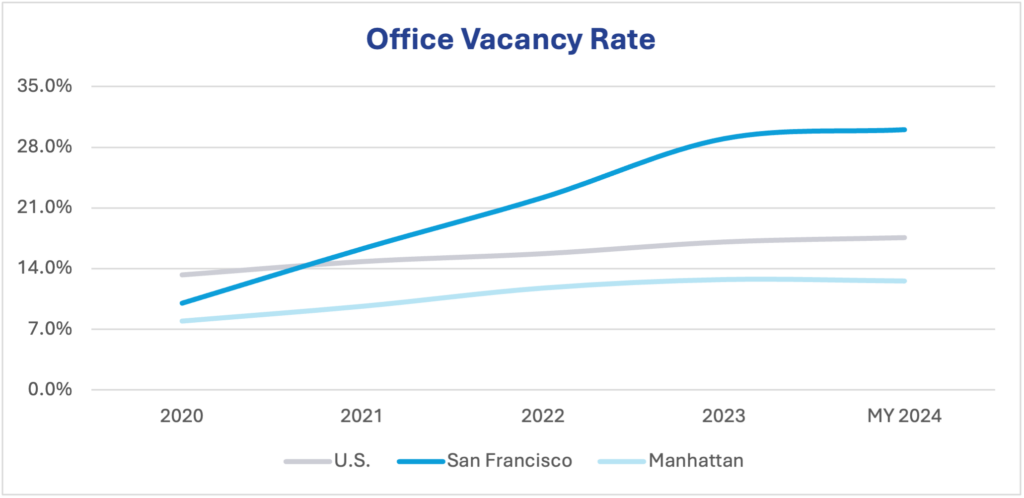

Four years ago, the COVID-19 pandemic created a worst-case scenario for the U.S. office market. The widespread adoption of hybrid and increased remote work led to office space downsizing across all industries, especially in downtowns nationwide. Employees and employers in central business districts and suburbs alike shied away from offices as social distancing and crowd-avoidance measures were adopted nationwide. Many cities saw limited office occupancy for various reasons, including employee relocations further from the office, few company mandates, and the adoption of hybrid or remote work policies. As office tenants dumped excess space, national vacancy spiked to an average of 17.6% as of midyear 2024.

Office properties in major cities across the country were hit hard. In Manhattan and San Francisco, two of the densest markets in the U.S., office fundamentals softened significantly. Manhattan had more than 21 million SF returned to the market between 2021 and midyear 2024, while San Francisco had just over 17 million SF vacated. During this period, vacancy in San Francisco spiked from 13.1% to 30.0%, and Manhattan’s jumped from 9.3% to 12.6%. These two markets became significant focal points, and examples of the health of the nation’s office market, and many publications forecasted the decline of the downtown due to the weak fundamentals in these specific markets.

However, that conversation is changing. These two markets are leading the way from the bottom after seeing new growth demands from tenants, removal of obsolescent inventory, and limited new construction. Market statistics are projected to reflect this change over the next 12 months, and there is cautious optimism about sustained improvements and recovery.

Manhattan: All Efforts Moving Up

The COVID-19 pandemic’s impact on the office market was widespread, and Manhattan was not immune. Leasing velocity fell, office attendance plummeted, and concerns about future occupancies became top of mind. Subway ridership numbers dropped by 62.3% in 2020 from 2019, leading to concerns about potential long-term cuts to services on the city’s buses and subways. The drop in demand and record-high availability led to projections that the office market was in trouble, with a challenging and unclear road to recovery.

But signs of a recovery have emerged. While still below the 2019 level, annual subway ridership increased by 80.1% between the end of 2020 and 2023. Leasing volume in the first half of 2024 grew 15.9% over the first half of 2023, and demand for total 2024 leasing volume is on pace to surpass that of 2023 if the current momentum continues. As in markets throughout the country, Class A space was the top preference for tenants, for 76.2% of leasing volume in the second quarter of 2024. Several older Manhattan buildings that are no longer competitive have been removed from the inventory for residential conversion.

San Francisco: Potentially Turning a Corner

The high concentration of technology firms in San Francisco left it vulnerable to any slowdowns within the industry. When the city and regional governments took aggressive approaches to limit the spread of COVID-19 in 2020, that impacted employees’ ability to utilize public transit, a significant commuter option. The inability to bring staff into the city forced many employers, especially technology firms, to embrace remote work. The extended duration of remote work forced companies to put large quantities of space on the sublease market, driving availability and vacancy rates in the city to record highs.

After leasing hit bottom in the second half of 2023 in San Francisco, it is beginning to rise. Including new leases and renewals, leasing activity totaled 3.1 million SF through the first half of 2024 and was on pace to surpass the 2023 total. Net absorption drastically improved from the preceding year and, although still negative, pointed towards optimism that the market is turning a corner. While San Francisco is still a tech-centric market, benefiting from growth in artificial intelligence firms, the tenant base is diversifying, with professional and financial services firms accounting for a larger share of demand than before the pandemic. Forecasts project that 2024 will have the best leasing performance since 2019.

Looking Ahead

While it’s a bit early to proclaim a recovery is in full swing across the country, the signs are positive in the two highest-profile office markets in the U.S. Sentiment and confidence have reached their highest levels since the onset of COVID-19. Key metrics are starting to reflect the improvements, which have the potential to continue for the rest of the year. However, the sustainability of this trend will largely depend on tenant demand continuing to grow and eventually surpassing the available supply.

Sources: Colliers Research, Metropolitan Transportation Authority.

Marianne Skorupski

Marianne Skorupski Derek Daniels

Derek Daniels Franklin Wallach

Franklin Wallach

Anjee Solanki

Anjee Solanki Sheena Gohil

Sheena Gohil

Makella Houdagba

Makella Houdagba Jeffrey Myers

Jeffrey Myers

Matt Gannon

Matt Gannon Craig Hurvitz

Craig Hurvitz