In my last post, we discussed the various drivers impacting the way retailers and operators are adapting to the way we shop. Although the CEE region is playing catch-up with other global regions, improving infrastructure, combined with an increase in technological investment by retailers and retail property owners, is helping to provide a more cohesive experience to consumers. Let’s look specifically at the impact on retail store layouts.

Impact on store layouts

While the most obvious change to formats resulting from e-commerce and new in-store technology would seem to be the smaller store footprints, our observations to date show no clear indication that the size of retail stores are shrinking generally in the CEE region — at least not across the fashion and grocery subsectors.

The exception to this trend is brown or white goods. Some retailers are opting for a showroom-style brick-and-mortar store, typically on a smaller floor-plate, where consumers can browse inventory in-store and then order online. The trend, which has been noticeable in Poland and Russia in particular, is essentially omnichannel retailing.

However, to remain competitive and move into multichannel and omnichannel shopping space, many retailers are making physical store changes:

- Technology kiosk: Kiosks integrate an additional service point in-store for customer use, typically self-service. For example, a kiosk may offer tablets (or touch-screen computers) to check store inventory, mobile scanners or AR technology such as a virtual mirror.

- Entertainment: The concept of adding or increasing the size and location of entertainment and leisure services to draw the consumer in for a complete shopping experience is nothing new. However, while it has been common to see cinema or a fitness gym incorporated into shopping centers for a couple of decades, today it’s not unusual to see a bowling alley or even a water park as part of a shopping venue. In the long run, we are likely to see a greater number of entertainment anchors, rather than just fashion and grocery retailers, in the traditional store format. For example, in Poland there is an interactive wall in Sky Tower, Wroclaw, said to be the largest in Europe covering 40 square meters. The wall enables consumers to play games, see animations and take a tour around the shopping center. Interactive playgrounds are also becoming popular.

- Pop-up retail has been used across a range of markets for some time. The concept involves the short-term leasing of a space, often underutilized, in order to raise brand awareness and increase footfall in a given retail strip or shopping mall. This is an expansion on the entertainment concept, offering a visual presentation or interactive station to engage customers, and it often features a new product or special event. In Prague’s high street Na Prikope there’s been a range of retailers occupying pop-up space under this concept, including Nike’s Air Max Studio concept, an Italian fashion retailer and recently Skoda.

Despite these examples of how retailers are using sophisticated technology, there are a large number of shopping centers yet to adopt technology. While some centers now provide Wi-Fi, a large number don’t. There is probably no easier way to attract the discerning consumer, especially the younger generation who are constantly attached to their smartphone. The subsequent ability to gather big data to monitor visitor or customer habits and consumer flows around a center and then target consumers with specific direct marketing messages is a wasted sales and strategic planning opportunity.

Consumers are increasingly discerning

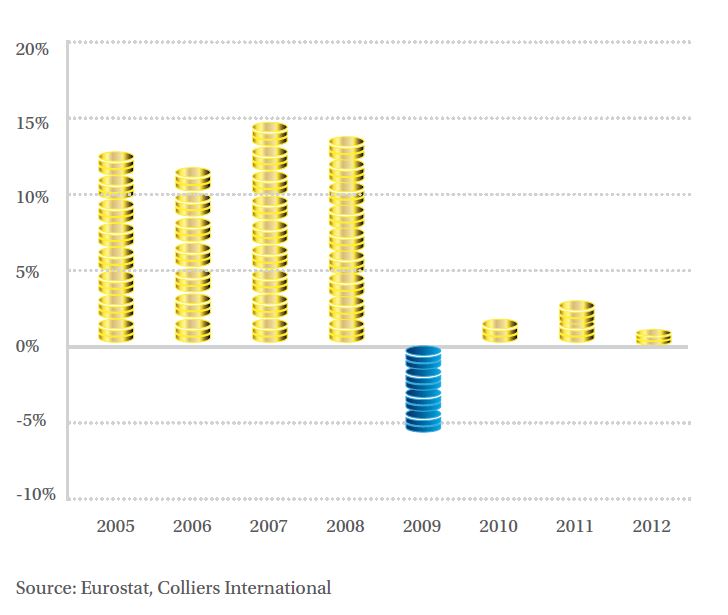

The sooner retailers do this, the better: Discretionary consumer spending is harder to come by. In 2009, household disposable income in the CEE region declined by an average of 6%. Annual growth rates post-crisis have been 2%, compared to more than 10% before the crisis. Conversely, consumer expectations have been on the increase as they seek greater value, access, transparency and convenience when they shop. While some of this is price-driven, the advancements in technology during the last five years have intensified the desire for a better service experience.

Average Annual Growth Rate of Household Disposable Income — CEE region

With consumer behavior likely to become more discerning and retail format offerings increasingly competitive and divergent, there will be increasing pressure on retailers and shopping center owners and asset managers to deploy innovative solutions and strong branding to maintain competitiveness. As technological and operating model changes impact the physical layout of the store, we could see a repricing of retail space in the long term. Retail is getting a lot more interesting.

Damian Harrington is Director and Head of Research for Colliers International in EMEA. He has lived and worked across the region, has a focus on investment and a love of “all things shed,” even the garden variety.

Damian Harrington

Damian Harrington

Colliers Insights Team

Colliers Insights Team

Lex Perry

Lex Perry

Anjee Solanki

Anjee Solanki