A prosperous holiday shopping season led the U.S. retail market to record levels at the end of 2021. American consumers pushed holiday sales to a record $886.7 billion, jumping 14.1% during November and December according to NRF, marking the highest growth in at least two decades and exceeding its latest forecast of a rise of as much as 11.5%. While retail’s story was largely positive in 2021, the reorientation of retailer locations and footprints toward a more efficient model continues to drive performance; based upon geography, box size, and shopping center type.

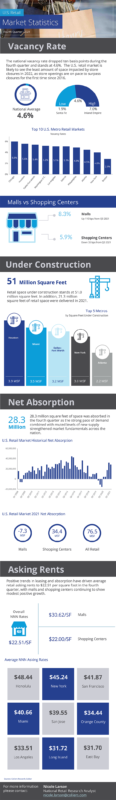

The national vacancy rate dropped 10 basis points, standing at 4.6% in the fourth quarter of 2021. Leasing activity fell over the quarter with 18,320 deals signed, but deal size grew to an average of 3,372 square feet, with a total of 61.8 million square feet leased in the fourth quarter. The U.S. retail market is likely to see the least amount of space impacted by closures, while store openings are on pace to surpass store closures for the first time since 2016.

There were 28.3 million square feet of space absorbed in the fourth quarter as the strong pace of demand growth combined with muted levels of new supply has stabilized market fundamentals within the national retail market. For the full year of 2021, a total of 76.5 million square feet was absorbed, with shopping centers accounting for nearly 45% of the positive absorption. Retail space under construction stands at 51 million square feet, with 21.3 million square feet of retail space delivered throughout 2021.

Positive trends in leasing and absorption have driven average retail asking rents to $22.51 per square foot in the fourth quarter, with malls and shopping centers continuing to show modest positive growth. Lease rates have grown by 3% year-over-year, the strongest nominal growth rate recorded in over a decade. Fast-growing metros in the Southern and Western regions of the U.S., such as Atlanta, Nashville, Las Vegas, Tampa, and Phoenix, are expected to continue to outperform the national average heading into the new year.

Download the U.S. Retail Market Statistics infographic here.

Nicole Larson

Nicole Larson

Aaron Jodka

Aaron Jodka

Anjee Solanki

Anjee Solanki