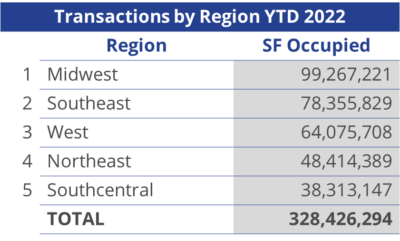

U.S. occupier activity in bulk industrial space (greater than 100,000 square feet) is off to a fast start as transaction volume outpaced midyear 2021 transaction volume by 41.4% and totaled more than 328.4 million square feet at midyear 2022. More than 1,000 industrial (warehouse, manufacturing, and flex) new leases, renewals and user sales were transacted year-to-date. In addition to increased volume for occupier transactions, the size of the transaction for bulk space is rising as well. The average size of a bulk transaction was roughly 293,000 square feet, up 3% over the average size of 285,000 square feet during the same period last year.

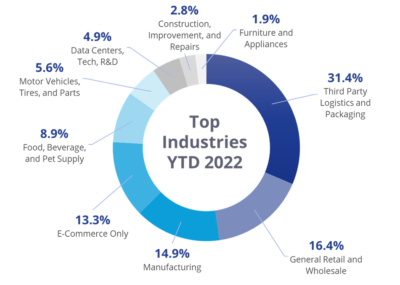

Third-party logistics and packaging companies (3PLs) remained the top occupier of bulk industrial space at midyear, and market share for the industry increased to 31.4%, up over the 29.9% of all bulk space transacted one year ago. 3PLs, who offer outsourced logistics and warehousing services for retailers and wholesalers, remain the top occupier of

industrial space for a variety of factors including cost savings for retailers and wholesalers and difficulty finding labor. While 3PLs were the top overall occupier, the data centers/tech/R&D industry more than doubled its space occupied at midyear 2021 and transacted 16.1 million square feet at midyear. The only industry to see a decline in activity was the furniture and appliances sector, falling 11.3% year-over-year.

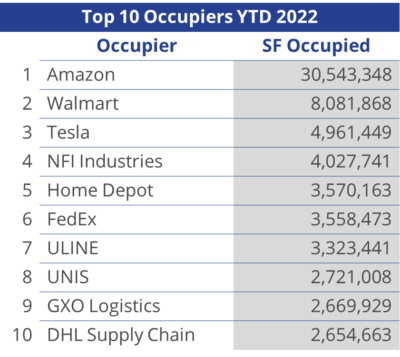

Amazon, once again, topped the list of bulk occupiers in the U.S., filling 30.5 million square feet at midyear, down slightly from the 33.1 million square feet transacted a year ago. Amazon’s activity included a 3.8-million-square-foot new fulfillment center in San Antonio, TX, and another 3.8-million-square-foot robotics fulfillment center in Suffolk, VA. E-commerce activity will be an interesting metric to watch in the coming quarters. While e-commerce as a percentage of retail activity has been on a downward swing in 2022, the new customer base introduced during the height of the pandemic will continue to shop online, leading for future demand for both sales and reverse logistics. E-commerce-only occupiers accounted for just 13.3% of transactions at midyear, but the average size of an e-commerce transaction was approximately 526,000 square feet – the largest average size of any industry included in our research. Amazon has held the title of the top e-commerce company and overall occupier of industrial space since 2014.

Transactions in the Midwest accounted for 30.2% of all bulk occupier activity, followed by the Southeast with 23.9%. The Southcentral market was the slowest at midyear, accounting for just 11.7% of transactions signed. The Midwest continues to attract industrial users for its significant transportation and logistics advantages. Population and labor growth continue to fuel activity in the Southeast region, while the West region remains in third, thanks to continued strong demand in the Inland Empire, which remains one of the top markets in the country for bulk leasing activity.

Transaction volume for bulk industrial space is expected to remain stable over the next 12 months, despite projected headwinds to economic fundamentals, including rising interest rates, economic uncertainty and falling consumer confidence. While 3PLs continued to dominate activity year-to-date, four industries experienced increased activity by more than 50%: data centers, tech, R&D (144.9%); food, beverage, and pet supply (114.2%); construction, improvement and repairs (96.3%); and motor vehicles, tires, and parts (87.7%). We expect these industries to remain in the top spots, as many of these occupiers continue to expand and modernize their distribution and manufacturing networks.

Occupiers will continue to focus on industrial product in the Midwest to optimize their omnichannel strategies, and population growth and seaport activity will keep occupiers in all industries interested in space in the Southern and Western portions of the U.S. Record levels of industrial product under construction, driven by low vacancy and strong demand, will continue to offer modern options for bulk occupiers in the coming quarters.

Company Type Description:

Construction, Improvement and Home Repair – Warehousing and distribution of materials used in residential and commercial construction, improvements and repair, could contain some e-commerce components.

Data Centers, Tech and R&D – The use of industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only – Warehousing and distribution of product that is ordered online and shipped directly to the end consumer only.

Food, Beverage and Pet Supply – Manufacturing, warehousing and/or distribution of food and beverage related products. Could contain some e-commerce or manufacturing components.

Furniture and Appliances – Warehousing and distribution of retail and/or wholesale furniture and appliance products. Could contain some e-commerce and or manufacturing components.

General Retail and Wholesale – The warehousing and distribution or retail and/or wholesale products not listed in any of the other categories. Could contain some e-commerce or manufacturing components.

Manufacturing – Industrial space used for manufacturing and/or storage of raw materials and equipment used in the manufacturing of non-automobile related products.

Motor Vehicles, Tires and Parts – The warehousing, manufacturing and/or distribution of motor vehicles, tires, and related parts and materials.

Third-Party Logistics and Packaging – Third-party logistics (3PL) and packaging of a wide variety of products, could contain some e-commerce components.

U.S. National Research

U.S. National Research

Baily Datres

Baily Datres Mike Otillio

Mike Otillio

Jesse Tollison

Jesse Tollison

Patrich Jett

Patrich Jett