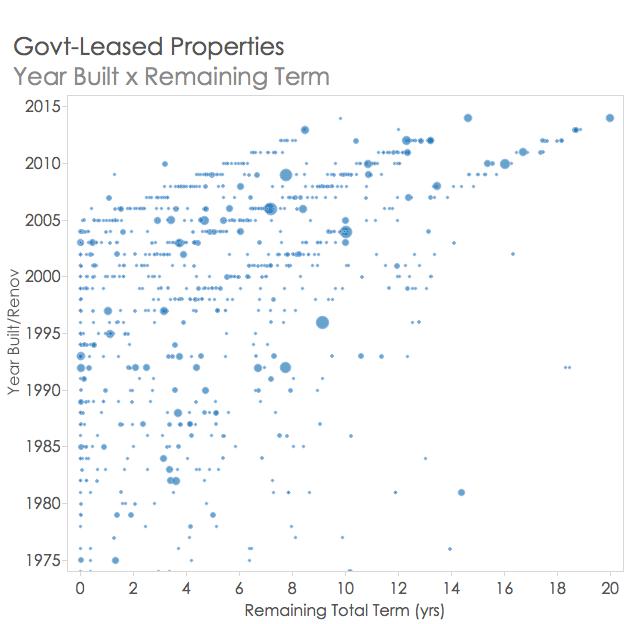

Looking at remaining term of federal leases relative to building age, an interesting pattern emerges: the leases appear in “waves.” The scattergraph below shows office buildings that are at least 85 percent leased by federal tenants. We’ve plotted every building based on its age and the remaining term of its government-leased space. The size of each dot corresponds with the overall amount of leased square foot in the building it represents.

(CapitolMarkets.com)

One can see that the government-leased buildings are generally oriented in three distinct diagonal lines. And if you stare a bit longer, you begin to see the possibility of a fourth and maybe even a truncated fifth line of data points. There’s a pretty simple reason for the trend, which also has interesting implications for investors.

Understanding the trend

GSA leases tend to occur in 5-year increments. Especially among newly built buildings and lease-construct projects, the lease terms are usually 10, 15 or 20 years. Look back at the graph, and you will clearly see that trend. Follow along the very top of the graph, which includes data for buildings built in 2014, and you will see each of the waves starts with dots at 10, 15 and 20 years. Those are fresh leases in new buildings.

Each year, as these new buildings age, the remaining term of their leases decreases. Each building ages one year, and its remaining lease term gets a year shorter. The building ages another year, and the remaining term decreases another year, and so forth. This explains why the lines develop into diagonal trails. Yet, when we look further down the vertical axis at buildings that are more than 15 to 20 years old (i.e., when their original leases have expired), the orderly trails now become more jumbled. This is because the government is not as consistent in its renewals. They may often renew space for 5, 10 or 15-year increments, but increasingly they also lapse into short term leases (or, more rarely, superseding leases). These soften the well-defined trend we see among newer buildings but vestiges of the trend still exist in the data where the government engages in traditional renewals, most often 5- or 10-year terms.*

Implications for investors

This is kind of interesting, but what does it mean? First, it suggests that many of the government-leased buildings in the inventory were originally leased when they were new. This is especially true of buildings originally leased for 15 or 20 years. Leases that long are generally reserved for lease-construct projects. When we look back at the graph, it is apparent that older buildings rarely have remaining lease terms of 15 or more years.

Second, the government favors new buildings (who doesn’t?). This doesn’t mean that federal tenants won’t remain in place for decades, but the lease terms will usually never again reach the length of the original term. More significantly, the trend suggests that, when government relocates, it usually doesn’t move into older buildings. Though we view the federal government as the quintessential “price-driven” tenant, it is fairly rare for it to trade down in building quality, especially for their long-term leases.

The trend also indicates why investors can very nearly guess the vintage of fully leased government properties. Wonder why so many buildings built in 1994, 1999 and 2004 were up for renewal this past year? It’s probably because they were built 10, 15 or 20 years ago, respectively. This year, we’ll work on leases from the class of 1995, 2000 and 2005. You can reliably guess at the provenance of most federally leased buildings.

Most importantly, we get a glimpse of what will begin to occur once the pipeline of lease-construct projects is fully exhausted. If the lease-construct spigot remains shut off (as it is now, by policy), then average lease terms will get ever shorter, and eventually the leasing cycle will begin churning a bit faster. Further, with leasing no longer focused on new buildings, the pattern of long waves will be broken. As leases grow shorter, the availability of long-term leased investments will also dwindle. For a while, capital will aggressively chase this dwindling number of long-term leased properties leading, possibly, to more cap rate compression.

One final implication (and an important point of note for GSA): Investors certainly do not invest in government-leased assets because they like the underlying lease structure. They do it because they like the underlying credit. Long-term federally leased buildings are a relatively safe haven for risk-averse capital, viewed as a better return than investing in T-bills, but with similar risk profile. Short-term leases, however, don’t provide the safety investors seek, regardless of the credit quality. Decreasing availability of long-term leased product will send cheap capital off to explore other property sectors. For GSA, that means that rent could ultimately become more expensive.**

* There are some interesting exceptions to the wave pattern. Among them is 1275 First Street, NE, a new building in Washington, D.C., that was leased to GSA for a short-term swing space related to the Stimulus-funded renovations of GSA’s headquarters. I think that lessor hoped that momentum would set in if they could get the government into their building (and they may eventually be proven correct). Also, a new lease-construct project to house NOAA in College Park, Maryland, was restricted to an unusual 13-year lease term to keep it from budget scoring as a capital lease. Further, due to unique complications, this new building sat vacant for a few years before it was ultimately occupied.

** This is primarily true of secondary and tertiary markets that aren’t normally the focus of institutional capital investors. In the largest major metropolitan areas, investor interest is unlikely to subside.

Kurt Stout is the national leader of Colliers International’s Government Solutions practice group, which provides government real estate services to private investors and federal agencies. He also writes about federal real estate on his Capitol Markets team blog. You can contact Kurt by email or on Twitter.

Colliers Insights Team

Colliers Insights Team

Coy Davidson

Coy Davidson

Lex Perry

Lex Perry