U.S. Office Market Pauses in Q1 2022

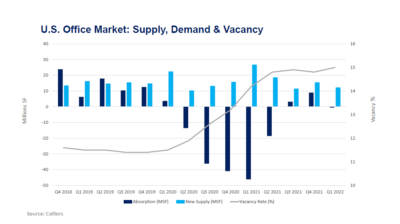

Following two consecutive quarters of occupancy gains, the U.S. office market paused in Q1 2022, but the overarching trend remains one of stabilization. Here’s how the numbers are trending for the key indicators.

Vacancy: The U.S. office vacancy rate stands at 15%, an increase of 20 basis points in the first quarter. This is still comfortably below the record peak of 16.3%, seen at the height of the Global Financial Crisis.

Tenant Demand: Net absorption was slightly negative in Q1 2022 totaling negative 533,590 sq. ft. This modest amount does not indicate any downturn in the office market. It is a major turnaround from one year earlier, when an all-time low of negative 46.1 million sq. ft. was recorded in Q1 2021.

New Supply: Construction activity has slowed. There is 121.9 million sq. ft. currently underway, which is down 25% from this cycle’s peak of 164 million sq. ft., seen in Q3 2020.

Sublease Space: There is 208.6 million sq. ft. of sublease space available across the U.S. office market – significantly higher than the prior cycle’s peak of 143.3 million sq. ft. seen in Q2 2009. Sublease space will remain a cost-competitive, short-term option until there is greater clarity on business and economic direction.

Rents: While there are localized variations, asking rates are, by and large, holding firm. The gap between asking and effective rents remains significant due to increased concessions on offer. Tenant improvement allowances of $100 per sq. ft. or more plus 12 to 15 months of rent abatement are available in several major markets on a new 10-year lease on Class A space.

Looking Ahead

We anticipate further stabilization in key fundamentals, with some in-demand markets achieving early-stage growth toward the end of the year. Office occupancy is slowly ticking up, but this does not mean that all employees will be back in the office five days per week. Some degree of remote working is here to stay.

The jury is still out on how shifts in working practices, business location and space utilization will impact the office sector moving forward. Given existing lease commitments and the time it will take to achieve optimum workplace solutions, any structural changes will take several years to fully play out.

Download the report.

Stephen Newbold

Stephen Newbold

Anthony Shell

Anthony Shell

Andrew Steele

Andrew Steele

Aaron Jodka

Aaron Jodka Michelle Cleverdon

Michelle Cleverdon