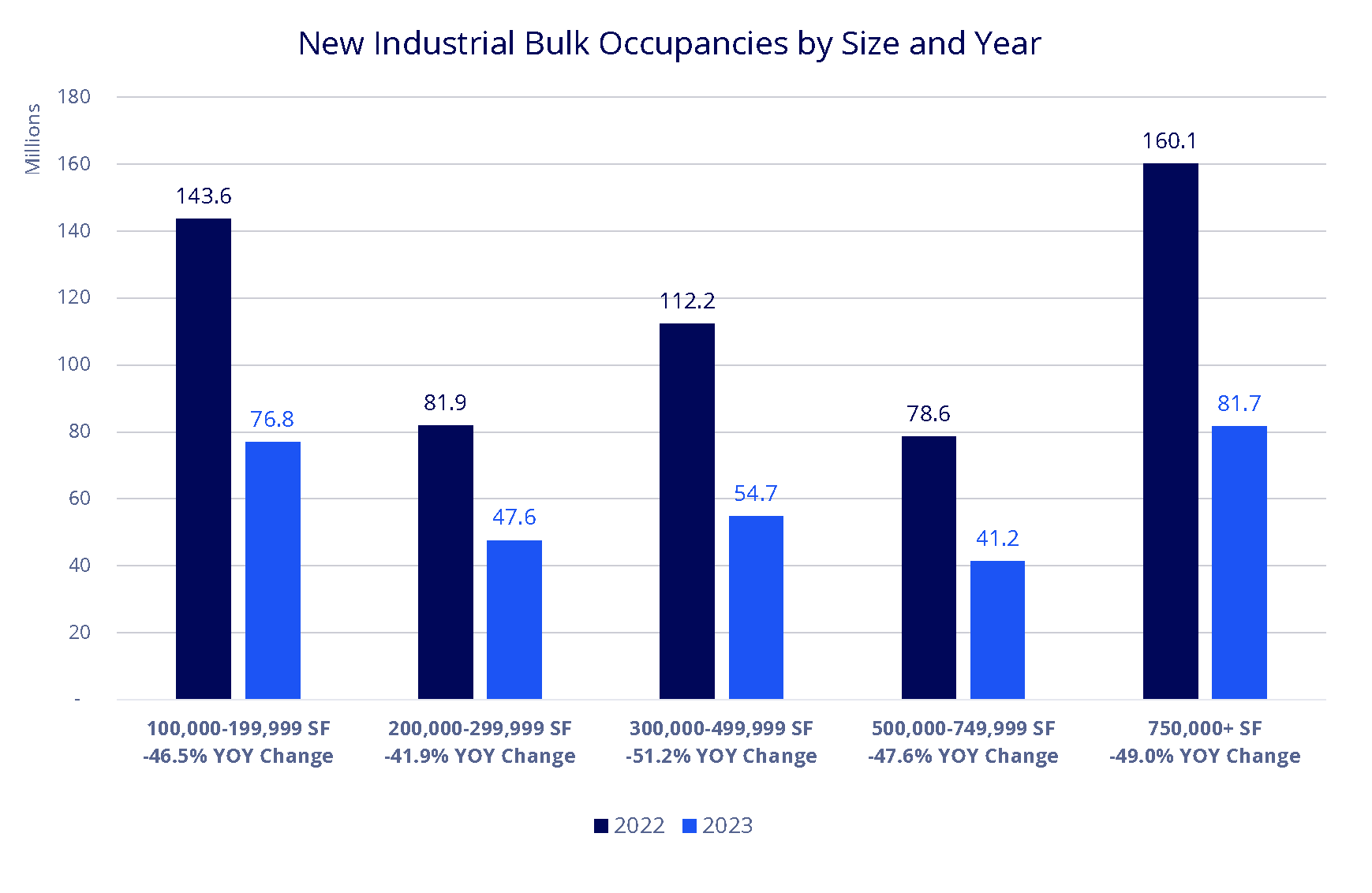

Velocity fell off by at least 41% year-over-year in all size segments, with new occupancies between 300,000 and 499,999 square feet seeing the greatest decrease of 51.2%. While new bulk occupancies will decrease again in 2024, the year-over-year drop is forecast to be less dramatic as demand normalizes near pre-pandemic levels.

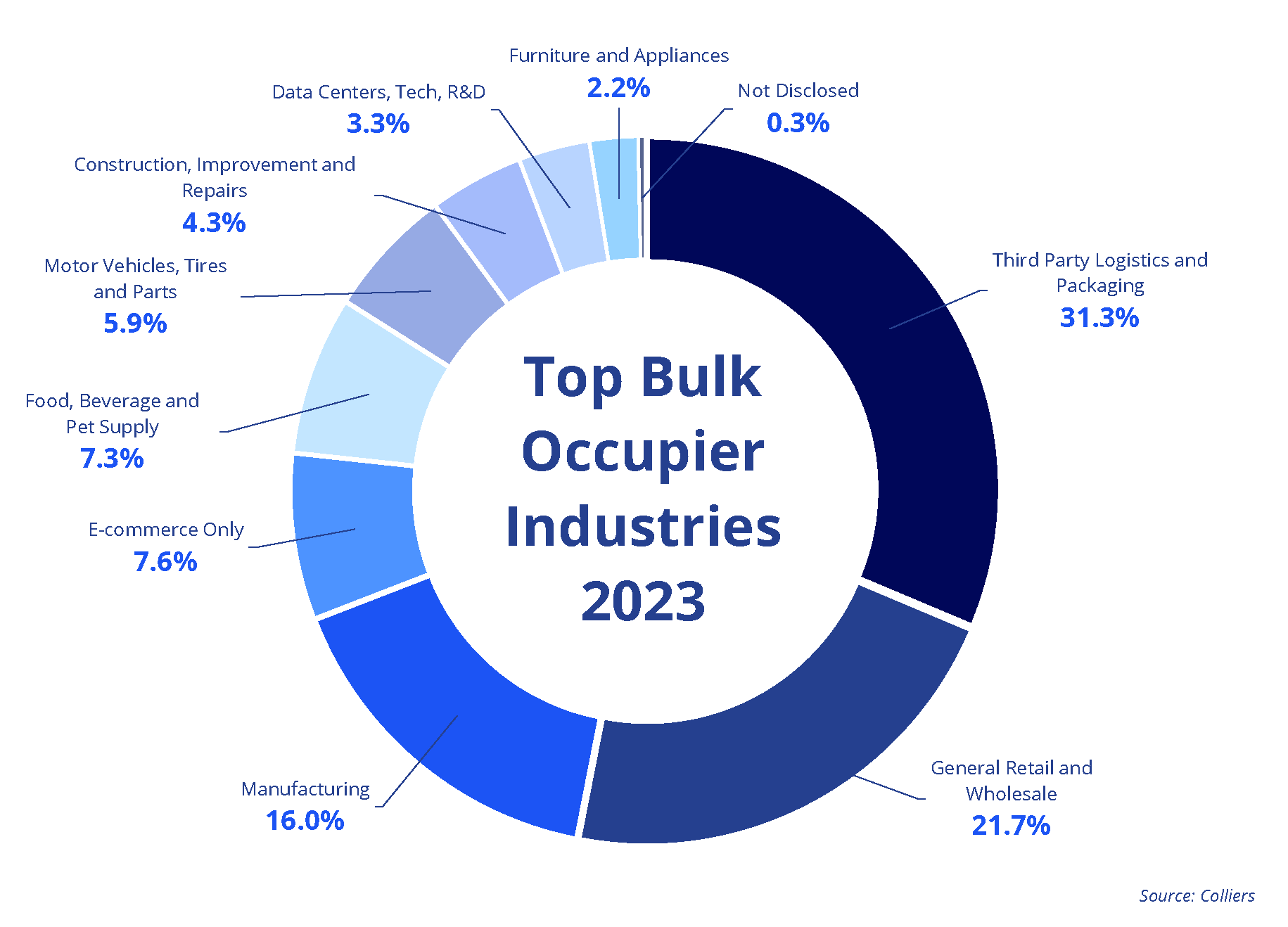

Similar to the last several years, third-party logistics providers (3PLs) and packaging companies occupied the most space in 2023, representing nearly one-third of the new bulk occupancies during the year. Manufacturing occupancies increased slightly to 16%, and this percentage is expected to increase further in 2024 as some of the large-scale manufacturing construction projects underway in response to the CHIPS act deliver. 44 manufacturing projects with an investment of $1 billion or greater were under construction at the end of 2023 or about to begin construction, most of which are semiconductor factories or electric vehicle battery facilities for users like TSMC, Texas Instruments, Samsung or Tesla. E-commerce users represented only 7.6% of new bulk occupancies during the year, a drop from 12.3% in 2022, largely due to Amazon significantly scaling back its expansion plans.

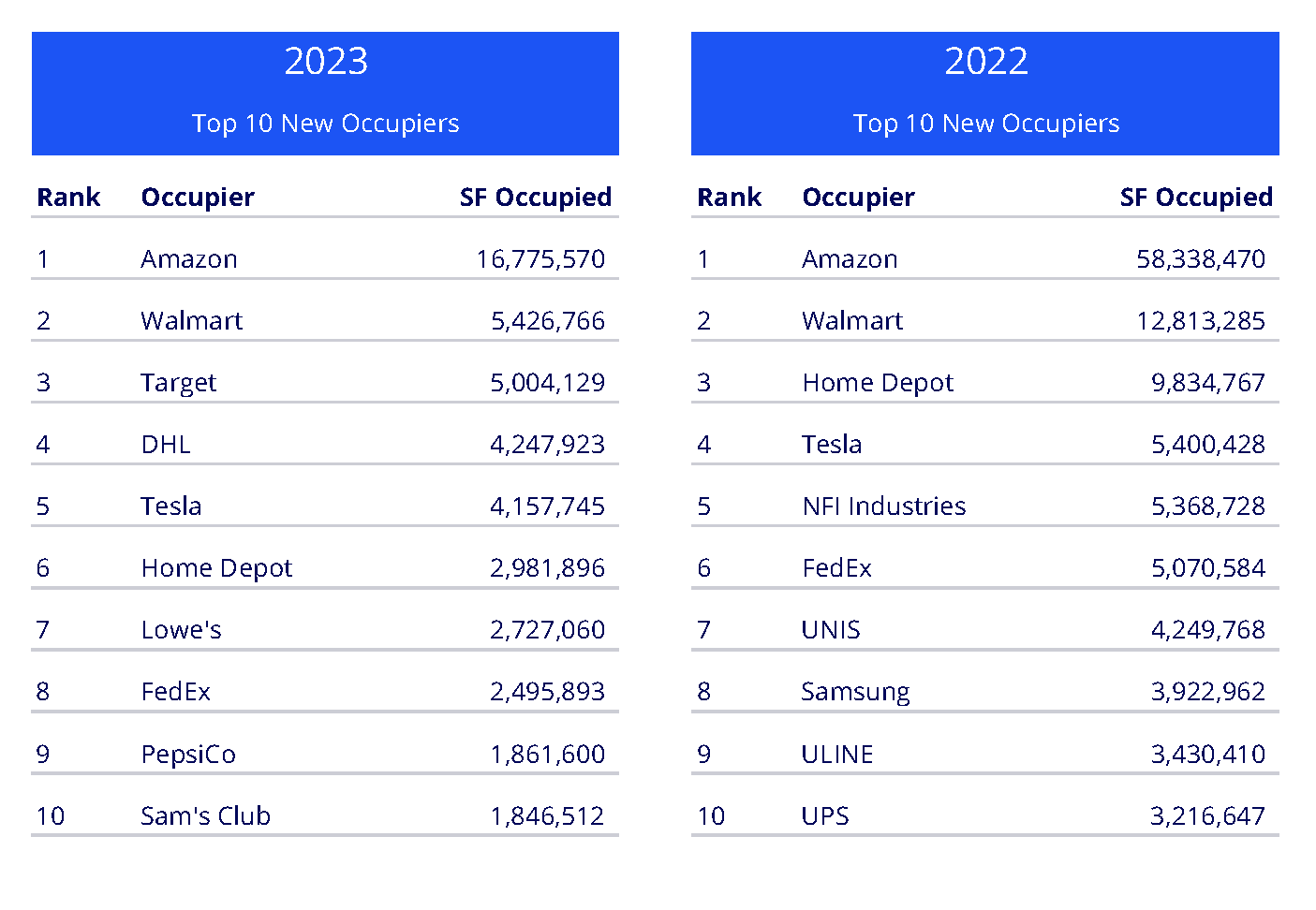

Despite the drop, Amazon was still the largest new occupier during 2023, taking 16.8 million square feet, although that is well below its total of 58.3 million square feet in 2022, and during each year going back to 2020. Target and Walmart followed behind as the second and third largest new occupiers, each taking at least 5 million square feet. Only five users took occupancy of 4 million square feet or more during 2023, compared to seven in 2022, another sign of the drop in demand.

Although new industrial bulk occupancies decreased by nearly 50% during 2023, this drop was anticipated as the market resets following two years of exceptional and unsustainable demand. A drop in construction starts will limit how high vacancy can climb throughout the country, and moderated but still historically strong demand for industrial space will usher in the next growth cycle for the product type sooner than most expect.

Craig Hurvitz

Craig Hurvitz

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett