Momentum in the industrial market, once red-hot, is decreasing due to a slowing economy influenced by rising interest rates and high inflation. The demand for bulk industrial space, for tenants requiring more than 100,000 square feet, reached slightly above 93.6 million square feet. Although total demand dropped by a significant 47% in Q1 2023 quarter-over-quarter, it was nearly identical to demand in Q1 2021.

In the first quarter, more than 325 new leases, renewals, and user sales were completed for bulk industrial properties, encompassing warehouses, manufacturing facilities, and flex spaces. The average size of these transactions decreased slightly, from 293,700 square feet in 2022 to 288,109 square feet in the first quarter.

Bulk tenants prefer newer facilities that offer the advantages of higher ceiling heights, ample power supply, generous parking provisions, enhanced building amenities, and a greater focus on environmental, social, and governance (ESG) factors.

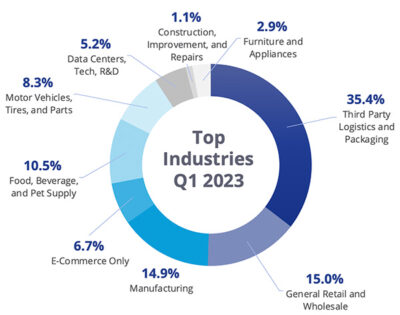

To kick off the year, third-party logistics and packaging companies (3PLs) maintained a significant lead in market share, growing to 35.4% in Q1 2023 as the primary occupiers of bulk space, from 28.1% in 2021. On the other hand, e-commerce demand, which previously dominated bulk space, substantially declined year-over-year, to 6.7% of market share, dropping from 14.5%. General retail and wholesale also lost market share, by 310 basis points, settling at 15.0%, while food, beverage, and pet supply market share increased 200 basis points year-over-year, to 10.0%.

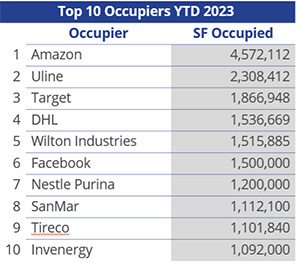

Although the e-commerce industry share of bulk space has declined, Amazon remained the leading occupant in the United States during the first quarter. Moreover, while it may have reduced its presence in certain markets, it continues to expand in others. Of the 15 facilities being constructed with an area surpassing two million square feet, Amazon plans to occupy six, resulting in a combined total space of over 21 million square feet.

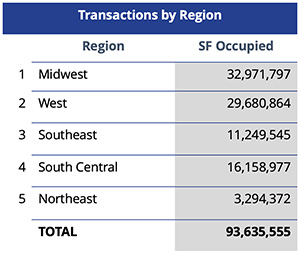

During the first quarter, the Midwest region led in bulk occupier transactions, at 35.2%. Following closely was the West region, at 32.0%, while the Northeast market was the least active, at a mere 3.5% of signed transactions. The Inland Empire in Southern California played a significant role in propelling the West region to second place. Its reputation as the top-tier big-box market in the area attracts major distributors, warehousers, e-commerce companies, and logistics firms, drawn to its ability to help consolidate operations within large, cutting-edge facilities. This results in a remarkably low vacancy rate, and the market accounts for a substantial portion of new bulk space transactions.

Despite a decline in overall bulk space activity, this is only in comparison to the exceptional performance of the past two years. Compared to pre-pandemic levels, the first quarter of 2023 is still above average historically. Occupiers actively seek space in competitive industrial markets to be closer to their largest consumer bases. Notably, more than 620 million square feet of space is still under construction as of the first quarter, with nearly 180 facilities exceeding one million square feet. An increase in manufacturing development is also anticipated in 2023: eight facilities larger than one million square feet are being constructed, many for automotive companies such as General Motors, Nikola Motor Company, and Ford Motor Company. The ongoing construction of a record-breaking number of industrial properties will continue to provide modern and attractive options for bulk occupiers in the upcoming quarters.

Source for all graphs: Colliers Research

Company Type Description:

Construction, Improvement and Home Repair – Warehousing and distribution of materials used in residential and commercial construction, improvements and repair; could contain some e-commerce components.

Data Centers, Tech and R&D – The industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only – Warehousing and distribution of a product ordered online and shipped directly to the end consumer.

Food, Beverage and Pet Supply – Manufacturing, warehousing and/or distribution of food and beverage-related products. It could contain some e-commerce or manufacturing components.

Furniture and Appliances – Warehousing and distribution of retail and/or wholesale furniture and appliance products. It could contain some e-commerce and or manufacturing components.

General Retail and Wholesale – The warehousing and distribution of retail and/or wholesale products not listed in other categories. It could contain some e-commerce or manufacturing components.

Manufacturing – Industrial space used for manufacturing and/or storing raw materials and equipment used to manufacture non-automobile products.

Motor Vehicles, Tires and Parts – The warehousing, manufacturing and/or distribution of motor vehicles, tires, and related parts and materials.

Third-Party Logistics and Packaging – Third-party logistics (3PL) and packaging of various products could contain some e-commerce components.

Steig Seaward

Steig Seaward

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett