The Q1 2022 numbers are in. Following two consecutive quarters of occupancy gains, the U.S. office market paused in Q1 2022, but the overarching trend remains one of stabilization.

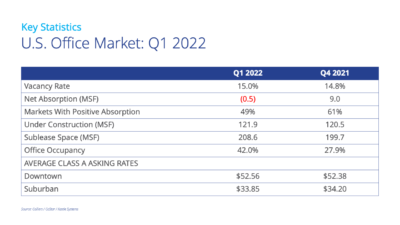

The U.S. office vacancy rate now stands at 15%, an increase of 20 basis points in the first quarter. However, vacancy is still comfortably below the record peak of 16.3% seen at the height of the Global Financial Crisis.

Sublease space has been a key contributor to the increase in vacancy. There is now 208.6 million square feet of sublease space available across the U.S. office market, up by 8.9 million square feet from Q4 2021. This remains significantly higher than the prior peak of 143.3 million square feet seen in Q2 2009. As firms evaluate their post-COVID real estate needs, sublease space will remain a cost competitive, short-term option until there is greater clarity on business and economic direction.

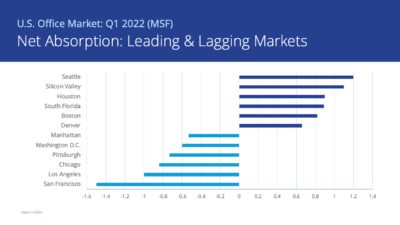

Net absorption, which measures the change in occupied office inventory, remained positive in just under half (49%) of the office markets tracked in our national survey, but was slightly negative in Q1 2022 at a national level, totaling negative 533,590 square feet down from an encouraging nine million square feet in Q4 2021. This modest amount does not indicate any downturn in the office market. It is still a major turnaround from one year earlier, when the national office market recorded an all-time low of negative 46.1 million square feet in Q1 2021.

Eight office markets posted more than 500,000 square feet of positive absorption in Q1 2022, led by Seattle (1.2 million square feet) and Silicon Valley (1.1 million square feet). Houston and South Florida both posted close to 900,000 square feet of positive absorption. Boston, Dallas, Denver and Salt Lake City also saw healthy gains. San Francisco took the hardest hit with 1.5 million square feet of negative absorption in the first quarter. Chicago’s challenges continued with a further 844,100 square feet of negative absorption in Q1 2022.

Construction activity has slowed. There is 121.9 million square feet currently underway, which is down 25% from this cycle’s peak of 164 million square feet, seen in Q3 2020. The New York metro area has by far the largest amount of ongoing construction, at 26.9 million square feet, followed by the San Francisco Bay Area with 9.1 million square feet and Washington D.C. with 8.5 million square feet.

While there are localized variations, asking rates are, by and large, holding firm. Although leasing activity is slowly picking up, the gap between asking and effective rents remains significant due to increased concessions on offer. Tenant improvement allowances of $100 per square foot or more plus 12 to 15 months of rent abatement are available in several major markets when a tenant signs a new 10-year lease on Class A space.

What’s in store for the remainder of 2022? We anticipate further stabilization in key fundamentals, with some in-demand markets achieving early-stage growth in the second half of the year. Office occupancy has ticked up to 43% and will only go higher as more firms return to the office. However, this does not mean that most employees will be back in the office five days per week.

The jury is still out on the extent that shifts in working practices, business location and space utilization will impact the office sector moving forward. Some degree of remote working is here to stay and could allow some firms to reduce their footprints. However, given existing lease commitments and the time it will take to achieve optimum workplace solutions, any structural changes will take several years to fully play out.

Stephen Newbold

Stephen Newbold

Anthony Shell

Anthony Shell

Andrew Steele

Andrew Steele

Aaron Jodka

Aaron Jodka Michelle Cleverdon

Michelle Cleverdon