After three record-setting years, bulk industrial demand, defined as tenants requiring more than 100,000 square feet, is beginning to return to its pre-pandemic pace. In 2019 the market recorded nearly 420 million square feet of new leases, renewals, and user sales for bulk industrial properties and peaked at nearly 675 million square feet in 2022. During the first quarter of 2023, the market recorded 93.6 million square feet, and the pace slowed even more during the second quarter to 86.5 million square feet.

Year to date, the market has recorded just over 635 transactions within bulk industrial properties and is well off the 2022 pace of nearly 1,200 transactions during the same period. Moreover, the average size of these transactions decreased slightly, from 293,680 square feet in 2022 to 282,801 square feet in the second quarter of this year.

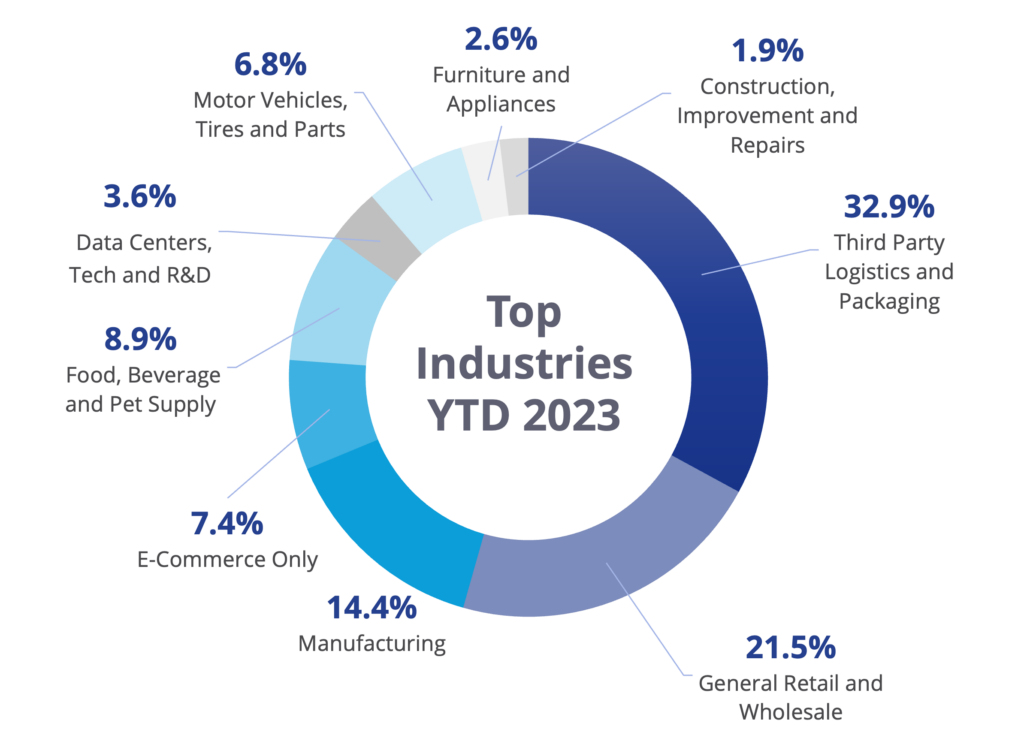

In terms of occupancy, third-party logistics and packaging companies (3PLs) have retained their prominent status throughout the initial half of the year. This sector has progressively expanded its market presence, ascending from 28.1% in 2021 to 29.8% in 2022 and ultimately reaching 32.9% in 2023. 3PL providers, focusing on outsourced logistics and warehousing services for retailers and wholesalers, continue to lead the pack due to their adeptness at delivering cost-efficiency to businesses and mitigating the challenges posed by labor shortages.

Although 3PLs maintain their stronghold, the demand for e-commerce space is witnessing a decline. Its market share has contracted from 14.9% at the close of 2022 to a mere 7.4% in the first half of the current year. Nevertheless, the e-commerce sector boasts the largest average square footage per transaction, standing at an impressive 438,659 square feet. The subsequent sector in terms of size is motor vehicles, tires and parts, boasting an average of 353,308 square feet.

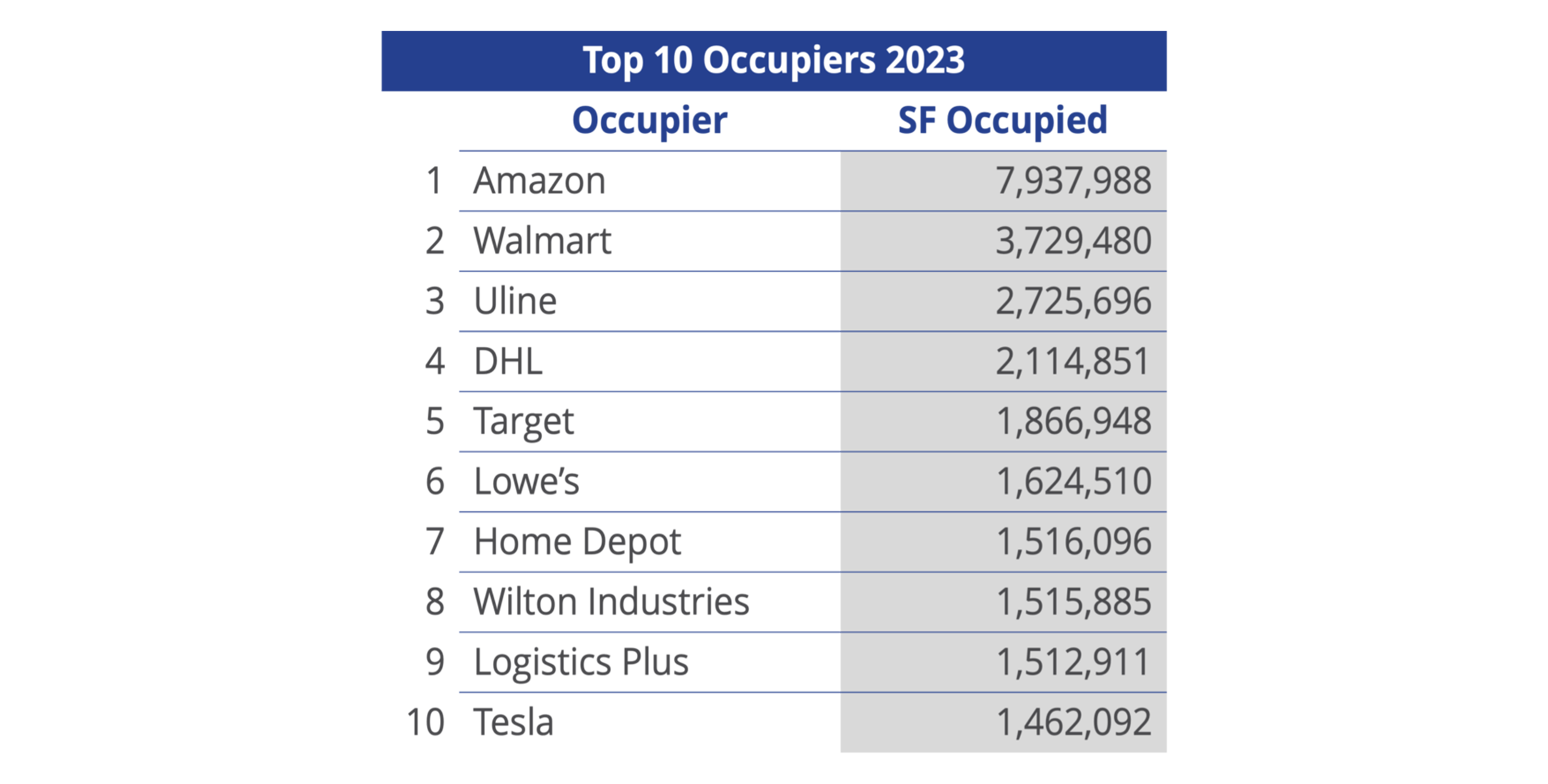

Amazon continues to remain the top occupant through the first half of 2023. Of the nearly eight million square feet occupied this year, 61.1% is located in the West region, followed by an additional 27.6% in the Midwest. Meanwhile, Walmart and Uline also exhibit notable activity in the Midwest, with over 75% of their 6.4 million square feet in this region.

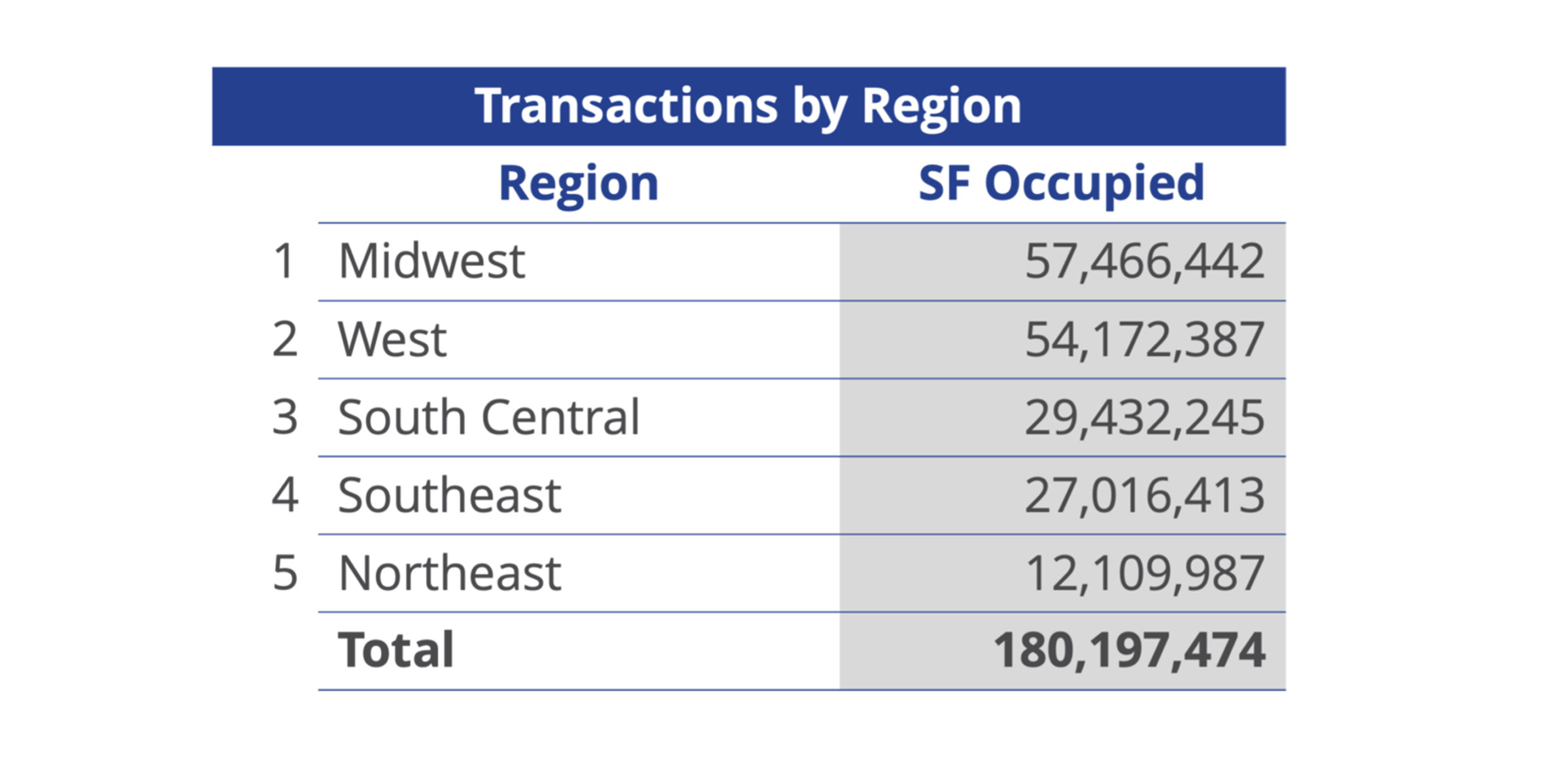

Transactions in the Midwest accounted for 31.9% of all bulk occupier activity, followed by the West region with 30.1%. The Northeast market experienced the least activity for the second consecutive quarter, accounting for just 6.7% of transactions signed. Despite a noticeable decrease in the Inland Empire, California led all states by transacting just over 20.1 million square feet in the year’s first half. The top five states were California with 20.1 million, Texas with -16.1 million, Illinois with -14.1 million, Ohio with -7.9 million and Georgia with -6.2 million square feet.

Demand for bulk industrial space has cooled considerably over the last few quarters. Year over year, the number of transactions has dropped by 46%, and the total square feet occupied has fallen by 49%. In addition, the average transaction size has steadily declined over the last five quarters after peaking at just over 311,000 square feet in Q1 2022. However, context is important, as 2022 was a record-setting year. Transaction volume for bulk industrial space will continue to moderate over the short term due to rising interest rates, economic uncertainty and falling consumer confidence.

With over 635 million square feet under development and roughly 175 of those projects exceeding one million square feet, coupled with softening demand, large users will have ample stock to choose from over the next year.

Source for all graphs: Colliers Research

Company Type Description:

Construction, Improvement and Home Repair – Warehousing and distribution of materials used in residential and commercial construction, improvements and repair; could contain some e-commerce components.

Data Centers, Tech and R&D – The industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only – Warehousing and distribution of a product ordered online and shipped directly to the end consumer.

Food, Beverage and Pet Supply – Manufacturing, warehousing and/or distribution of food and beverage-related products. It could contain some e-commerce or manufacturing components.

Furniture and Appliances – Warehousing and distribution of retail and/or wholesale furniture and appliance products. It could contain some e-commerce and or manufacturing components.

General Retail and Wholesale – The warehousing and distribution of retail and/or wholesale products not listed in other categories. It could contain some e-commerce or manufacturing components.

Manufacturing – Industrial space used for manufacturing and/or storing raw materials and equipment used to manufacture non-automobile products.

Motor Vehicles, Tires and Parts – The warehousing, manufacturing and/or distribution of motor vehicles, tires, and related parts and materials.

Third-Party Logistics and Packaging – Third-party logistics (3PL) and packaging of various products could contain some e-commerce components.

Steig Seaward

Steig Seaward

Aaron Jodka

Aaron Jodka

Craig Hurvitz

Craig Hurvitz