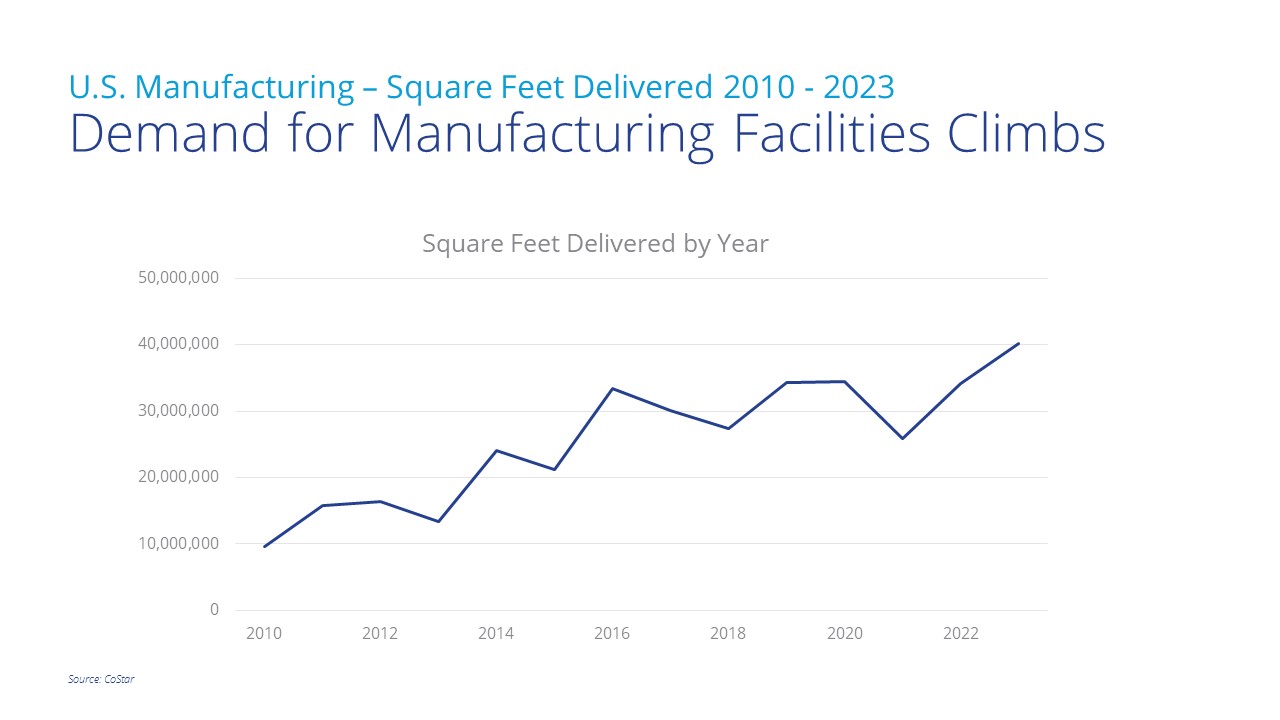

The economic landscape has witnessed dynamic transformations, and amid these changes, one aspect that has been shining through is the resurgence of U.S. manufacturing. Propelled by initiatives like the CHIPS Act and incentivized by a range of measures, the manufacturing sector is experiencing increased demand.

In the graph above, manufacturing facility deliveries have quadrupled since 2010. Deliveries have climbed steadily since 2010, with a slight dip during the COVID-19 pandemic.

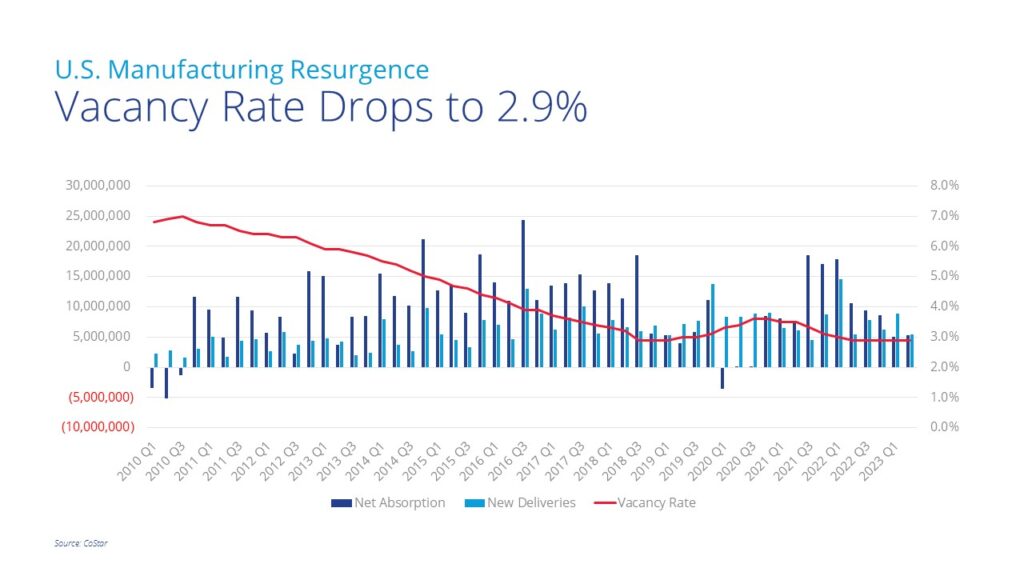

Demand for manufacturing space persists as new product has been absorbed quickly. Since 2010, the U.S. manufacturing vacancy rate has steadily declined from a peak of 7% to 2.9%.

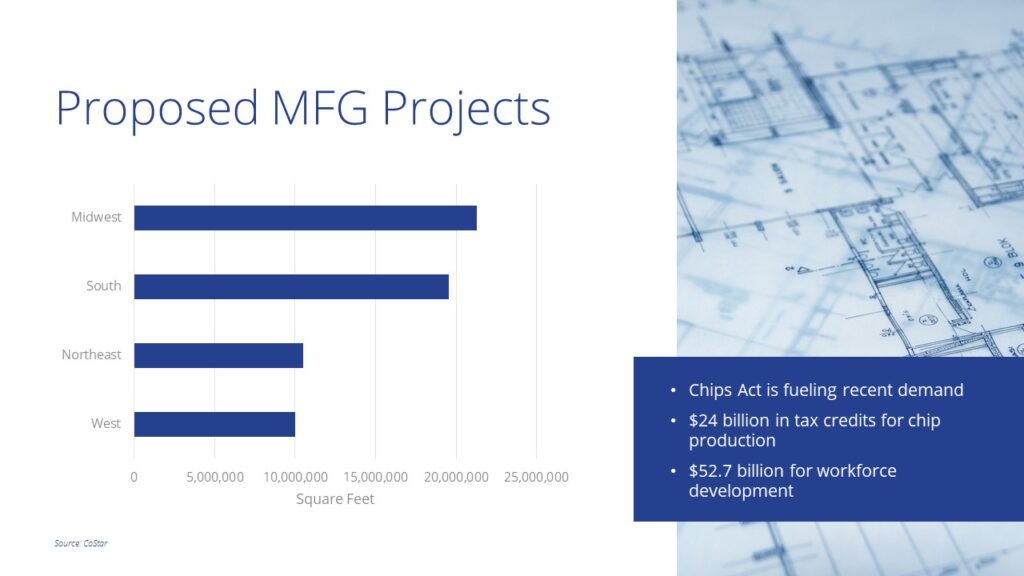

The top 20 states show the regions most impacted by recent development activity are located in the Sun Belt and Midwest regions. The Sun Belt states benefit from their proximity to Mexico, a growing population and labor availability. U.S. manufacturing has traditionally been centered around the Midwest, which already has a skilled labor force.

Manufacturing Facilities Demand Fueled by Recent Incentives

In addition to onshoring, foreign investors are pouring into the U.S. manufacturing sector, with key initiatives like the U.S. Inflation Reduction Act and the CHIPS Act playing instrumental roles. Recent data from the U.S. Bureau of Economic Analysis (BEA) reveals that foreign direct investments in greenfield projects, including establishing and expanding U.S. businesses, have skyrocketed to an impressive $5.3 billion. This figure more than doubles the pre-pandemic levels, clearly showcasing the allure of U.S. manufacturing investments to international players.

The CHIPS Act, bolstered by $24 billion in tax credits for chip production and an additional $52.7 billion allocated for workforce development, has driven a manufacturing renaissance in the U.S. By incentivizing businesses to invest in cutting-edge chip manufacturing facilities and nurturing a skilled workforce, the CHIPS Act has worked to ensure the U.S. continues to be a global leader.

Impact to Investors: Lucrative Investment Opportunities Beckon

The resurgence of U.S. manufacturing opens up a wide variety of attractive investment opportunities for discerning investors. As manufacturing projects return to domestic soil, a thriving pool of ventures are seeking financial backing. Moreover, the continued positive performance of the industrial real estate market further enhances these prospects. Despite a softening in market fundamentals in the first quarter of the year, the U.S. industrial sector remained one of the top-performing commercial real estate property types. Investors who seize this opportunity can position themselves advantageously at the forefront of this push. As the demand for US-made goods continues to rise, companies need to expand their operations, upgrade infrastructure, and embrace new technologies. Investing in such ventures offers the potential for substantial returns and the chance to play a pivotal role in rebuilding and strengthening the US manufacturing sector.

Impact to Occupiers: Enhanced Supply Chain Resiliency and Efficiency

The increase in U.S. manufacturing and the subsequent reshoring of supply chains have brought forth a multitude of benefits, prominently including enhanced supply chain resiliency and efficiency. The pandemic’s disruptions exposed the vulnerabilities of global supply chains, prompting companies to reevaluate their sourcing strategies. By bringing manufacturing operations back to the U.S., businesses can lessen their reliance on distant suppliers and mitigate the risks associated with geopolitical and economic uncertainties. The localization of production facilitates quicker responses to market demands and reduces transportation costs, further bolstering the allure of U.S. manufacturing. Notably, the Midwest and Southeast regions have emerged as the leading contenders for manufacturing job density, with all but two of the top 12 onshoring job markets in the first half of 2022 located in these areas.

Opportunities and Challenges Ahead for Occupiers and Investors

The resurgence of manufacturing in the U.S. is yielding tangible benefits and exciting opportunities for businesses and investors. Government support and sustained growth are attracting foreign investors, positioning them at the forefront of this transformative era, offering significant returns and long-term prosperity. The strong government incentives, coupled with the sector’s revitalization, create a win-win situation for occupiers and investors, fostering economic growth and a thriving industrial landscape in the U.S.

However, there are still challenges to address. For instance, the delay of Taiwan Semiconductor Manufacturing Co.’s Arizona facility to 2025 highlights that bringing manufacturing back to the U.S., especially in the chip-making space, is a complex and gradual process. It requires accessible infrastructure, natural resources, and skilled labor to succeed. On-shoring will require a methodical approach and cannot be achieved overnight.

Stephanie Rodriguez

Stephanie Rodriguez

Patrick Beard

Patrick Beard Jacob Crist

Jacob Crist

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Craig Hurvitz

Craig Hurvitz