Building owners should be aware of risks to the energy grid that feed them power. There are strategies to reduce reliance on the grid, insulating building from various competition for finite energy supply. In markets across the country, data centers are taking up more and more power. This is far from the only competition for energy that households and commercial buildings must contend with. The growing popularity of electric vehicles and the associated need for more charging stations is also a recent development that will also take more capacity from the existing grid. Aging electrical infrastructure makes it difficult to increase capacity at-scale. This means there need to be local and regional solutions to bolster the energy supply for all consumers, from office tenants operating coffee machines to people turning on lights in their home and big tech firing up a data center that powers artificial intelligence.

Aaron Jodka

Aaron Jodka

“The rising popularity of home automation and electric vehicles is also applying more pressure to already stressed grids… As AI continues to advance and expand its presence in various industries, the demand for hyperscalers [i.e. Amazon Web Services, Google Cloud, and Microsoft Azure] and their need for larger high-density data centers and campuses will also grow.”

This is an opportunity and responsibility for current property owners. Those who want to secure their access to abundant power have options when it comes to financing improvements to their property. Some internal building systems will motivate upgrades to ensure more power, such as EV charging stations and higher connectivity requirements for tenants. Other motivations will be in furtherance of sustainability goals, which more resilient energy systems will help companies and property owners achieve.

“While demand for data centers is rapidly increasing, there are significant hurdles, particularly concerning emissions and grid scarcity. Although renewable sources, like wind and solar, along with innovative solutions such as small nuclear reactors and fuel cells, are being explored, there is not a scalable clean energy replacement for generators that provide necessary backup power. This reality poses a considerable challenge for hyperscalers aiming to achieve 100% clean energy targets by 2030 or 2040.”

There are many options building owners have at their disposal to reduce their need for energy and create new energy streams to use, reducing their reliance on the traditional grid. Energy reduction strategies include peak shaving (i.e. strategically using less energy during periods of high demand), more protective insulation, and more efficient systems and fixtures. Creating new energy streams rely on site-specific guidance and can include solar arrays, wind power, and geothermal systems. Combined with the building’s infrastructure, these can be combined to create a “district energy system” or “microgrid,” allowing a building to generate more energy than it uses, as well as protect it from potential disruption as other users tax the grid. Unfortunately, these systems, like data centers, require the utilization of generators, which still run on fossil fuels, delaying the clean energy transition. This counteracts environmental, social, and governance (ESG) commitments by companies, particularly those with ambitious goals to have 100% clean energy by 2030 or 2040. The Washington Post recently ran a story about these tech giants working on futuristic and experimental solutions, such as harnessing fusion. This will help long-term, but until they become operational, small scale solutions are the only viable options. Even the small scale options are expensive, but from a capital expenditures standpoint, there are unique funding mechanisms that minimize the downside risk to consumers.

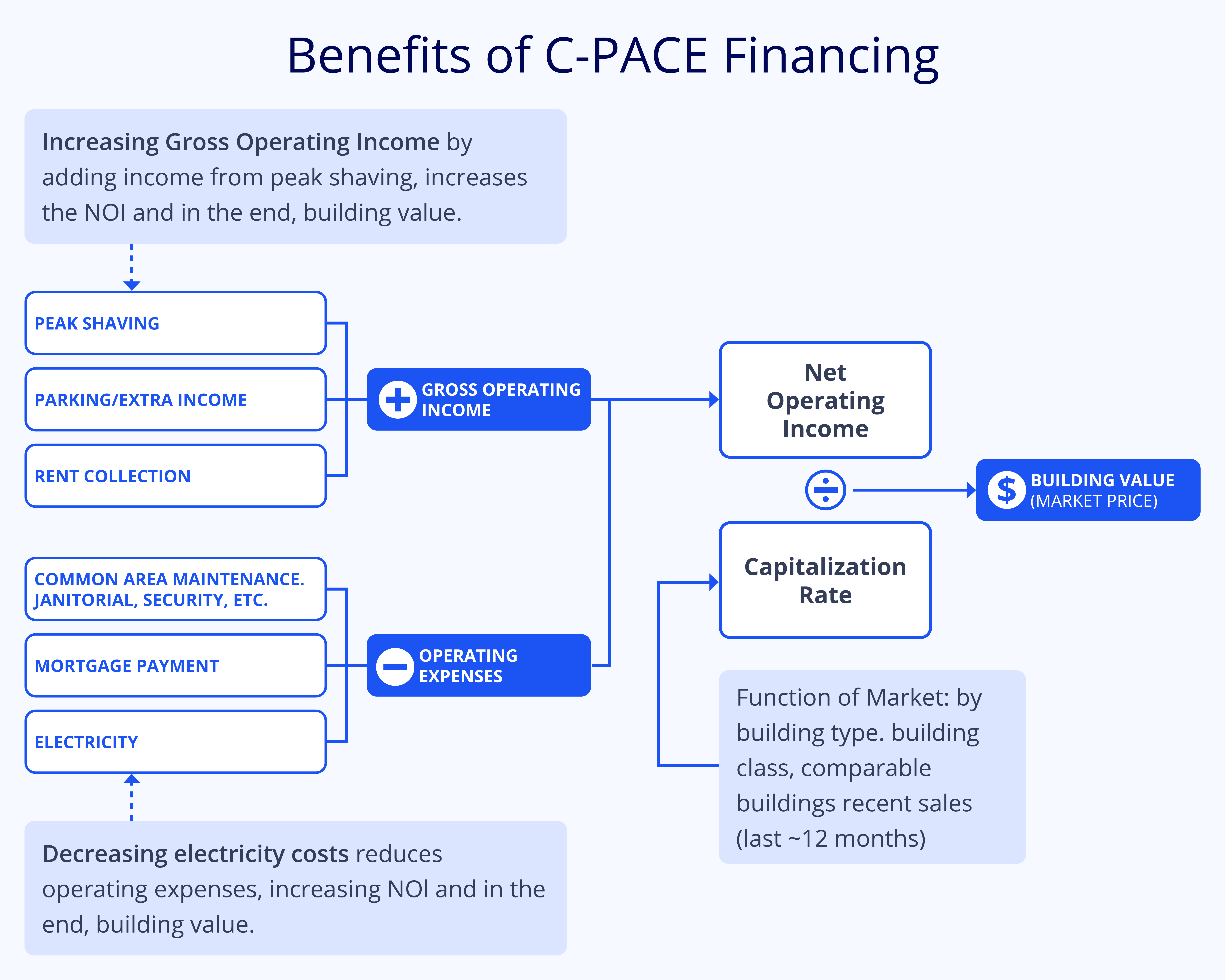

One avenue to securing funding for energy upgrades is called “C-PACE,” or Commercial Property Assessed Clean Energy. C-PACE funding is in the form of a voluntary property tax assessment, which is repaid with property taxes, reducing the taxable liability. The U.S. Department of Energy developed this toolkit for local jurisdictions to adopt providing an innovative way for property owners to pay for energy-efficient upgrades to their buildings without punishing them “above the line.” This line is the critical net operating income, or NOI, line, which is a major piece of valuating a building. It is a result of taking the income minus expenses, which often includes debt. C-PACE financing, however, is not included in that formula, making it a strategic financing mechanism. It also does not have to reset upon property sale, since it is associated with the building rather than the borrower.

Eligible improvements could be as simple as getting new, more efficient siding, a roof, or as far as installing a microgrid that uses geothermal energy and solar panels. In some cases, a microgrid could be used to create more energy than the building needs, allowing the owner to sell electricity back to the grid, creating another income stream. Improving tax benefits as well as operational efficiencies gained by a more energy-efficient building create a double-win for property owners who consider C-PACE funding.

“C-Pace financing provides benefits to NOI, directly increasing the value of a building by decreasing the cost to operate it, while avoiding recourse loans or tapping into capital expenditure budgets,” said Devesh Nirmul, Executive Director, Counterpointe SRE. “Especially in areas with insurance concerns, seismic upgrades ensure long-term value. These PACE-financed improvements push out the upfront costs of high-performance features well into the future.”

With many options on the market to “green” a building and new ways to finance those improvements, it is worth the time to consider upgrading a building’s energy systems. Colliers is researching alternative energy production methods to support client efforts. Data center developments may not be risking every building’s energy supply yet, but the proliferation of artificial intelligence, increasing use of electric vehicles, and other energy-intensive innovations are picking up speed. Having a plan for how to power traditional buildings, potentially in untraditional ways with innovative financing tools is a worthwhile investment protection.

Patrick Duffy

Patrick Duffy John Scott

John Scott Jacob Pavlik

Jacob Pavlik

Anjee Solanki

Anjee Solanki Mike Spears

Mike Spears

Sheena Gohil

Sheena Gohil

Jeff Gerwig

Jeff Gerwig