I had the pleasure of presenting in New York last month, at a European property investment event hosted by PropertyEU and DLA Piper. One of the most interesting aspects of this was presenting to a different audience and real estate circuit, helping to explain the diversity of the European and CEE region. We dispelled some myths and piqued some interest along the way. For instance, the wider CEE region has not been adversely impacted by the Russia-Ukraine situation but has in fact seen investment volumes grow outside of these two countries in 2014, driven by strong macro and pricing fundamentals.

Plus: How CRE can respond to urbanization in developing nations | World’s largest megacities

In advance of the event, we spent some time looking at the role of North American investors in the CEE region over the last 10 years, which showed up some interesting trends. First, U.S. investors currently in the market represent some of the big U.S. household names like Lone Star, Blackstone (including Logicor), Prologis, Morgan Stanley, GLL Real Estate, Invesco, Heitman, Hines, Starwood Capital and GE Capital amongst many others. A number of these players have been active in the region since the early days, investing just over €13 billion since 2004 — accounting for around 13 percent of all investment market activity during this time.

Also: Closer look at the U.S. and China commercial real estate dynamic

U.S. investors increasingly active – at scale

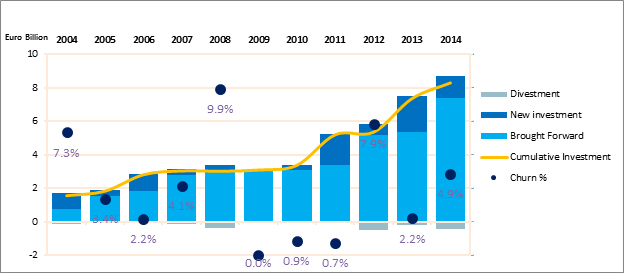

More recently, it is clear that U.S. investors have been increasingly active post-crisis, especially from 2012. When we look at the top 10 U.S. investors active in the region by size, we can see a rise in new and cumulative investment holdings, reaching close to €9 billion at the end 2014, despite some divestment activity enabling a balancing of existing portfolios.

In line with this change, we have seen a number of U.S. investors increase the scale and style of their activity, marrying their capital with local expertise. U.S.-based private equity firm Lone Star took a large ownership interest in a large CEE property developer, as Lone Star Fund III signed an agreement to acquire 27.75 percent of shares in Warsaw-listed Globe Trade Centers (GTC) for €160 million.

Modern logistics very popular

The TPG Capital deal with P3 properties is another example of this, TPG (Ivanhoe) buying into an existing and expanding pan-CEE and European logistics portfolio in 2013. The €1 billion joint venture deal, between Segro and Canada’s Public Sector Pension Investment Board (PSP Investments) in the same year, is yet another example of North American capital entering the market at scale. The Prologis Norges JV deal the same year is another example but with the capital/expertise roles reversed.

The last three deals also point to the significant demand growth market for pan-European logistics and the increasing interest in the CEE-region, which is able to service an increasingly large network of European locations. Tristan Capital & AEW got in on the act at end of 2014, buying a Czech industrial portfolio from P3 for over €500 million.

This is only one growth story: Offices remain very popular as does retail — when the opportunity arises.

What’s next?

Looking further ahead, the current Grexit situation is not a healthy one for the European market, especially for those living through this day-to-day in Greece. Eurozone leaders recently agreed a conditional deal to provide up to €86 billion (£61 billion) of financing for Greece over three years, including an offer to reschedule Greek debt repayments “if necessary.” Yet uncertainty remains, given the concerns around the actual implementation of this new deal. Markets and investors will need to get to grips with the short-term economic costs, which is likely to create some trading inertia until the situation becomes clearer. Should a Grexit ever happen, financial liquidity across the eurozone will be impacted short-term, with the majority of the longer-term impact localized to Greece.

This will impact investment demand for the CEE region, but we have started to see much more domestic capital involvement in the markets in recent years, which will continue to drive market liquidity and activity. One can understand why, as capital values have yet to significantly pick up since 2009, given that there has been limited yield compression and rental growth across the region in the past five years. When combined with improving economic results and growing occupational markets, this provides a strong platform to drive high returns, keeping both domestic and international investors engaged.

Damian Harrington is Director and Head of Research for Colliers International in EMEA. He has lived and worked across the region, has a focus on investment and a love of “all things shed,” even the garden variety.

Damian Harrington

Damian Harrington

Colliers Insights Team

Colliers Insights Team