- U.S. office absorption turned positive for the first time since Q1 2020.

- More than half of the markets tracked posted occupancy gains in Q3.

- Growth corridors in the South and Southwest are leading absorption.

- Absorption in New York and Boston also turned positive in Q3.

- Sublease space is decreasing, and asking rents mostly continue to hold.

- Further stabilization is expected as more workers return to the office by early 2022.

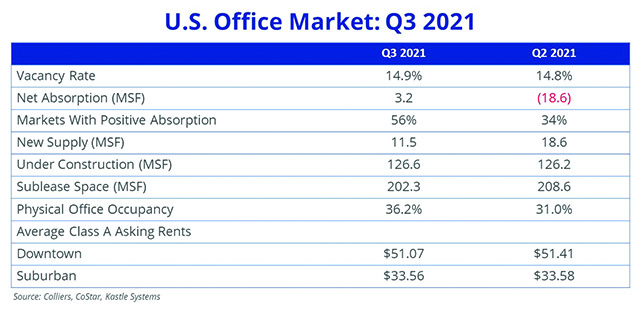

The Q3 2021 numbers provide encouraging signs for the U.S. office market. The vacancy rate looks to be leveling off, the amount of sublease space is decreasing, and net absorption was positive for the first time since Q1 2020.

The U.S. office vacancy rate increased by just 10 basis points to 14.9%, which is comfortably below the record peak of 16.3% at the height of the Great Financial Crisis.

Net absorption is turning positive in an increasing number of office markets. In Q2 2021, one-third of office markets had positive absorption. This share rose to 56% in Q3. U.S. net absorption in Q3 was 3.2 million square feet, the first time the national office market has posted positive absorption since Q1 2020.

Three metro office markets: Atlanta, South Florida, and New York, posted over one million square feet of positive absorption in Q3 2021. Growth markets such as Austin, Dallas, Las Vegas, Nashville, and Salt Lake City also posted healthy occupancy gains. At the other end of the scale, Chicago and Los Angeles remain two of the more challenged major office markets, both with over one million square feet of negative absorption in the third quarter.

Sublease space and construction activity are both down. There is now 202.3 million square feet of sublease space available across the U.S. office market, a decline of 6.6 million square feet from the prior quarter’s record total. New York and San Francisco lead the nation in new construction. But overall, the 126.6 million square feet underway nationwide is approaching 25% lower than the cyclical peak set in Q3 2020.

While there are localized variations, the softening in market fundamentals has yet to result in any significant reduction in asking rates, which are mostly holding firm. However, the gap between asking and effective rents continues to widen due to increased concessions. Class A suburban asking rates held steady in Q3 at $33.56 per square foot, but average Class A CBD asking rates declined slightly, by 0.6%, to $51.07 per square foot. Pressure on rents could increase next year as more active requirements emerge and landlords compete for tenants that are in the market.

Where do we go from here? One quarter’s worth of data doesn’t indicate a trend, but further stabilization is anticipated in the fourth quarter. With more workers expected to return to the office by early 2022, there’s cause for measured optimism.

U.S. National Research

U.S. National Research

Aaron Jodka

Aaron Jodka