The industrial sector continued to outperform in 2021 and closed the year with record gains in occupancy, rental rates and construction activity. The bulk industrial market was no exception, as demand for industrial space from bulk occupiers (companies occupying more than 100,000 square feet) remains at unprecedented levels across the U.S. The scarcity of modern, quality space lingers in many markets, prompting a record level of new builds in core and smaller secondary industrial markets. At the end of 2021, occupier activity in bulk industrial space totaled 582.9 million square feet, 16.1% higher than the previous record of 501.9 million square feet recorded in 2020. In addition, a total of 2,006 bulk industrial new leases, renewals and user sales were transacted in 2021, well above the 1,804 transactions recorded in 2020. Occupiers’ footprints also increased as the average size of a bulk transaction in 2021 was 291,000 square feet, 5% higher than at the end of 2020.

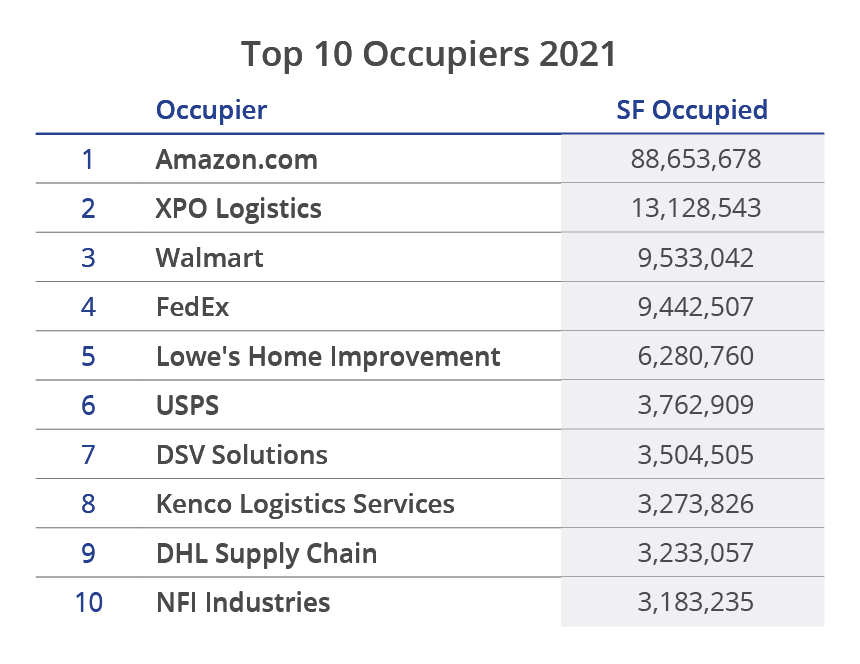

The undisputed e-commerce behemoth, Amazon, continued its aggressive growth strategy in 2021, occupying a record-setting 88.7 million square feet at year-end, almost 1 million square feet more than they occupied at the height of the pandemic in 2020. Amazon has held the title of the top e-commerce company and overall occupier of industrial space since 2014, occupying an average of 35.2 million square feet each year. Amazon’s dominance was represented by the 179 transactions the company signed in 2021.

As supply chains continue to be retooled and the need for reliable distribution channels is paramount, third-party logistics (3PLs) and packaging companies accounted for 28.3% of all bulk activity. Many 3PL providers were also in expansion mode to meet consumer demand, and the industry experienced the highest market share increase in 2021, up from 22.1% in 2020. E-commerce companies came in second, accounting for 19.5% of activity, followed by manufacturing at 16.2% of bulk activity.

Illustrating the high demand for warehouse management and transportation, 7 of the top 10 bulk occupiers in 2021 were 3PL companies, totaling 39.5 million square feet. With XPO Logistics announcing the spin-off of its logistics arm, GXO Logistics, in 2021, the firm is poised for massive growth and have already occupied 13.1 million square feet in 2021, taking the second spot on the list. Two general retail and wholesale companies also made it onto the top 10 list in 2021 – Walmart (9.5 million square feet) and Lowe’s Home Improvement (6.3 million square feet). With bulk transactions at an all-time high, most industries saw a year-over-year increase in square footage occupied. The furniture and appliances industry saw the largest increase, 50%, mainly due to the pandemic-induced increase of home improvement projects. In addition, 3PLs increased 33% and data centers, tech and R&D industries increased 26.4%, with the increased need for data infrastructure due to many employees being shifted to more work-from-home and flexible schedules. In fact, according to Upwork’s Future Workforce Report, the number of remote workers is expected to nearly double the pre-pandemic level of 16.8 million people in the next five years. This means that data storage and technology occupiers will continue to require additional space to meet the demand of the new online workforce.

With bulk transactions at an all-time high, most industries saw a year-over-year increase in square footage occupied. The furniture and appliances industry saw the largest increase, 50%, mainly due to the pandemic-induced increase of home improvement projects. In addition, 3PLs increased 33% and data centers, tech and R&D industries increased 26.4%, with the increased need for data infrastructure due to many employees being shifted to more work-from-home and flexible schedules. In fact, according to Upwork’s Future Workforce Report, the number of remote workers is expected to nearly double the pre-pandemic level of 16.8 million people in the next five years. This means that data storage and technology occupiers will continue to require additional space to meet the demand of the new online workforce. Transactions in the Midwest accounted for 29.4% of all bulk occupier activity, with the West region not far behind with 27.1%. Market activity in the Southcentral region was the slowest at year-end, accounting for just 8.6% of transactions signed. Bulk activity in the Midwest continues to attract bulk occupiers who take advantage of its strong labor, transportation and logistics benefits, with Amazon signing 43 transactions in Midwestern states, including Illinois, Indiana and Ohio. Occupiers in the West region signed 51 transactions greater than 500,000 square feet, largely fueled by continued elevated demand in the Inland Empire, despite the lack of available space in many western markets.

Transactions in the Midwest accounted for 29.4% of all bulk occupier activity, with the West region not far behind with 27.1%. Market activity in the Southcentral region was the slowest at year-end, accounting for just 8.6% of transactions signed. Bulk activity in the Midwest continues to attract bulk occupiers who take advantage of its strong labor, transportation and logistics benefits, with Amazon signing 43 transactions in Midwestern states, including Illinois, Indiana and Ohio. Occupiers in the West region signed 51 transactions greater than 500,000 square feet, largely fueled by continued elevated demand in the Inland Empire, despite the lack of available space in many western markets.

After two consecutive years of record-shattering activity, bulk transaction volume is expected to stabilize over the next few years. While bulk space will remain in high demand to meet the acute needs of industrial users looking to expand or relocate, the economy is projected to moderate in 2022, so a natural return to equilibrium is expected. Higher inflation, labor shortages, supply chain concerns and the lingering effects of the global pandemic are all matters to watch in the coming year.

Company Type Description:

Construction, Improvement and Home Repair – Warehousing and distribution of materials used in residential and commercial construction, improvements and repair, could contain some e-commerce components.

Data Centers, Tech and R&D – The use of industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only – Warehousing and distribution of product that is ordered online and shipped directly to the end consumer only.

Food, Beverage and Pet Supply – Manufacturing, warehousing and/or distribution of food and beverage-related products. It could contain some e-commerce or manufacturing components.

Furniture and Appliances – Warehousing and distribution of retail and/or wholesale furniture and appliance products. It could contain some e-commerce and or manufacturing components.

General Retail and Wholesale – The warehousing and distribution of retail and/or wholesale products not listed in any of the other categories. It could contain some e-commerce or manufacturing components.

Manufacturing – Industrial space used for manufacturing and/or storage of raw materials and equipment used to manufacture non-automobile-related products.

Motor Vehicles, Tires and Parts – The warehousing, manufacturing and/or distribution of motor vehicles, tires and related parts and materials.

Third-Party Logistics (3PL) and Packaging – Third-party logistics and packaging of a wide variety of products, could contain some e-commerce components.

U.S. National Research

U.S. National Research

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Craig Hurvitz

Craig Hurvitz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen