- An increasing share of markets posted positive absorption in Q4.

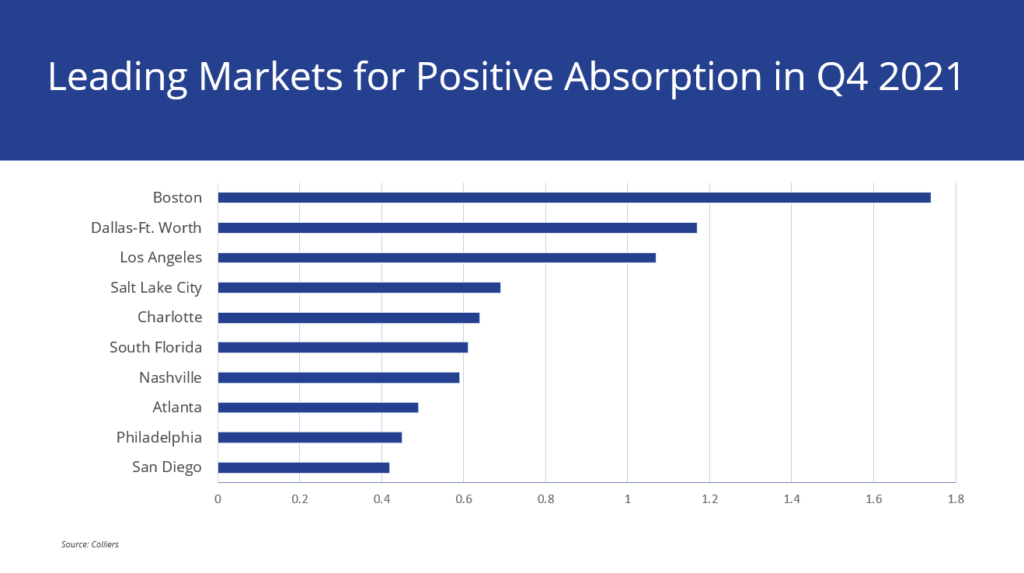

- Boston, Dallas-Fort Worth, and Greater Los Angeles all reported more than one million square feet of positive absorption at year-end.

- Vacancies ticked down for the second quarter in a row.

- Sublease space persists but it, too, is slowly falling.

- Omicron appears close to peaking, after which physical occupancy could grow throughout Q1.

The Q4 2021 numbers are in, and once more signs are encouraging for the U.S. office market. The vacancy rate is starting to tick down, sublease space is slowly decreasing, construction is easing, down 27% from this cycle’s high, and net absorption was positive for the second successive quarter. While there are local variations, asking rates are, by and large, holding firm.

The U.S. office vacancy rate stands at 14.8% in Q4, down by 10 basis points from Q3 2021. If this does represent a leveling off for this cycle, it will be comfortably below the record peak of 16.3% at the height of the Global Financial Crisis. There is now 199.7 million square feet of sublease space available across the U.S. office market, down from the record 208.8 million square feet in Q2 2021. The amount fell for the second successive quarter.

Net absorption continues to turn positive in an increasing number of office markets. In Q3 2021, 56% of office markets saw positive absorption, which increased to 61% in Q4 2021. U.S. office net absorption in Q4 was an encouraging 9.0 million square feet, up from 3.2 million square feet in Q3, and a significant turnaround from the cumulative 153 million square feet of negative absorption between Q2 2020 and Q2 2021.

Three metro office markets posted more than one million square feet of positive absorption in Q4 2021: Boston, Dallas-Fort Worth, and Greater Los Angeles. Charlotte, Nashville, and Salt Lake City also saw strong gains. Chicago remains the most challenged major office market, again reporting over one million square feet of negative absorption.

What’s in store for 2022? There is a growing public health consensus that cases of the Omicron variant are close to peaking. That should drive an increase in office occupancy later in the first quarter, and we expect further stabilization in the first half of the year.

The key question will be how shifts in working practices, business location, and space usage will impact the office sector. Although remote work will allow some firms to reduce their footprints, others may seek to expand to account for an evolving office environment and accommodate employees working remotely at flexible workspace locations. Given existing lease commitments and the time needed to achieve optimum workplace solutions, it will take several years for this to fully play out.

Download the full report.

U.S. National Research

U.S. National Research

Aaron Jodka

Aaron Jodka