Key Takeaways

- Though Manufacturing, Fabrication, & Materials Processing accounted for 14% of bulk occupancies in 2024 and saw a slight year-over-year decline, demand from manufacturing users is expected to rise in 2025.

- Demand for industrial bulk space rebounded in 2024, with total occupancies increasing, despite a decline in average lease size. This signals a market recovery following a slowdown in 2023.

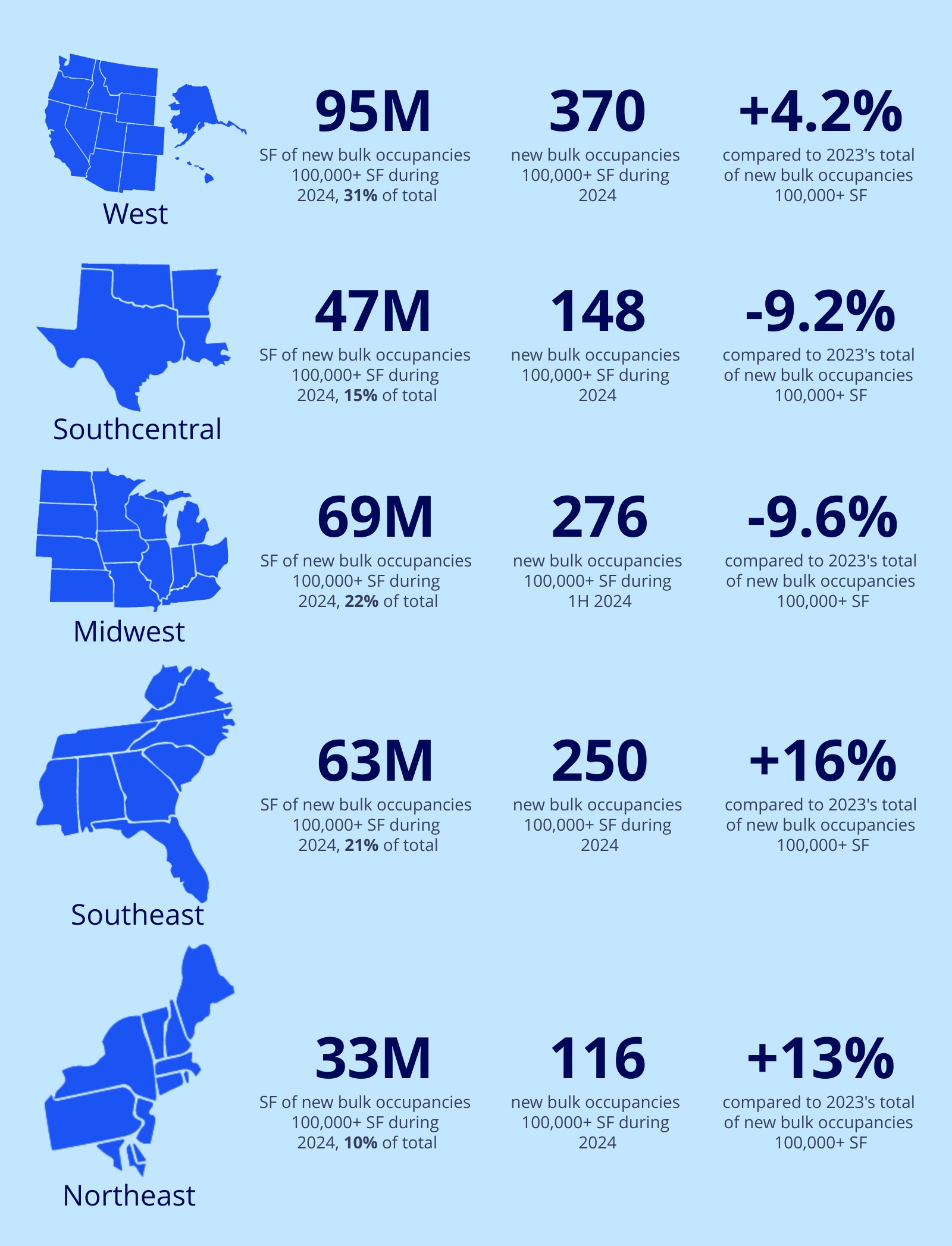

- The Southeast led in year-over-year growth, with bulk occupancies rising 16% to 63 million SF. The West had the most activity, with 370 users moving into 95 million SF, up 4.2%. The Northeast grew 13%, while the Midwest and South Central saw declines.

- Demand is shifting toward smaller bulk spaces, with occupancies under 500,000 SF growing—especially in the 300,000–499,999 SF range (up 23%). Meanwhile, spaces over 500,000 SF saw declines, with those 750,000 SF and larger dropping 26%, continuing a post-pandemic trend of tenants opting for less space.

- Third-party logistics, trucking, and transportation companies dominated new bulk occupancies in 2024, accounting for 33% and growing to 101 million SF. Asian-based 3PLs played an increasing role, making up 27% of this segment.

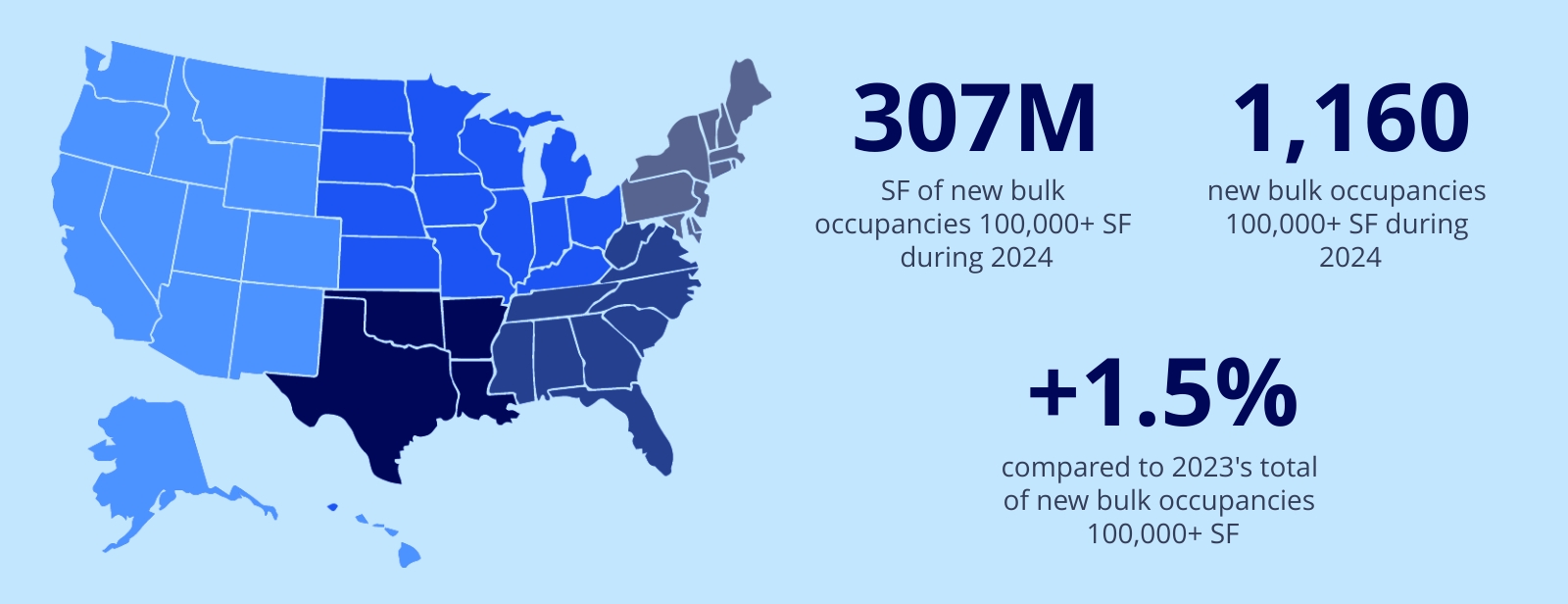

In 2024, new industrial occupancies in bulk space rose to 307 million SF, a 1.5% increase from 2023. Users moved into 1,160 spaces of 100,000 SF or greater during the year, up from 1,042 the previous year. Bulk occupancies grew as the year progressed, reaching 156 million SF in the second half — 3% higher than in the first half of 2024. This growth indicates a rebound in demand for industrial space following a sharp decrease between 2022 and 2023. The average bulk transaction size in 2024 was 264,251 SF, down from 289,336 SF in 2023 and 309,029 SF in 2022. While the average lease size has decreased, the overall number of transactions increased year-over-year.

The Southeast region saw the largest year-over-year growth in new bulk occupancies, with 250 users moving into 63 million SF — an increase of 16% from 55 million SF in 2023. The West region recorded the highest number of new bulk occupancies, as 370 users moved into 95 million SF, a 4.2% rise from 92 million SF in 2023. While the Northeast experienced a 13% year-over-year increase in bulk occupancies, the Midwest and South Central regions saw declines.

New occupancies grew across all size segments under 500,000 SF in 2024, with the most significant increase in spaces between 300,000 and 499,999 SF, reaching 67 million SF — up 23% year-over-year. In contrast, spaces larger than 500,000 SF saw a decline in new occupancies, with those 750,000 SF and larger experiencing the sharpest drop to 61 million SF, down 26% from the previous year. This shift toward smaller spaces has been a continuing trend over the past two years as tenants opt for less space compared to the mega-sized leases signed during the pandemic.

Third-party logistics providers, trucking, and transportation companies represented the largest share of new bulk occupancies in 2024, at 33%. Up from 96 million SF last year, these companies took occupancy of 101 million SF in 2024. Over the past two years, Asian-based third-party logistics companies have played a growing role in this category, comprising 27% in 2024. Other industrial categories that experienced occupancy growth in 2024 included Vehicles, Aviation, Tires, & Auto Parts (22 million SF), Food, Beverage, & Pet Supply (26 million SF), Building Materials, Construction, Power Equipment, & HVAC (16 million SF), and General Warehousing & Storage, Packaging, Apparel, & Event Production (13 million SF).

While Manufacturing, Fabrication, & Materials Processing accounted for 14% of bulk occupancies in 2024 and saw a slight year-over-year decline, demand from manufacturing users is expected to rise in 2025. Several large-scale advanced manufacturing projects are set to be delivered, driving increased manufacturing activity and prompting more companies to relocate operations to the U.S.

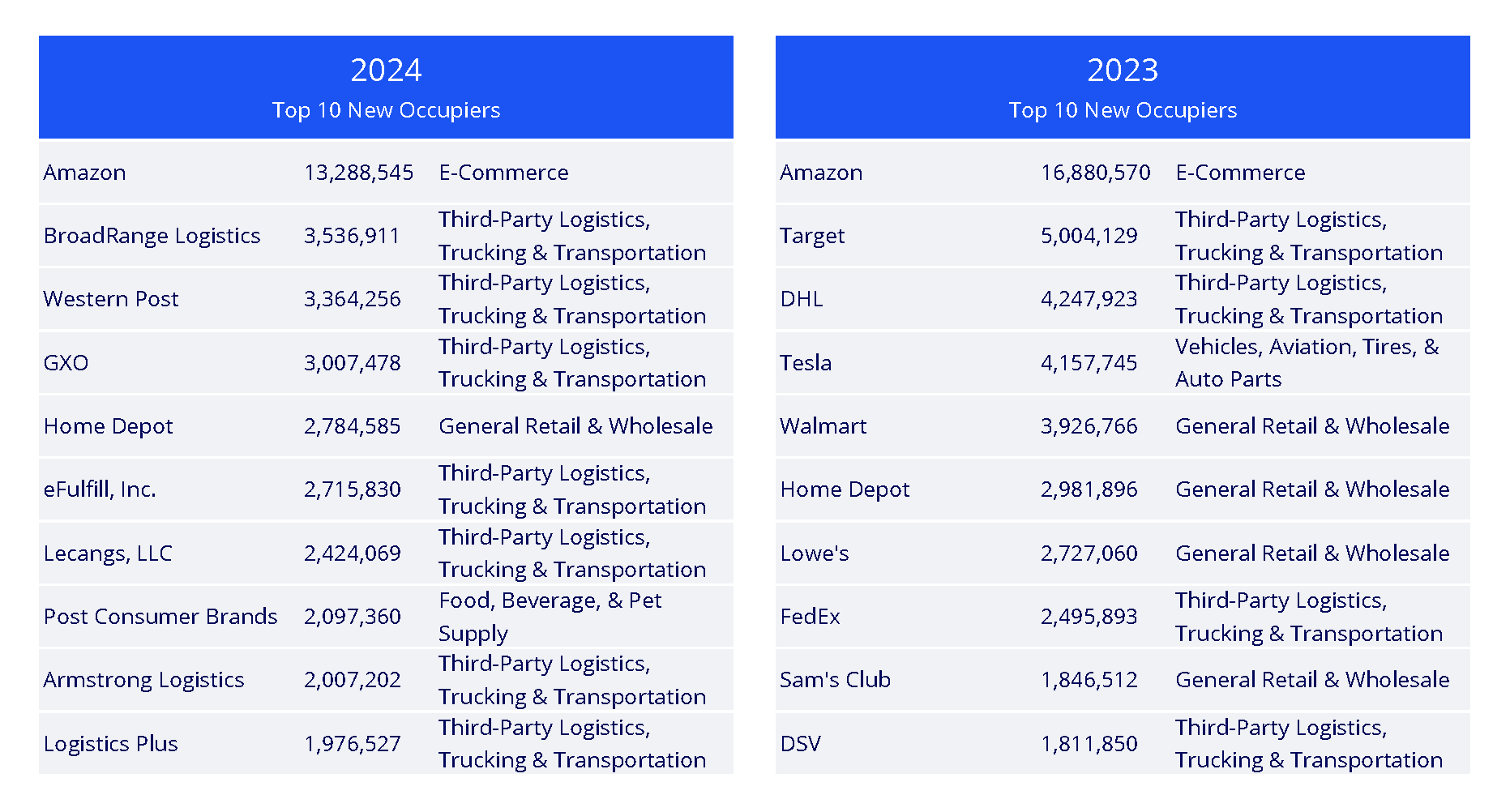

Top Bulk Occupiers in 2024

Consistent with the past several years, Amazon was the largest new occupier in 2024, moving into 13 million SF. The company is set to expand further in 2025 as it moves into additional recently leased facilities, reinforcing its industrial presence. Among the nine largest new bulk occupiers in 2024, six were third-party logistics providers or trucking and transportation companies. This includes Georgia-based BroadRange Logistics, which occupied four buildings totaling 3.5 million square feet, and China-based logistics company Western Post, which moved into five facilities totaling 3.3 million square feet.

Tenant demand is expected to continue evolving in 2025, with third-party logistics providers, transportation companies, and manufacturers driving leasing activity. While demand is unlikely to reach the record highs of 2021 and 2022, a gradual return to near pre-pandemic levels is anticipated.

Some markets have stabilized following a surge in new supply, while others continue to face high vacancy rates and supply-side pressures. As demand rebuilds and construction activity returns to pre-pandemic levels below 300 million SF, the U.S. industrial market will undergo a recalibration in 2025., although it will remain segmented as some markets take longer to balance than others.

Craig Hurvitz

Craig Hurvitz

Vytas Norusis

Vytas Norusis

Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka