As terms such as “farm to table,” “superfood” and “clean eating” become entrenched in our lexicon, the organic food industry is just one of the lucky beneficiaries.

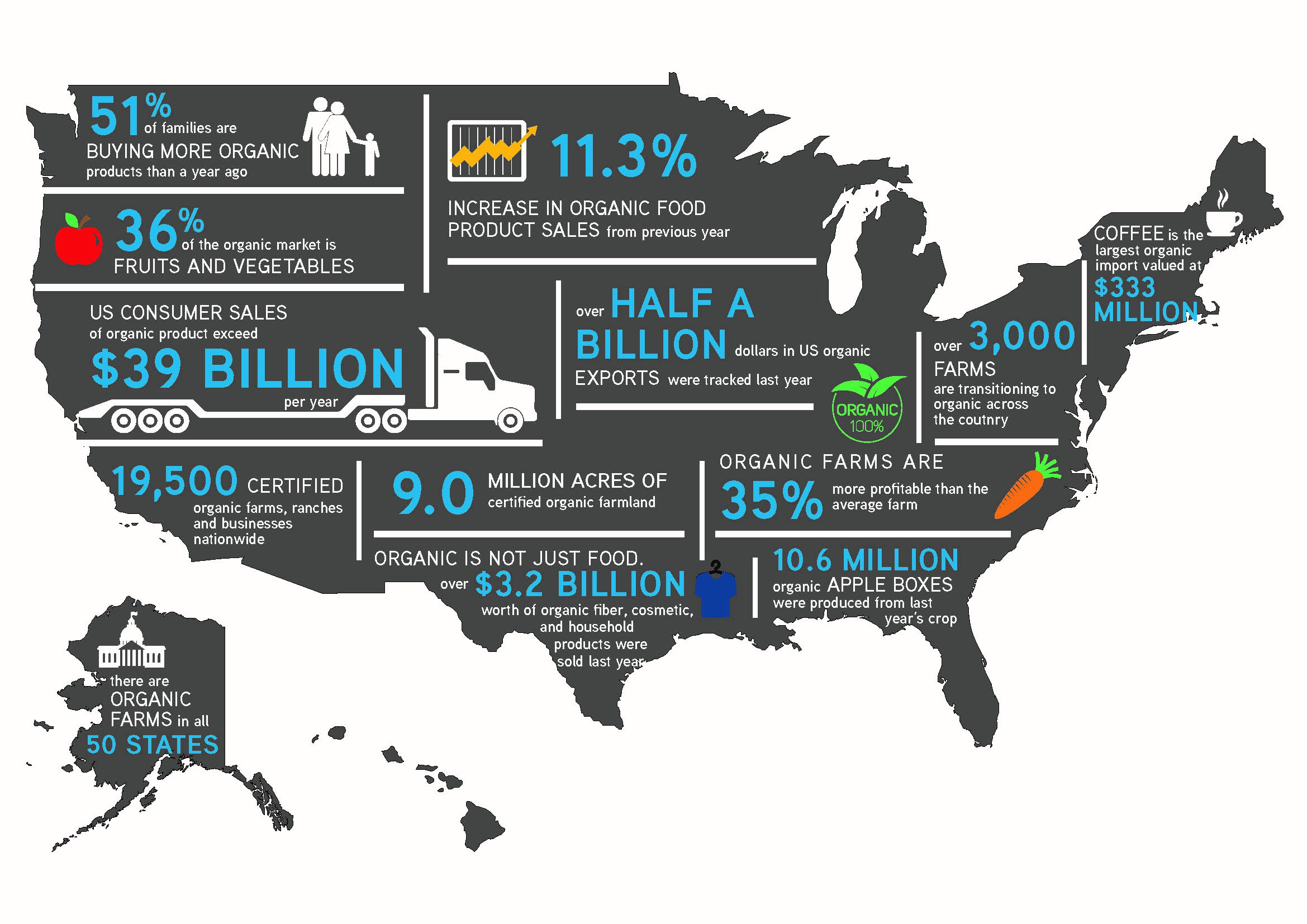

According to the Organic Trade Association’s (OTA) annual survey, sales of organic food and products in the United States shattered another record in 2014, totaling $39.1 billion. Despite the industry struggling with tight supplies of organic ingredients, the $35.9 billion in organic food sales equated to an 11% increase. Organic non-food sales, at $3.2 billion, jumped almost 14% for the biggest annual increase in six years. Exports are up as well, as American organic growers sold more than $550 million of products to buyers around the world.

Download the Winter 2016 edition of Knowledge Leader magazine

Organic fruits and vegetables continued to be the biggest-selling organic category (36%) in 2014 with $13 billion in sales, up 12% from the previous year. Of all the produce now sold in the United States, 12% of it is organic, a market share that has more than doubled in the past 10 years when organic produce sales accounted for only 5% of the fruit and vegetable market.

So who’s buying organic? It’s not the narrow demographic slice you may suspect.

“Our survey shows that organic has turned a corner,” OTA Executive Director Laura Batcha said in a statement. “Organic hasn’t been a niche for some time, and today it is the face of America. The demographics of the organic consumer are not any different than the demographics of America.”

Data sourced from the Organic Trade Association’s 2014 Organic Industry Survey

There is no better example of the industry’s astonishing growth than the success story of KeHE Distributors, a Naperville, IL-based organic food supplier. After scoring some high profile contracts such as Albertsons Companies, Inc., which hired KeHE to distribute its natural, organic, specialty and fresh products to its nationwide network of over 2,200 grocery stores in 33 states and the District of Columbia, KeHE has doubled in size in just the past five years.

Behind the scenes, though, many food distributors like KeHE understandably face very specialized challenges as they relate to the handling of organic foods.

“Short shelf-life is a supply chain challenge that every distributor has to overcome,” said Ari Goldsmith, KeHE’s senior director of marketing. “KeHE is continually optimizing our process, our distribution centers and our distribution technology to solve for these challenges.”

“KeHE has proven nimble enough to adjust its infrastructure and logistics channels to meet the explosive demand of its clients,” said Frederick Regnery, a principal with Colliers International who serves as KeHE’s real estate advisor. In 2015 alone, KeHE signed leases for four new distribution centers from Georgia to Oregon totaling more than 1.6 million square feet, each ranging between 270,000 square feet to 450,000 square feet. Portland is home to KeHE’s newest facility and has over 100,000 square feet of refrigerated and 57,000 square feet of freezer space. The property has the capacity to serve KeHE’s customers who increasingly demand product assortments in all three temperature zones.

“We are excited about our new facilities. This growth strategically aligns with our long-term strategy and demonstrates our commitment to our growing customer base,” said Mike Leone, KeHE Chief Commercial Officer. “The optimized proximity to our customers helps reduce time in our supply chain and our carbon footprint. In addition, we believe this expansion enables our vendor community with more efficient shipping. The new facilities are larger and carry a wider assortment of products,” he added.

So what’s next for KeHE and this ever-evolving industry?

After lagging far behind other major consumer sectors — primarily due to issues such as freshness, product damage, and comparatively low margins— the food and beverage category has finally made its foray into e-commerce. However, a tremendous opportunity still remains as 78% of organic buyers say they still typically buy their organic foods at conventional food stores/supermarkets, “big box” stores and warehouse clubs.

According to research firm BI Intelligence, online grocery sales (all categories) will grow at a compounded annual growth rate of 21.1% by 2018, reaching nearly $18 billion by the end of the forecast period. As a comparison, offline grocery sales will rise by 3.1% annually during the same period. But can the fresh/organic food category really thrive under the same e-commerce model? According to KeHE, the answer is a resounding yes.

A quick search of organic e-commerce platforms (both food and non-food) reveals a wide range of participants from small independent operators to international distribution giants.

“As the world becomes more digital, e-commerce for natural and organic and specialty food has also grown,” said Goldsmith. “The e-commerce channel for natural and organic food is projected to rise by 9.5% from 2013-2018. We recognize that this is a valuable tool and are very excited about the opportunity to grow our brand through a multi-channel expansion.”

It remains to be seen what lies ahead in 2016 for KeHE as it continues its impressive evolution. One thing is for certain – US consumers’ growing commitment to organic foods is not waning anytime soon. We should be encouraged by a non-geographic, non-partisan, non-economic trend that is driven by the simplest goal of making ourselves and our families healthier.

Aimee has developed a passion for commercial real estate through her 20 years in the business. She spends the majority of her time outside the office in hockey rinks and on football fields, cheering on her four active boys.

Colliers Insights Team

Colliers Insights Team

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett