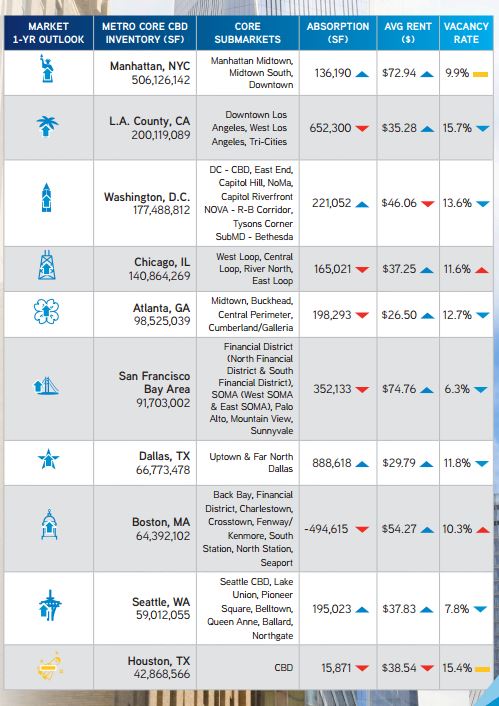

As Q2 2016 wraps, we take a look at the top 10 office metros from around the United States. The biggest takeaways? Rental rates increased and vacancies declined in most markets. And professional services and tech sectors show no signs of slowing.

Featured highlights:

- Office market fundamentals continued to improve into mid-year 2016 in the core areas of the top 10 office markets we track, as renewed job growth helped to fuel optimism for office space demand. Vacancy rates fell or were flat in eight of the markets. The overall vacancy rate for these markets was stable quarter-over-quarter at 11.5 percent and down 30 basis points (bps) from a year ago.

- The jobs report was exceptionally strong in June as we added 287,000 new payroll jobs, a very welcome rebound from the anemic 11,000 jobs in May. Absorption showed steady increase in the second quarter with nine of the 10 markets recording positive figures.

- Areas with a strong new tech presence continued to see heightened competition for space as the shrinking supply of creative-type officespace pushes asking rents ever higher. Firms must expand beyond the traditional clusters of tech-centric submarkets to find suitable expansion options as heavy demand has far outpaced supply. A prime example is in Boston where the tight Cambridge submarket helped give rise to growth in the Seaport.

- The continuing growth of corporate relocations has fueled impressive growth in areas of Dallas and Atlanta. Each quarter brings new record highs in asking rents, and demand is unrelenting. The significant cost savings realized by companies relocating from higher-priced markets has allowed them to seek better quality space in their new home markets, which puts a new twist on the trend of flight to top-quality properties.

Colliers Insights Team

Colliers Insights Team

Sheena Gohil

Sheena Gohil Bob Shanahan

Bob Shanahan Dougal Jeppe

Dougal Jeppe Kai Shane

Kai Shane

Bret Swango, CFA

Bret Swango, CFA Michelle Cleverdon

Michelle Cleverdon

Aaron Jodka

Aaron Jodka