After years of negotiations, President Biden signed the Inflation Reduction Act into law. While the bill will do little to ease inflation, at least over the short run, the White House press release noted that over 120 economists promoted the bill insisting it will put “downward pressure on inflation by reducing the government’s budget deficit by an estimated $300 billion over the next decade.”

Despite its name, the bill focuses on climate, health care, and taxes. The package is the largest climate bill in history, with approximately $369 billion earmarked for climate and energy programs. In addition to tax credits for switching to electric vehicles, the bill paves the way for more clean and sustainable energy sources and investment in clean domestic energy production and manufacturing.

Inflation Reduction Act Allocations

Small businesses will find the Inflation Reduction Act appealing if it lowers healthcare costs. The bill aims to curb the rising cost of healthcare by extending Affordable Care Act subsidies for three more years, allowing Medicare to negotiate drug prices, and implementing a $2000-year cap on out-of-pocket prescription costs starting in 2025.

In addition, under the bill, building owners and developers will be incentivized to make energy-efficient improvements. Under the 179D Energy Efficient Buildings Tax Deduction, the maximum allowable benefit will increase from $1.88/SF to $5.00/SF in 2023, provided the buildings meet the specific energy reduction requirements.

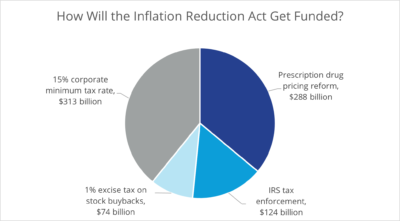

Large businesses stand to bear the brunt of the new legislation as corporations with over $1 billion in average annual adjusted financial statement income will be subject to a 15% domestic tax beginning December 31, 2022. Lobbyists were, however, able to eliminate several tax proposals from the final approved bill, such as increases to long-term capital gains rates, carried interest, caps on property deductions and elimination of Roth conversions for high-net-worth individuals.

Going forward, companies with at least $1 billion in income will be required to calculate their annual tax liability using traditional tax accounting methods, typically 21% of profits less deductions and credits, and by applying the 15% rate to reported earnings, known as book income. Companies will then pay the higher of those two methods.

While the carried interest tax loophole was ultimately removed from the bill, a 1% excise tax was added in its place when corporations repurchase stock from their shareholders.

Additional tax provisions in the bill include:

- A two-year extension (to tax years beginning before January 1, 2029) of the loss limitation rules applicable to noncorporate taxpayers under Section 461(l) of the Internal Revenue Code, which generally limits the business loss that can be taken on a joint return to $500,000 per year.

- An increase in the research tax credit available to offset the payroll taxes of qualified small businesses under Section 41(h) of the Internal Revenue Code.

- An increase in IRS funding of approximately $80 billion over 10 years to expand direct filing, provide faster tax refunds, and hire additional staff for tax enforcement.

- A new excise tax on drug producers who fail to comply with new drug pricing requirements.

- The reinstatement of a Superfund excise tax on crude oil and certain imported petroleum products at a rate of 16.4 cents per barrel (indexed to inflation) beginning January 1, 2023.

- The permanent extension of an excise tax on coal from US mines.

- Climate and energy-related taxes, tax credits, and other incentives.

“This historic bill will lower the cost of energy, prescription drugs, and other health care for American families, combat the climate crisis, reduce the deficit, and make the largest corporations pay their fair share of taxes.” – The White House

Steig Seaward

Steig Seaward

Patrick Beard

Patrick Beard Jacob Crist

Jacob Crist

Shawn Janus

Shawn Janus

Nicole Larson

Nicole Larson