Owners of residential and commercial properties alike have been receiving jaw-dropping property tax increases. This article examines Hennepin County, Minnesota and how property taxes are being redistributed in the wake of the COVID-19 pandemic.

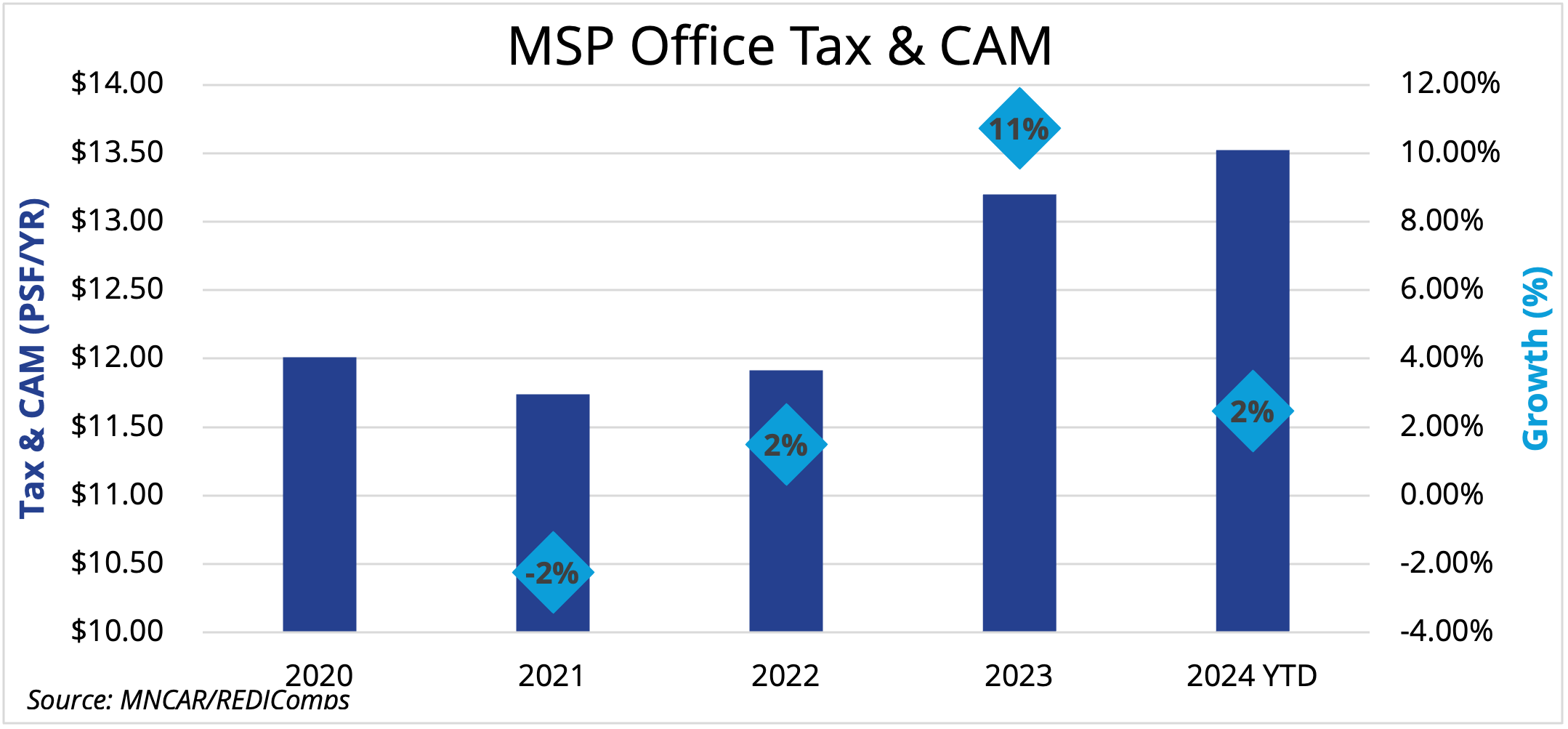

In the Twin Cities, much of the discourse about property taxes has centered around how the tax burden is being redistributed onto single-family homeowners; however, commercial property taxes have also seen significant increases, with Tax & Common Area Maintenance (CAM) costs for office owners rising by 11% in 2023.

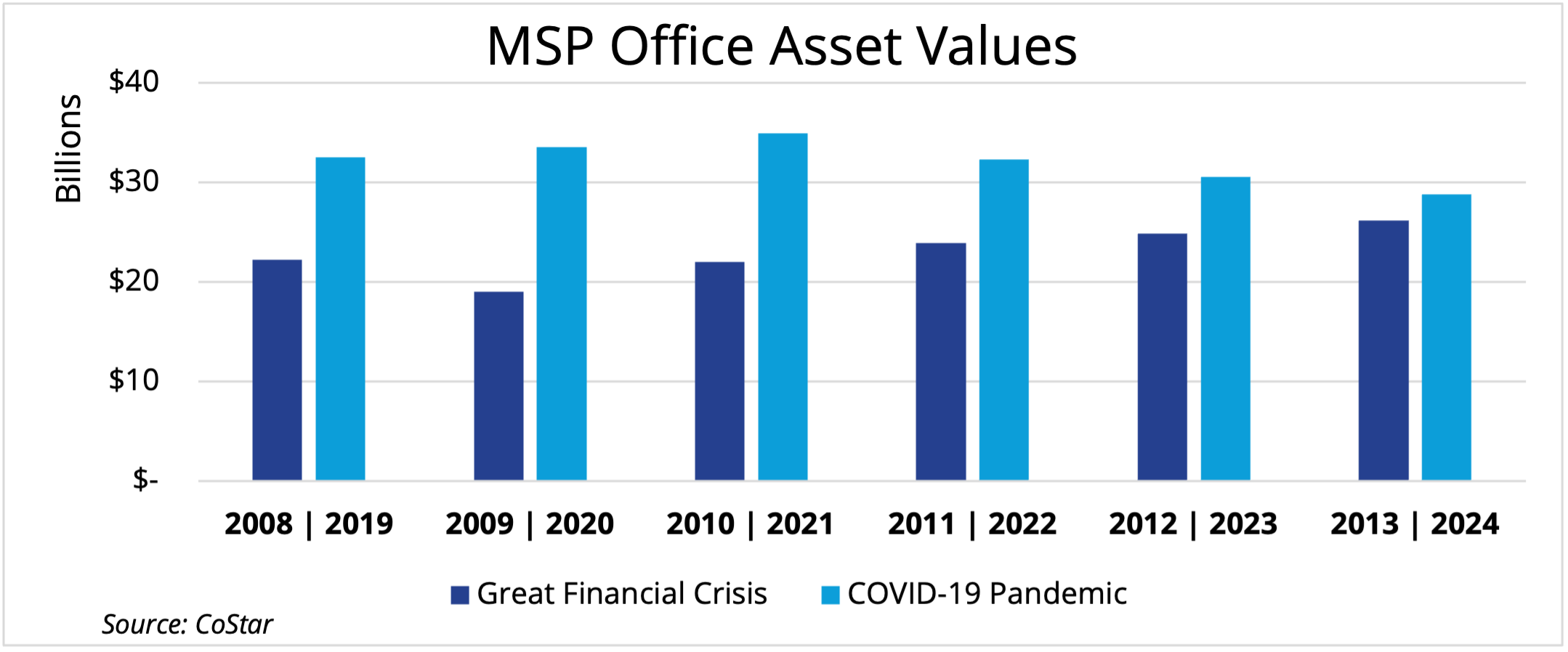

Like the Great Financial Crisis (GFC) of 2008, the real estate fallout from the COVID-19 pandemic has lagged the broader economy. During the GFC, valuations dropped in 2009 but fully rebounded within a few years. Moreover, receiverships that occurred due to office distress peaked about three years later, in 2011. However, this time around is a little different for three main reasons:

- Inflation wasn’t a primary concern in the initial years following the GFC

- The pandemic has created a paradigm shift in office labor

- and housing was the primary contributor to the crash of 2008.

The outlook on interest rates is higher for longer, as the Fed projected only one rate cut in 2024 at the June FOMC meeting. Three years after the pandemic took root, office values have begun to erode as companies bringing their people back to the office en masse have not manifested with the strength necessary to prevent property tax ramifications.

Office values are not likely to return to pre-pandemic levels. On the national scale this means distress, receiverships, short sales, and value resets to make office buildings profitable at lower stabilized occupancy. In the case of property taxes however, the fallout of the office market is harder to generalize into a scalable narrative about what it means for a ‘typical’ American landlord and homeowner. The US Government lacks the authority to levy property taxes itself, and every state has different property tax codes. As a result, the effects of falling office values on real estate taxes are localized and vary based on state, county, and local tax policy.

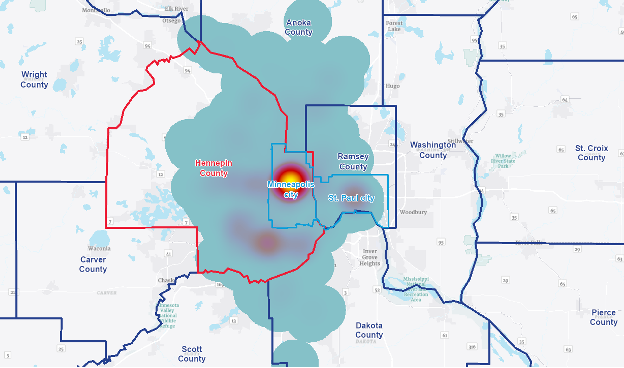

Minneapolis-St. Paul Office Inventory

In Minnesota, most of the state’s office inventory is in Minneapolis-St. Paul, particularly in Hennepin County. The Minneapolis-St. Paul metro area houses over half of the state’s population, and Hennepin County accounts for the largest portion of office space in the metro, leading the state in total office square footage.

Suburban residential property values have skyrocketed, and these owners are starting to feel the local taxburden shift onto them. In addition, due to Minnesota’s State General Property Tax on commercial properties, commercial taxes are also being redistributed between commercial asset classes. Here’s how it works:

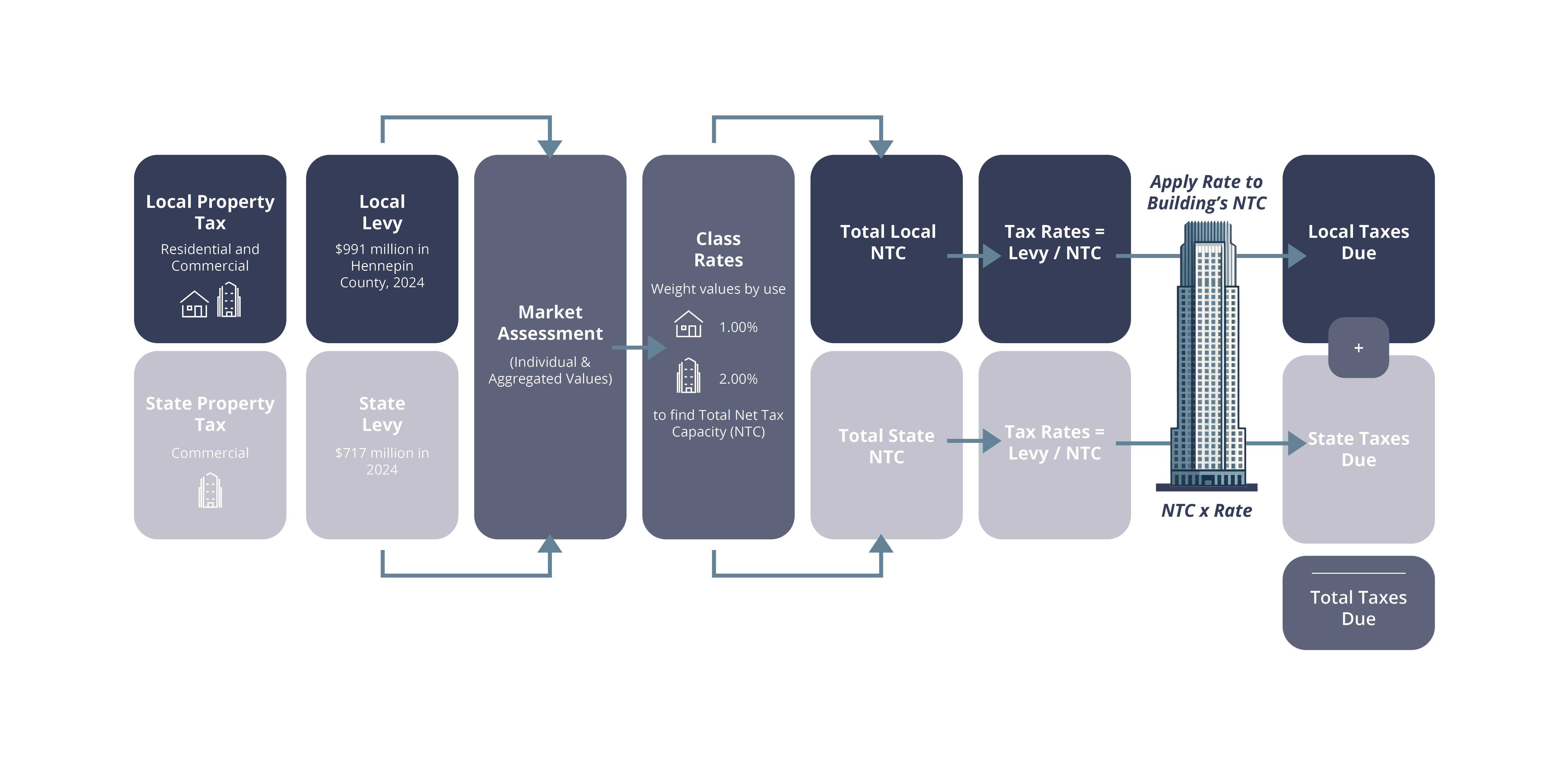

The diagram below distills property tax calculation in Minnesota down to its essential elements. The key concept to understand about Minnesota’s property tax system is Net Tax Capacity (NTC), which determines how much of any building’s value can be taxed by the state and local governments. Each levy is set by the state and local (county, city, schools) governments.

Once the government knows how much money they need (the levy) and how much taxable value exists in their jurisdictions (total NTC), the tax rate for the jurisdiction is as simple as dividing the levy by the total NTC. Then, apply the tax rate to a specific building’s NTC to know how much tax is due at each level of government for that building. This guarantees the government will meet its levy. Each year, the exact tax rate for each jurisdiction fluctuates in response to levies and property value changes.

Most property classes only pay local property taxes to the county, city, and school district. However, the Minnesota state government levies two additional State General Property Taxes (SGPT), one on commercial properties and one on Seasonal Residential Recreational properties, like cabins.[1] In this state levied commercial property tax, commercial buildings, including office properties, are seeing surprising tax growth because each dollar of NTC lost from an office tower must be recuperated from all other commercial buildings directly as they’re the only class being taxed for the commercial-industrial SGPT levy.

The state of Minnesota classifies properties based on use including classes like Residential (homestead/non-homestead), Apartments, Commercial, and specialty uses. Different types of buildings take on different shares of the tax burden. The commercial class includes office, industrial, and retail buildings and are classed at 2% of value, so a $1 million commercial building would have a Net Tax Capacity of $20,000[2].

Single-family residential properties in MN are classed at 1% and apartment buildings at 1.25% of value.[3] So, if that same hypothetical $1 million commercial building were instead an apartment building, it would have an NTC of $12,500 or 37.5% less than the commercial building of the same market value.

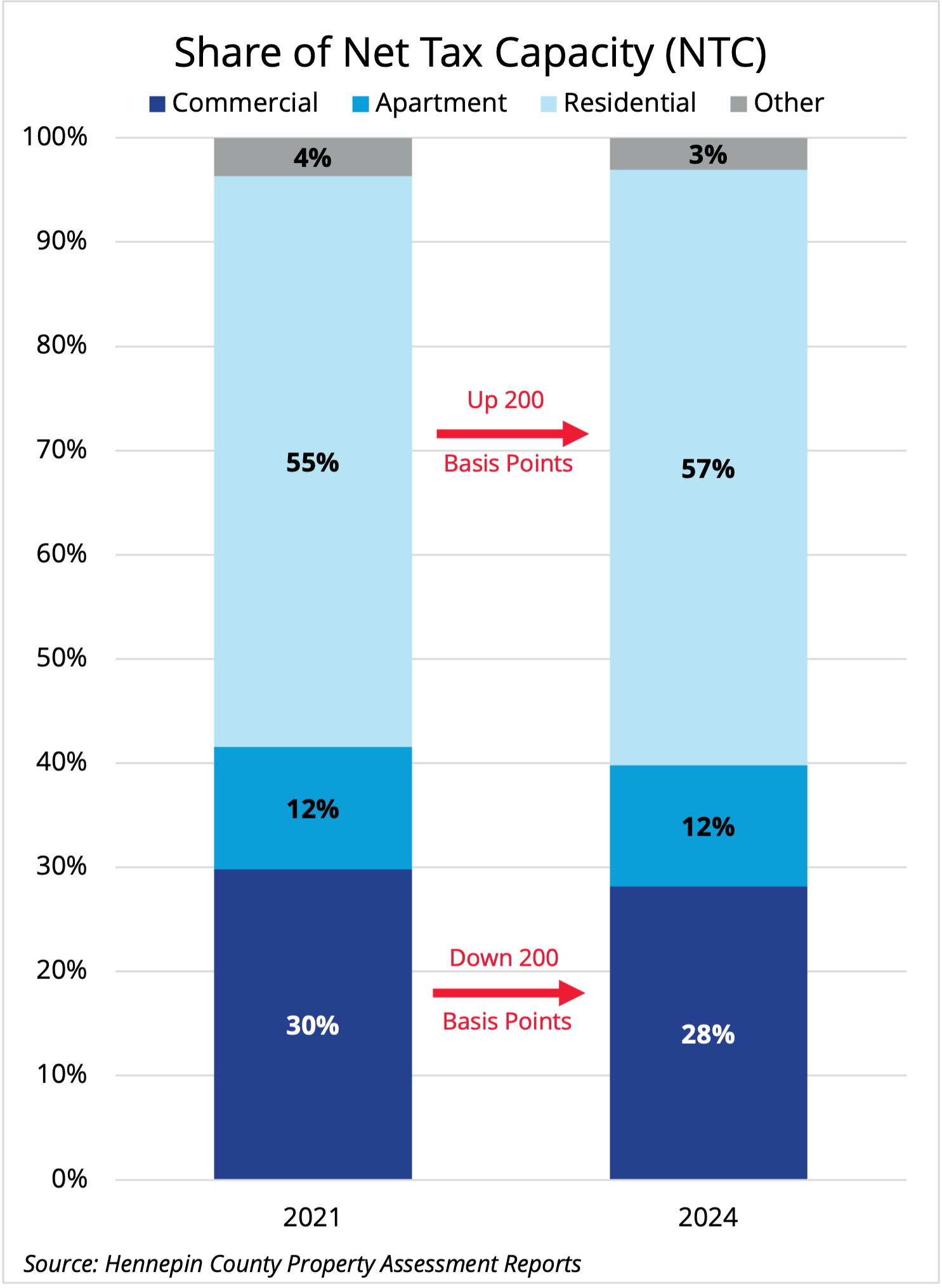

Every property’s Net Tax Capacities are combined to find a total NTC for each tax district. Represented as portions of the overall NTC, we can see how the Hennepin County tax burden spreads across different uses and changes as property values change.

Between 2021 and 2024, residential property values outgrew commercial values and increased their share of the tax burden by 200 basis points. During this period, residential NTC grew by 23%.

Overall commercial values grew by 13.5% during this same period, but commercial growth had to overcome the revaluation of distressed office assets before contributing to the growth of the overall market.

As such, this seemingly minor shift in tax burden accounts for $18.6 million of the $930 million Hennepin County levy, and the same phenomenon is occurring at the smaller scales of city and school district property tax levies, too. This leads to an over $45 increase in property tax per single-family home due solely to the shifting tax base between 2021 and 2024.

While this might feel negligible, combined with over 45% growth of suburban residential property values in the same period, many homeowners face significantly higher tax bills than expected.[4]

Although Hennepin County’s industrial values are up $412.3 million (3.1%) year-over-year, but this growth has been negated by other commercial types (office) falling $805.2 million (2.7%) in value. The net effect on the NTC base is about $8 million, so of that $18.6 million of NTC redistributed since 2021, about 43% (or $8 million) of that change occurred in the most recent tax year.

Unfortunately, we are only at the beginning of this domino effect. Almost every office building will have to reset values on lower stabilized occupancy. For every $1 of net commercial value loss, residential must gain $2 in value to achieve the same tax base. As such, Hennepin County’s total Net Tax Capacity stagnated at 0.0% growth this past year.[5]

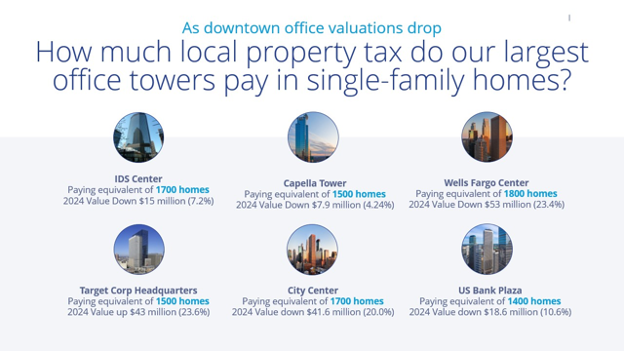

The values of Minneapolis’ biggest office towers dwarf almost every individual building in the state, and to the government, these towers pay the equivalent of over 1,500 single family homes’ taxes. As more and more office buildings face distress, the property tax base will continue to shift toward residential homeowners on the local level and to other commercial properties on the state level.

The maps below show the change in NTC for Residential Homestead, Commercial/Industrial, and Apartment buildings for municipalities in Hennepin County. In the City of Minneapolis, Residential Homestead and Apartment NTC grew 9% between 2021 and 2024; however, Commercial saw NTC decline by 1% due to falling office tower values. Consequently, for the city, homeowners and apartment landlords will foot the bill.

Of all NTC in Hennepin County, 27.7% of the NTC lives in the City of Minneapolis. For the county, this means less money coming from the city center and more from those cities where commercial property flourished. Outer ring suburbs have benefitted from new construction but don’t have the density to make up for urban property value losses. The first ring suburbs have more density, meaning they can’t benefit from development in the same way and therefore saw smaller growth.

The cost of working from home and diminishing office values is here to collect its debt. Minnesota’s double layer of state and local property taxes creates an environment where all property taxes rise to compensate for lost office value.

On the state level, the tax burden is being redistributed onto other commercial properties, driving retail, industrial, and well-performing office taxes up. On the local levels, the tax burden is shifting onto suburban residential homeowners. Hennepin County will experience the most significant impact on property taxes from office valuations, given that the majority of the state’s office inventory is located here. However, this trend is evident across all counties in the Twin Cities metro.

[1] https://www.revenue.state.mn.us/state-general-property-tax

[2] Most taxable property classes use a progressive classing system, meaning that a property is usually classed at a lower rate for a portion of its value. For example, residential homesteads are classed at 1% up to $500,000 and at 1.25% on all value over that $500,000.

[3] https://www.house.mn.gov/hrd/issinfo/clsrates.aspx

[4] Hennepin County Property Assessment Reports

[5] Hennepin County Property Assessment Reports

Jesse Tollison

Jesse Tollison

Vytas Norusis

Vytas Norusis Craig Hurvitz

Craig Hurvitz

Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka