- Industrial shattered sector growth records throughout 2021.

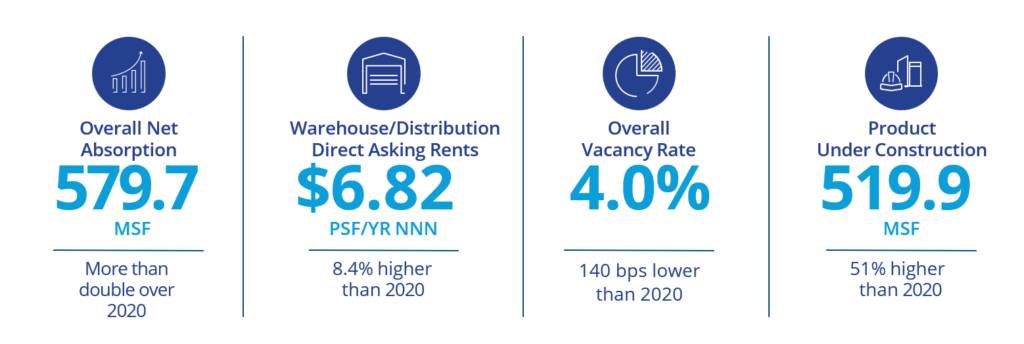

- Absorption of nearly 580 million square feet doubled the previous record in 2016.

- Construction, too, set a new all-time high of nearly 371 million square feet delivered in 2021. About 520 million square feet are under construction.

- 60 markets posted occupancy gains of at least one million square feet in Q4, demonstrating widespread growth across the U.S.

- Rents soared 8.4% on the year, while vacancies ended 2021 at 4%. Momentum is showing no signs of slowing in early 2022.

- Investment sales volumes skyrocketed at year-end, setting a new all-time high. Cap rate compression in strong secondary markets has been substantial.

Following a record-setting year in 2020, the U.S. industrial sector did it again in 2021 and continued unprecedented growth. Despite obstacles from all links of the supply chain — port congestion, labor shortage, transportation costs, and historically low warehouse vacancy rates — the industrial sector flourished, and many occupiers paid top dollar for much-needed high-quality space. E-commerce growth continues to be a driving factor for industrial expansion. This growth bodes well for the coming year, and all expectations point to further demand for warehouse distribution space, especially near already-tight port markets.

Given strong consumer demand throughout 2021, the U.S. industrial sector continued to report encouraging fundamentals at year-end. Overall net absorption totaled 579.7 million square feet on the year and 163.7 million square feet of occupancy gains in the fourth quarter. These record-setting totals are more than double the previous record of 288.9 million square feet in 2016.

Year-end new supply of 370.7 million square feet, 0.8% higher than one year ago, added up to the highest yearly growth on record. New supply to meet the insatiable demand of the industrial sector is not expected to subside, as the industrial construction pipeline remains remarkably active. The nearly 520 million square feet under development is approximately 51% higher than construction underway at the end of 2020. The Chicago market delivered the largest amount of product in 2021, 30.9 million square feet, while Dallas-Fort Worth remains the top market for product under development, at 59.3 million square feet.

Sixty markets each gained more than one million square feet in occupancy at the end of 2021, with Chicago, Dallas, Atlanta, the Inland Empire, and Houston leading the way. Markets with the most activity growth (absorption as a percent of inventory) include emerging markets such as Charleston, Austin, Las Vegas, and Savannah. Demand for logistics and distribution space, primarily fueled by e-commerce occupiers, supports the strong growth in these cities.

The voracious hunger for modern warehouse space strengthened the industrial sector in 2021, and positive momentum is expected to continue this year. Issues that face many ports in the U.S. persist — capacity concerns, increased freight rates, and continuing port congestion — making modernizing warehousing and technology a high priority. The industrial market has proven that it can weather the storm and come out stronger on the other end. With the spectacular closing of 2021, look for higher occupancies and an abundance of high-quality industrial space to be added to the market in 2022.

Meanwhile, Investors cannot get enough industrial product. The year ended with record sales volume in back-to-back quarters. Strong capital flows are expected to continue in 2022. Cap rate compression continued into year-end, setting new lows. Amazon-anchored assets have been price-setters, both on a per foot basis, and from a cap rate perspective. Compression has been particularly pronounced in strong secondary markets surrounding the gateway markets such as Las Vegas, Phoenix, Indianapolis, and Columbus. The spread between these markets and Los Angeles, the Inland Empire, Chicago, Dallas, Atlanta, and New Jersey is the narrowest we have seen.

Download the report.

U.S. National Research

U.S. National Research

Aaron Jodka

Aaron Jodka