Industrial demand in the Tampa and I-4 Corridor markets has seen strong growth since the start of COVID-19 with over 10 million square feet of new industrial buildings that have been completed in 2021 and 2022. With this strong demand, the industrial supply has struggled to keep up with tenant demand in prior years, which drove vacancies down and rent up to unprecedented levels for the market. Yet, as we enter 2023 the Tampa and I-4 Corridor market could be showing signs of overbuilding.

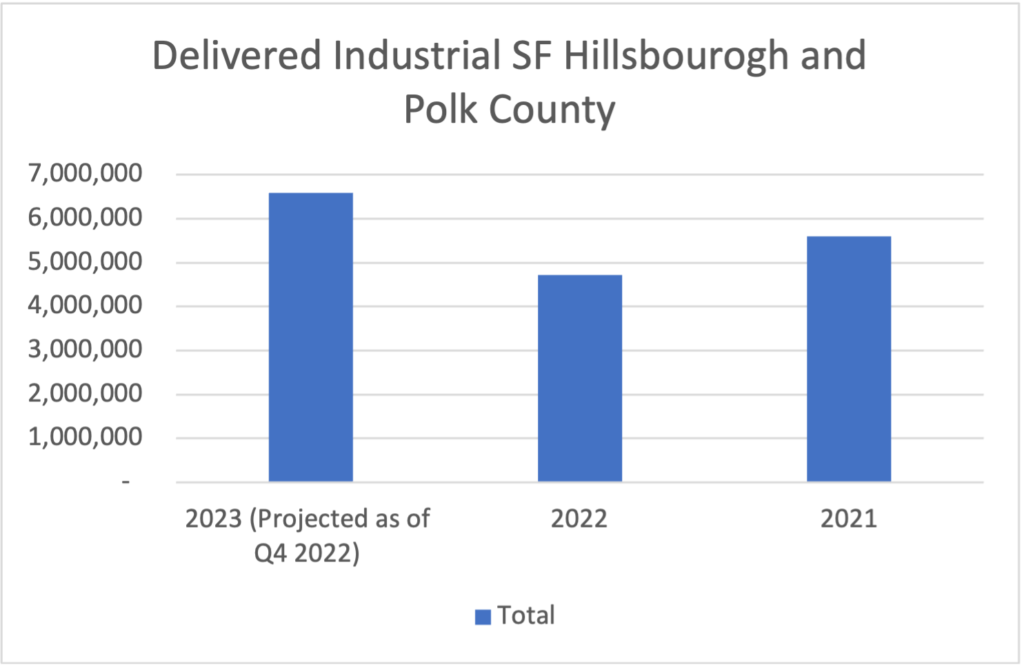

2023 Industrial Construction

Construction for 2023 is on track to deliver the most square footage we’ve seen in our market in a calendar year with well over six million square feet that is set to deliver this year. This represents a 39% increase over 2022’s deliveries and an 18% increase over 2021, which was the Tampa & I-4 Corridor market’s record setting year.

Estimating Market Vacancy in 2023

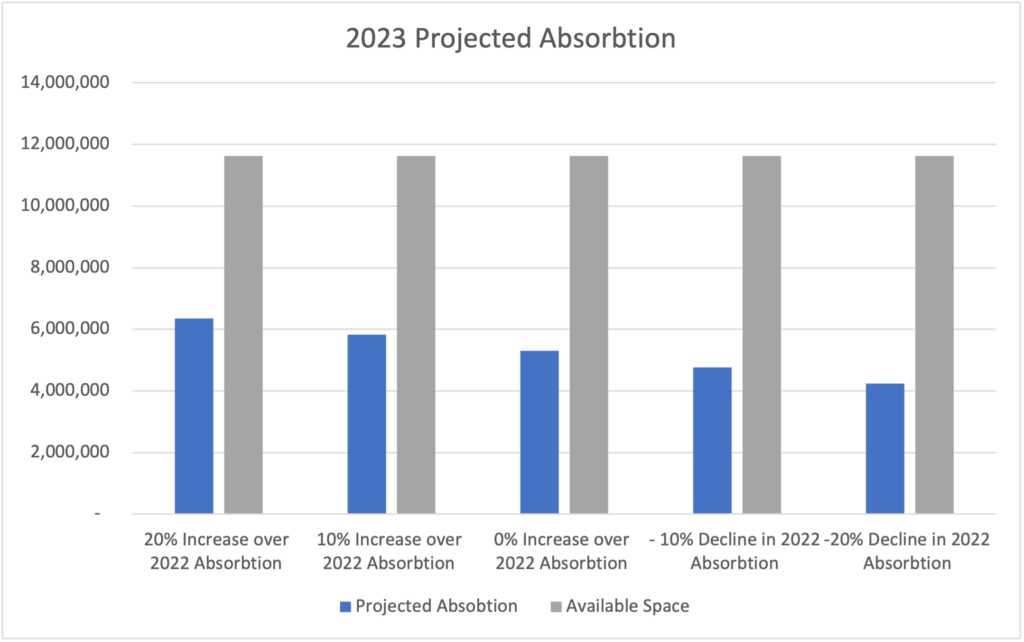

As we further dig into the numbers, we can extrapolate 2023 absorption from the markets 2022 performance to give us a rough estimate of what the market will look like this year, given the uncertainties of inflation, construction timing/costs, and capital market pressures. Let’s assume a 10% decline in absorption from 2022 to 2023 due to the various outlined pressures facing industrial. With these assumptions we can calculate an estimated vacancy rate of 5.31% for 2023, a 16% increase from 2022.

Looking Further into Absorption

With over 11 million square feet of vacant space available at the time of this article, it leaves the market with more than enough industrial space that won’t be fully absorbed until Q2 2025. This assumes that absorption remains stabilizes around 2022’s YTD absorption and has the possibility of extending past that date if we see significant decline in our market’s absorption.

With this glut of space, industrial space will be forced to compete on their asking price per square foot causing a peak in the rising rental prices we are seeing in the market. This will allow tenants to decide between the Core Class A locations or slightly tertiary Class A buildings for a significant discount, a choice that is not available to them currently. Despite location, the tertiary buildings are priced at core rental building rates, as they are facing the same pricing and challenges as projects located in the core market.

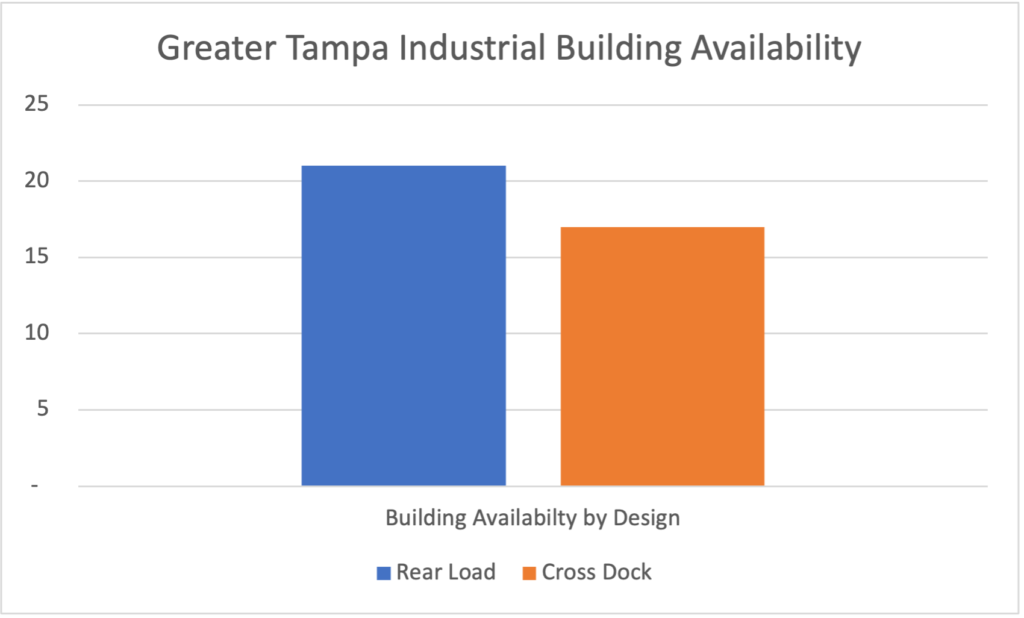

Class A 300,000 Square Feet Above and Below

Slicing the data differently we can see the two styles of buildings in the market, which is currently separated by the 300,000 square foot mark, with cross dock being greater than 300,000 square feet and rear load being less than 300,000 square feet. For rear-load property types, as of this article, there is almost two million square feet available in our market. Additionally, tenant size in our market averages 50,000 to 75,000 square feet, in 2022 our industrial market saw a large influx of new to the area tenants in this size range. Assuming a similar absorption and similar influx of tenants in our average range, rear-load buildings should be well positioned going into 2023.

The big-box industrial market in Tampa is the area to watch going into 2023. Deal volume in this market and size has been low over the last two years when compared to the number of available buildings and options. This analysis does not even take into consideration the number of proposed buildings that have pivoted to build-to-suit opportunities, because of the previously outlined industrial pressures. This will give the few big box tenants in the market more power as their options is varied in the marketplace going into 2023.

Summary

The Greater Tampa and I-4 Corridor industrial real estate market has seen strong demand and growth in the past two years with over 10 million square feet of new construction completed. However, as 2023 approaches, the market may start to show signs of overbuilding with a possible increase in vacancy rate and shifting power back to the tenants from the landlords, while Class A rear-load property types seem decently positioned going into 2023. Big-box industrial is the market I would be watching over the next year as more of these buildings are vacant in our market with reduced tenant demand.

Landon Beck

Landon Beck

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Craig Hurvitz

Craig Hurvitz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen