Despite economic concerns and industry challenges, the medical office sector (MOB) continues to go from strength to strength, setting record highs for asking rents, sales volume, and pricing over the past four quarters.

Demand is outpacing supply, vacancy remains tight, and cap rates are relatively stable. As a result, development activity is gaining momentum, reflecting confidence in the sector.

This performance is particularly impressive given the continued cost containment pressures faced by the healthcare industry.

The data referred to below is based on the top 100 MOB markets in the U.S.

Key Takeaways

Vacancy: The MOB vacancy rate fell by 40 basis points in the first half of 2022 to 8%. This compares favorably to the broader office sector where vacancy rose by 30 basis points over the corresponding period to 15.1%.

Absorption: Demand for medical office space remains strong and is outpacing new supply. Net absorption totaled 22.1 million square feet over the 12 months to mid-year 2022, up from 12.5 million square feet during the prior 12 months.

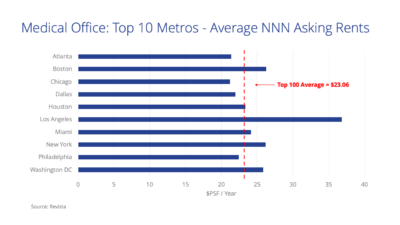

Rents: Average net asking rents for MOB space increased by 1.7% in the first half of 2022 to $23.06 per square foot — setting a new high for the sector.

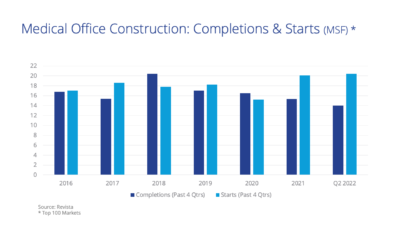

Construction: A total of 14 million square feet of MOB space was delivered during the four quarters ending in Q2 2022, up slightly from 13.7 million square feet during the prior 12 months. The volume of MOB space under construction rose from 30.9 million square feet in Q2 2021 to 37.1 million square feet in Q2 2022.

Sales: Total investment in MOBs reached $17.2 billion over the four quarters to Q2 2022, up from $9.6 billion during the preceding 12 months. Average pricing rose to $397 per square foot over the same period.

Boston enjoys the lowest MOB vacancy rate across the major markets at 6.3%, followed by New York at 7%. Conversely, Dallas and Houston have the highest vacancy levels across the leading markets at 10.6%

Los Angeles has the highest average net MOB asking rents among the top 10 markets by a fair distance at $36.85 per square foot. However, none of the other top 10 metros have an average MOB rent higher than $30 per square foot. Boston and New York are the next highest at $26.26 per square foot and $26.19 per square foot, respectively.

Currently, 711 healthcare real estate projects are underway, comprised of 261 hospital developments and 450 MOB buildings. MOB construction remains concentrated in off-campus facilities that provide readily accessible locations and out-patient clinics to accommodate the shift away from in-patient hospital care. Off-campus properties — which tend to be smaller than new on-campus facilities — account for 77% of projects underway.

Twenty metros exceeded $250 million in MOB property sales during the four quarters to Q2 2022, led by Los Angeles with $1.4 billion, followed by New York at $1.1 billion and Phoenix and $760 million.

Outlook

While no property sector will be immune to the impact of high inflation, a slowing economy and rising operating costs, the MOB sector is well placed to weather the storm. Underlying business fundamentals for medical tenants are strong, which reduces concern over future income streams

There is consistent demand for medical services and, potentially, pent up demand from procedures canceled or postponed during the pandemic. In addition, U.S. Census data estimates that one in five Americans will be 65 or older by 2030, rising to one in four by 2060, thereby under-pinning demand for healthcare services.

These fundamentals, coupled with a limited pool of available medical office assets, should continue to drive healthy sales volume. However, pricing expectations between buyer and seller may widen, particularly for leveraged acquisitions.

Stephen Newbold

Stephen Newbold

Anthony Shell

Anthony Shell

Andrew Steele

Andrew Steele

Aaron Jodka

Aaron Jodka Michelle Cleverdon

Michelle Cleverdon