In a recent webinar hosted by Colliers Industrial and Occupier Services, experts delved into the dynamic landscape of the supply chain, focusing particularly on the concept of nearshoring with a spotlight on Latin America. The panelists provided valuable insights to guide real estate strategies in a rapidly evolving global market. Here is a summary of the key takeaways shared during the webinar.

Onshoring, Nearshoring, and Friendshoring

While they are similar, there are clear differences in the definitions of onshoring, nearshoring, and friendshoring. Onshoring involves bringing manufacturing or sourcing activities back to the company’s home country to mitigate supply chain risks and improve quality control. There’s a trend of American companies onshoring manufacturing that demands specialized personnel, robotization, AI integration, and dependable energy sources.

Nearshoring relocates these activities to nearby countries, maintaining cost advantages while reducing risks. Mexico, Guatemala, Puerto Rico, Colombia, and Costa Rica are among some of the top destinations for nearshoring. Friendshoring focuses on countries with friendly trade relations, aiming to capitalize on lower costs and political stability. Each approach comes with its set of advantages and challenges, influencing companies’ decisions in crafting their supply chain strategies.

A Look at Recent Trends in Foreign Direct Investment (FDI)

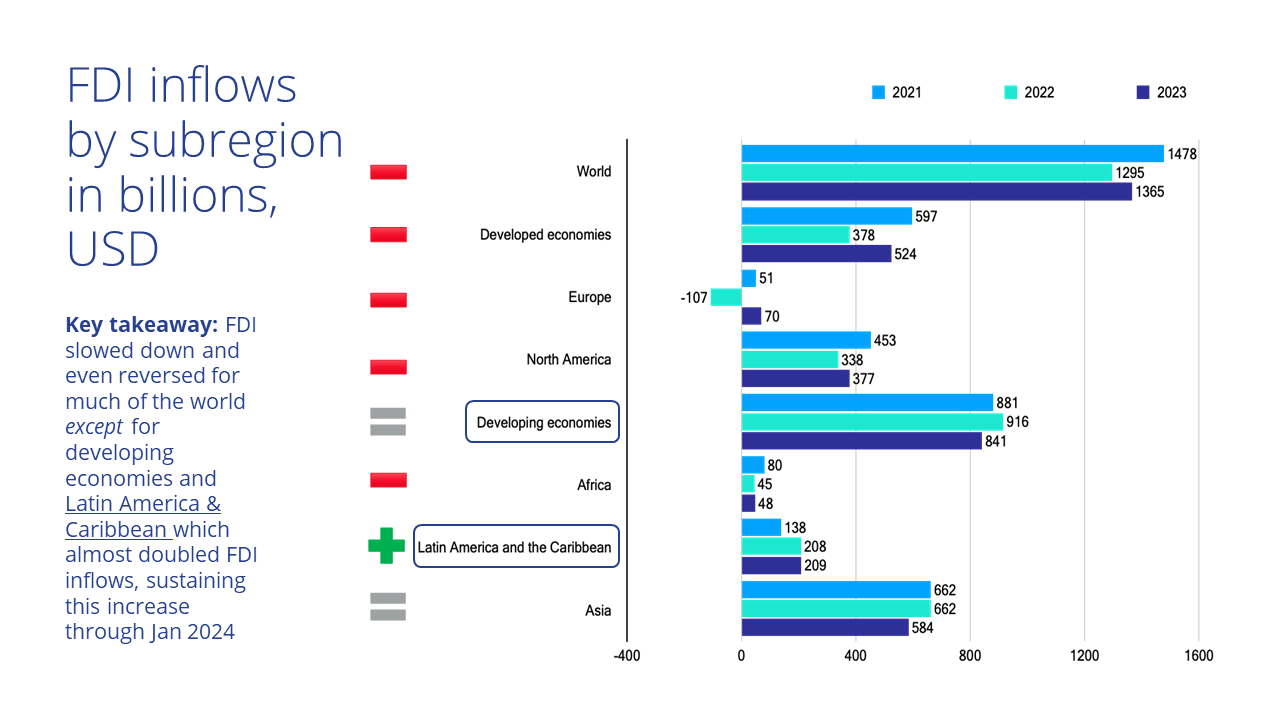

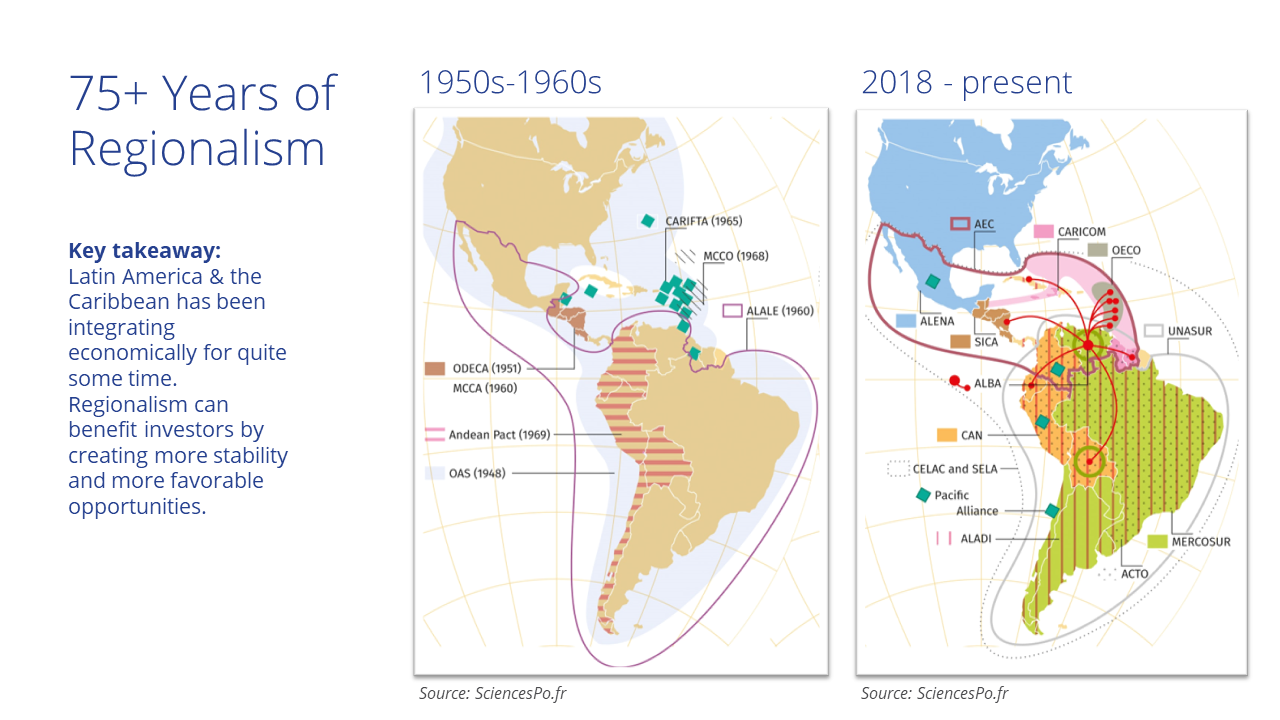

Dr. Tina Zappile of Stockton University shared how FDI plays a crucial role in shaping global supply chains and evolving capital trends. While overall FDI has seen fluctuations, Latin America and the Caribbean have sustained growth, doubling between 2021 and 2022, as depicted by the inflow data below. Notably, companies within the region are also increasingly investing outside their borders, indicating a favorable environment for both inbound and outbound investments.

Regional integration, particularly in Latin America, fosters stability and specialization, further nurturing these favorable conditions for investment in manufacturing. Mexico continues to be a pivotal trading partner for the U.S., with its geographical proximity and historical ties driving increased economic activity.

Cost and Risk Factors

As companies embark on nearshoring initiatives, Brewster Smith, SVP, Supply Chain Solutions noted that there are four major cost and risk factors that need to be taken into account: operational decommissioning, raw material sourcing, automation investment, and regulatory compliance.

Operational decommissioning entails the process of transitioning manufacturing operations from offshore locations, potentially involving contractual payouts, intellectual property transfer, and machinery relocation. Raw material sourcing emerges as the second critical factor, as not moving raw material vendors will lead to disruptions. Automation investment is the third key consideration, requiring substantial upfront capital for the integration of technologies to fill the gap of skilled labor, depending on the local workforce composition. Finally, regulatory compliance poses a multifaceted challenge, encompassing adherence to diverse legal frameworks in both the home and nearshoring countries that could require significant recalibration of the manufacturing process.

These big four factors underscore the complexity that companies must carefully navigate to ensure the success of their nearshoring endeavors.

Nearshoring in Mexico: Opportunities and Challenges

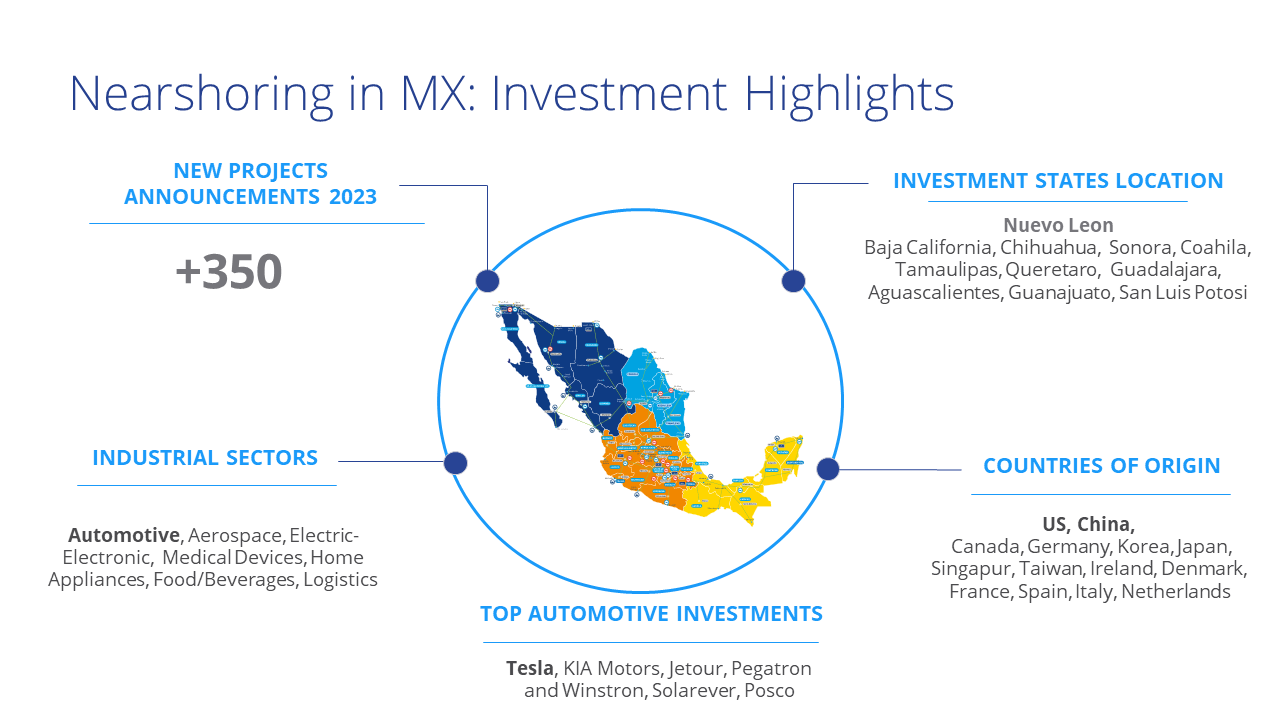

Rafael McCadden, Industrial & Logistics Director, shared insights into Mexico’s evolution as a nearshoring destination, which traces back to the mid-1960s, and gained momentum with initiatives like NAFTA. Recent events, such as the pandemic and supply chain disruptions, have accelerated this trend, with many companies relocating manufacturing operations to Mexico.

Mexico specifically, has emerged as a central player in nearshoring, driven largely by its strategic location which provides transportation savings and faster delivery time, its young and skilled workforce, low labor costs, and more than 14 free trade agreements. An additional benefit is Mexico shares the same four time zones as the US and Canada.

While nearshoring in Mexico presents abundant opportunities, it also poses significant challenges, particularly in infrastructure development. Issues related to raw material sourcing, power and water infrastructure remain critical considerations for companies. However, with the guidance of site selection specialists, investors can navigate these challenges and capitalize on the region’s potential.

Future Sustainability and Resilience in Supply Chains

As global markets continue to adapt to changing geopolitical landscapes, understanding the nuances of nearshoring becomes imperative for investors, occupiers, and real estate professionals. Latin America, with Mexico at its forefront, offers a compelling destination for companies looking to optimize their supply chain networks. By navigating the opportunities and challenges outlined in the webinar, businesses can position themselves for success and supply chain resilience in an increasingly interconnected world.

Stephanie Rodriguez

Stephanie Rodriguez

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Craig Hurvitz

Craig Hurvitz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen