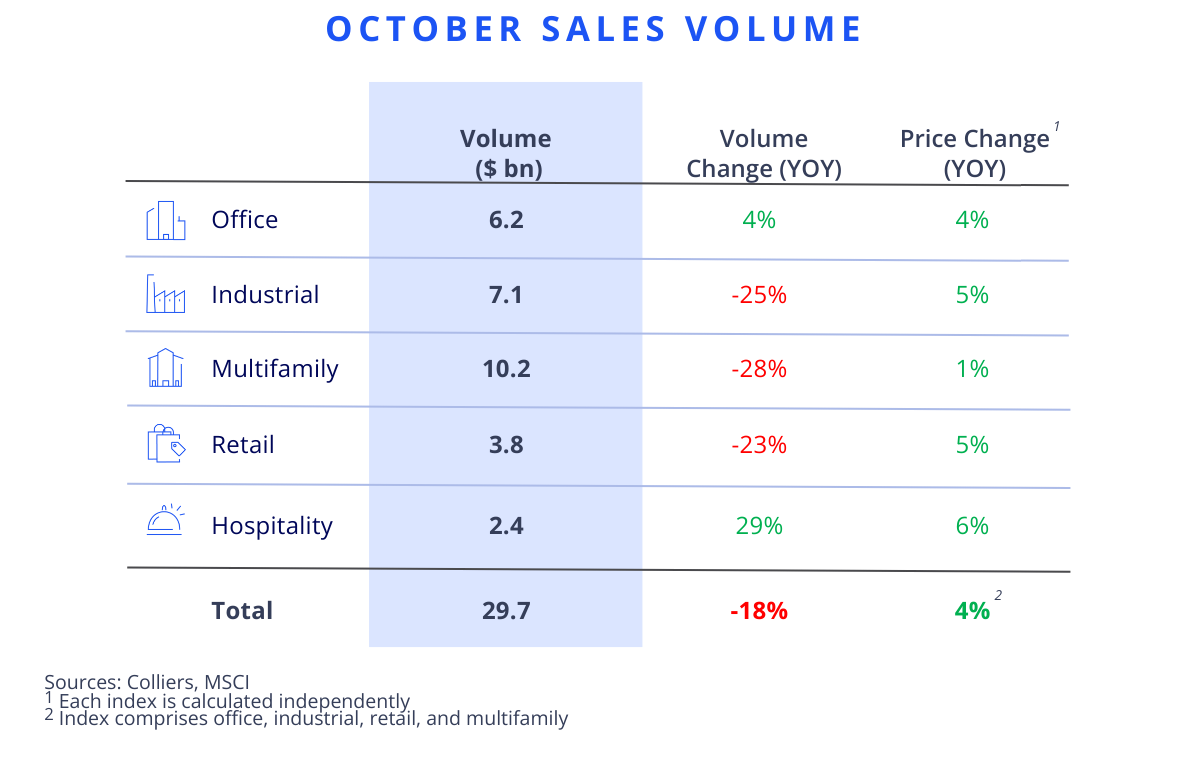

- Investment sales eased in October, down 18% from last year.

- We have seen this multiple times in 2025, only for future updates to erase those declines.

- Mori Trust acquired a 5% stake in One Vanderbilt, expanding its share of the asset at a valuation of $4.7 billion.

- Office and hospitality posted gains relative to the prior year, while the other major asset classes were down.

- As the year draws to a close, expect a flurry of activity. The start of 2026 also looks promising from a listings standpoint.

Office

Headline numbers show $6.2 billion of sales activity, up 4% from last year. However, One Vanderbilt sold a 5% stake to Mori Trust at a building value of $4.7 billion, indicating the strength of the trophy office market. If that total value is added to the stats, office volume surged and aggregate totals were only down marginally for the month. The other headline deal was Welltower’s sale of a $2 billion medical office portfolio.

Industrial

Industrial sales were down 25% in October, though they remain 12% ahead of 2024’s year-to-date pace. Single-asset deals were 35% slower, while portfolio activity increased 12% in the most recent month. A highlight was Prologis’ acquisition of a 10-property portfolio from Principal Financial for $285.7 million. Additionally, Harrison Properties acquired an 11-property portfolio from BREIT in and around Denver.

Multifamily

Multifamily volume has eased over the past couple of months, with October sales of $10.2 billion, reminiscent of activity earlier in the year. The number of properties trading pulled back to the lowest level in more than a year. AIMCO sold a five-property portfolio in Massachusetts, New Hampshire, and Rhode Island for an estimated $740 million to Harbor Group International and CBRE Investment Management, driving one of the largest deals of the month.

Retail

Retail activity, similar to other asset classes, cooled in the month. Volume was down 23% compared to last October, though portfolio volume increased 15%. Pricing is on the rise. Federal Realty acquired the 480,000 SF Annapolis Town Center in Annapolis, MD, for $187 million, while National Development purchased the Watertown Mall in Watertown, MA, for $99.3 million. Alexandria, the seller of Watertown Mall, had previously planned for a life sciences campus on the site.

Hospitality

Hospitality was the only other asset class, aside from office, to post sales gains in October. Volume was up 29% on $2.4 billion in sales. Both single-asset and portfolio deals increased in the month. October’s showing helped bring year-to-date volume in line with 2024 levels. Nahla Capital acquired a four-property portfolio, three of which were hospitality assets, for $270 million. Of that total, $256.3 million was allocated to hospitality. The three assets in Miami Beach included 264 rooms.

Colliers Insights Team

Colliers Insights Team

Steig Seaward

Steig Seaward

Miles Rodnan

Miles Rodnan Andrew Wellman

Andrew Wellman