The U.S. industrial sector continued to show positive momentum at the beginning of 2022, posting favorable fundamentals during the first quarter. While supply chain and employment challenges remain, occupiers and developers remain optimistic as solid demand remains for high-quality industrial space. Economic growth in the first three months of the year was also positive, encouraging further industrial expansion. The U.S. industrial sector has operated full steam ahead since 2020, and that momentum has carried quarter after quarter.

Overall net absorption totaled 108.8 million square feet in Q1 2022, just 3% below the previous year’s 112.2 million square feet record. E-commerce growth continues to be a driving factor for industrial demand, although its hold on overall retail sales has begun to fade. According to the U.S. Census Bureau, e-commerce sales accounted for 13.2% of total sales in 2021, a year-over-year decline from 2020s 14%. However, the number of global e-commerce users is still expected to outperform 2021 in the coming years, and e-commerce occupiers will continue to require additional space to meet the demands of online consumer shopping.

First quarter new supply rose 27.4% year-over-year, and deliveries in 2022 are expected to outpace last year as the industrial construction pipeline remains incredibly full. A total of 96.9 million square feet was built during the first three months of the year, and a record 581.1 million square feet were under construction at the close of the quarter. 27 buildings larger than one million square feet were built during the first quarter, with the largest being Tesla’s 4.5-million-square-foot plant in Austin. In addition, there are currently over 150 facilities under construction that are one million square feet or larger. The Dallas-Fort Worth industrial market is the most active development market, evidenced by the 7.3 million square feet delivered and the 72 million square feet under construction.

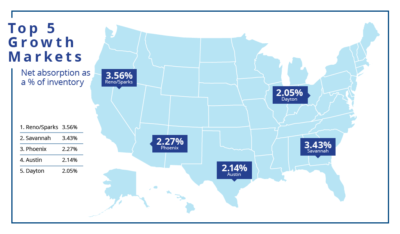

33 markets posted occupancy gains greater than one million square feet during the first quarter, including Chicago, Phoenix, Greater Los Angeles, Houston and Kansas City. On the other hand, just four industrial markets posted negative absorption – Memphis and Augusta/Aiken among them. The markets experiencing the most activity growth (absorption as a percent of inventory) include emerging markets such as Reno/Sparks, Savannah, Austin, Las Vegas and Salt Lake City. Demand for logistics and distribution space and proximity to seaport activity, primarily fueled by e-commerce occupiers, supports the strong growth seen in these cities.

Robust industrial fundamentals at the beginning of 2022 point to further expansion for the sector. E-commerce and overall retail growth will continue to fuel the need for industrial space for the foreseeable future. Land scarcity remains an issue, however, especially in core markets. The reduced land supply has created new interest in infill development opportunities, although rising costs for materials could limit development in those core markets. Despite these potential challenges, the industrial market remains poised for further growth and will continue to post records across the country.

U.S. National Research

U.S. National Research

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett