While core industrial markets continue to thrive, Colliers’ latest research report—10 Emerging U.S. Industrial Markets to Watch in 2022—explores the markets positioned to experience the most robust increases in demand from occupiers and owners. Learn more about one of these core markets: Salt Lake City.

“The Salt Lake City industrial market continues to make national headlines and is perfectly situated to benefit from overall growing industrial demand – a Union Pacific Intermodal Hub providing direct rail access to all of the major West Coast seaports, the newly formed Utah Inland Port Authority, a $4 plus billion dollar expansion of the Salt Lake International Airport and Delta Hub, immediate access to I-15 and I-80, and is within an 18-hour drive of all major cities west of the Mississippi. These factors, combined with a fiscally responsible and pro-business government, have led Forbes Magazine to name Utah “The Best State for Business” six out of the past eight years. We are both grateful and excited about the growth Utah has experienced and look forward to the future.” – Rusty Bollow, SIOR, MRED, CCIM & Bobby Stevens, Executive Vice President & Vice President | Salt Lake City

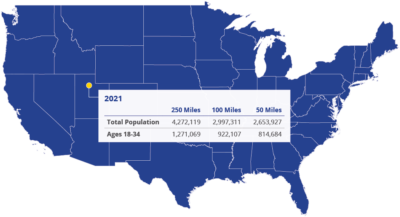

KEY STRENGTHS: Utah is consistently ranked as one of the fastest growing states, best states for business, and has a young and highly educated workforce. The unemployment rate is consistently below the national average, and its GDP growth is consistently higher. Utah’s manufacturing industry represents approximately a third of all industrial users, and Utah was listed as the tenth best state for manufacturing. Utility and real estate costs are lower than most comparable states, and Utah has a favorable tax climate. It is a right-to-work state and has the third-lowest unionization rate in the country.

LOGISTICS DRIVER: The Salt Lake Valley is located at the intersection of two major highways. I-15, a main thoroughfare between Mexico and Canada, and I-80, which connects the West Coast to the Central United States. Its infrastructure and central location allow distribution companies to service nearly all major cities west of the Mississippi River in less than 18 hours. It’s the first rail intersection between all major West Coast Seaports and is the home of the Utah Inland Port Authority (UIPA). A major transload facility adjacent to the Union Pacific Intermodal Hub is currently under development with the UIPA, which will help alleviate congestion at the West Coast Ports and further cement Salt Lake’s position as a major logistics player. Its international airport, a Delta Hub, recently completed a $4.1 billion first phase expansion to allow for additional planes, passengers, and air cargo. The airport saw $8 billion of cargo in 2020 and is expected to see at least that in 2021.

VACANCY: Record breaking leasing activity has driven vacancy rates down 240 basis points in the last 12 months, from 4.1% to 1.7%. This all-time low isn’t expected to rise drastically anytime soon, due in part to delays in construction and rising rental rates creating a vacuum of second and third generation space.

ABSORPTION: A greater number of larger deals are being completed in the Salt Lake City market than ever before. Increased average deal size and increased volume of leases have caused absorption to increase at an unprecedented rate. A total of 9.5 million square feet was absorbed at year-end, an increase of 85% year-over-year.

DEVELOPMENT: The amount of industrial space under construction totaled 13.2 million square feet at the end of 2021, with approximately a third of that space already preleased. The North West submarket remains the most active in the Salt Lake City region and continues to lead in big-box construction and absorption. The South West submarket is now the second most active market and is expected to continue its growth as the Mountain View Corridor creates better interconnectivity in the Salt Lake Valley than ever before and has opened up additional acreage for industrial development.

ASKING RENTS & SALES ACTIVITY: Over the past year, rental rates have increased at a record pace to an overall average asking rate of $8.41 per square foot. This is 32% higher than the same time last year. Decreasing vacancy, a nearly nonexistent inventory of second-generation space, and rising development costs have all contributed to this dramatic change. Among other reasons, increased attention from national and international investors has caused sales prices for investment properties to track on a similar trajectory. Cap rates are shrinking to below 4% on stabilized Class A big box assets and below 3% in certain cases. Investment sales of vacant product have traded at over $150 per square foot, and similar stabilized assets have traded at over $180 per square foot.

To learn more, explore the 10 Emerging U.S. Industrial Markets to Watch in 2022.

U.S. National Research

U.S. National Research

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Craig Hurvitz

Craig Hurvitz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen