The retail industry has undergone a significant transformation over the past five years, primarily influenced by the burgeoning rise of online shopping and shifting consumer preferences. As more shoppers turn to digital platforms for their purchasing needs, the physical footprint of retail stores is evolving to keep pace with new consumer behaviors and expectations. This shift in consumer preferences has transformed retail environments from large areas designed for one-stop shopping to more compact, efficient spaces.

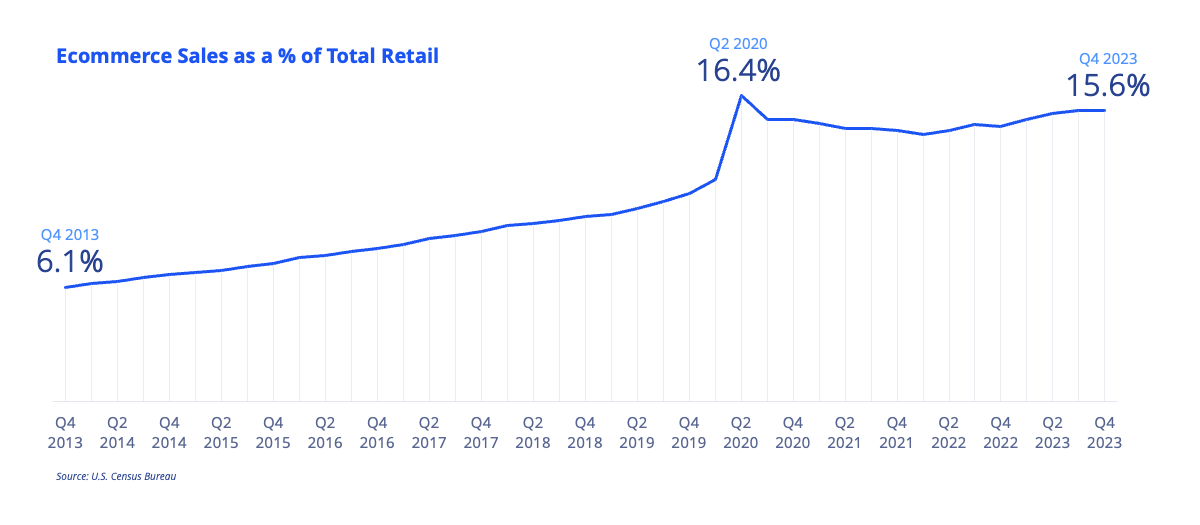

Online shopping has drastically reshaped the retail landscape, challenging traditional brick-and-mortar stores to adapt to shifting consumer preferences. Though the pandemic advanced ecommerce growth, online sales have since stabilized, accounting for 15.6% of total retail sales at the end of 2023.

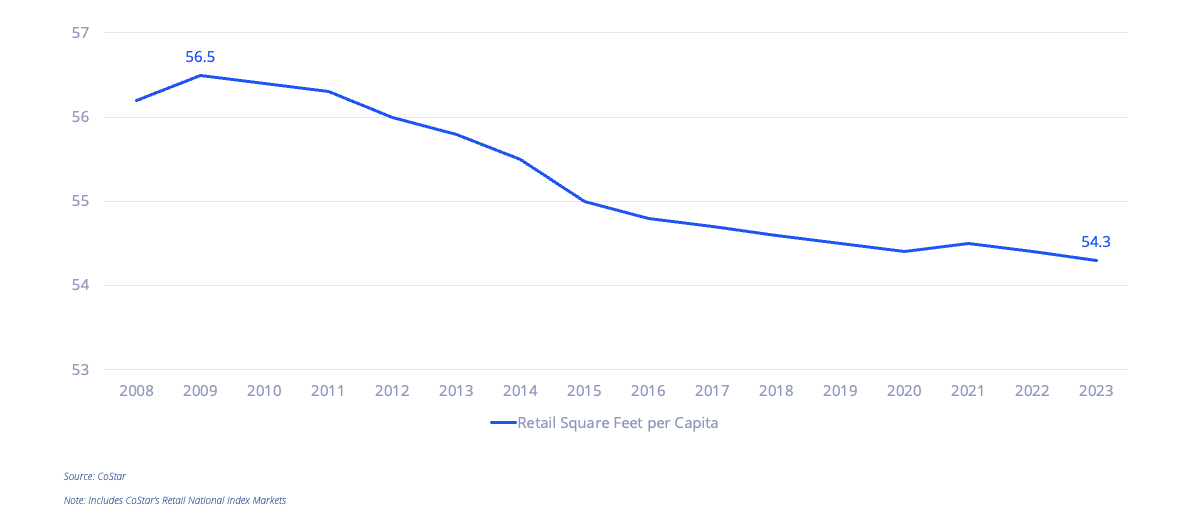

Retail space per capita in the U.S. declined to 54.3 square feet in 2023 from 56.5 square feet in 2009 despite increased retail sales and total population. This underscores the urgent need for retailers to focus on enhancing the consumer experience to stay relevant in this evolving landscape, and today’s consumers, more than ever, prioritize experiences and convenience.

Retail construction activity remains limited across most markets in the U.S. In contrast, a significant amount of retail space, especially former department stores in aging malls, has been redeveloped into other types of retail spaces such as mixed-use developments, experiential retail spaces, or last-mile delivery hubs. This has resulted in over 130 million square feet of retail space demolished over the past five years alone. Against this backdrop, retail inventory levels have risen by less than 0.5% annually over the past decade, while population and spending totals have risen at a brisker clip, increasing the efficiency of retail space, all else equal.

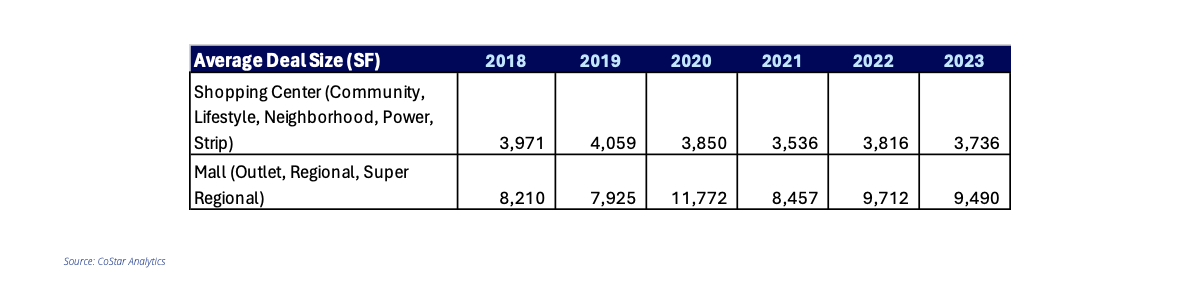

The average deal size for shopping centers and malls illustrates a dynamic landscape where retailers are actively experimenting with and adjusting their spatial requirements. The average deal size for shopping centers started at 3,971 square feet in 2018, peaked at 4,059 square feet in 2019, and then showed a general decline, reaching 3,736 square feet by 2023. This trend indicates a slight reduction in space, potentially reflecting a shift towards more compact formats in response to evolving consumer preferences and the impact of online shopping.

In contrast, malls saw more significant fluctuations, with deal sizes increasing dramatically to 11,772 square feet in 2020, possibly due to consolidations or larger retailers expanding their presence, before moderating to 9,490 square feet in 2023. These variations suggest that while there is a trend towards downsizing in some segments, the idea that all retail spaces are shrinking does not hold universally. Retailers are still determining the optimal store size, balancing operational efficiency and their customers’ experiential demands. These fluctuations in deal sizes are influenced by a variety of factors, including market conditions, consumer preferences, and the strategies of individual retailers.

The historical evolution of retail store footprints is not just a reflection of change, but a dynamic shift towards creating experiences beyond traditional shopping. As the retail landscape continues to evolve, stores’ strategic location and format remain crucial in drawing customers and fostering spaces that double as social hubs. To stay competitive, retailers must embrace flexibility, integrate advanced technologies, and continually focus on enhancing the consumer experience. In an industry where innovation and adaptability are essential, those retailers who swiftly adjust to these changing dynamics are not just poised to succeed, but to lead the way in shaping the future of retail.

Nicole Larson

Nicole Larson

Anjee Solanki

Anjee Solanki