The softening in key U.S. office market fundamentals, seen in the prior two quarters, continued in the second quarter of 2023. As a result, net absorption remained negative, while vacancy and sublease space hit new record highs.

Here’s a summary of the key trends:

- The U.S. office vacancy rate stands at 16.4%, up 30 basis points from the first quarter. Vacancy in this cycle has now exceeded the prior record peak of 16.3%, seen at the height of the Global Financial Crisis.

- On an encouraging note, net absorption, which measures the change in occupied office inventory, was positive in 37% of the metro office markets tracked in our national survey, up from 24% in the first quarter. National office absorption totaled negative 14.4 million square feet, compared to negative 25.4 million square feet in Q1 2023.

- Construction activity continues to slow. Currently, 88.4 million square feet are underway, down 46% from this cycle’s peak of 164 million square feet in Q3 2020.

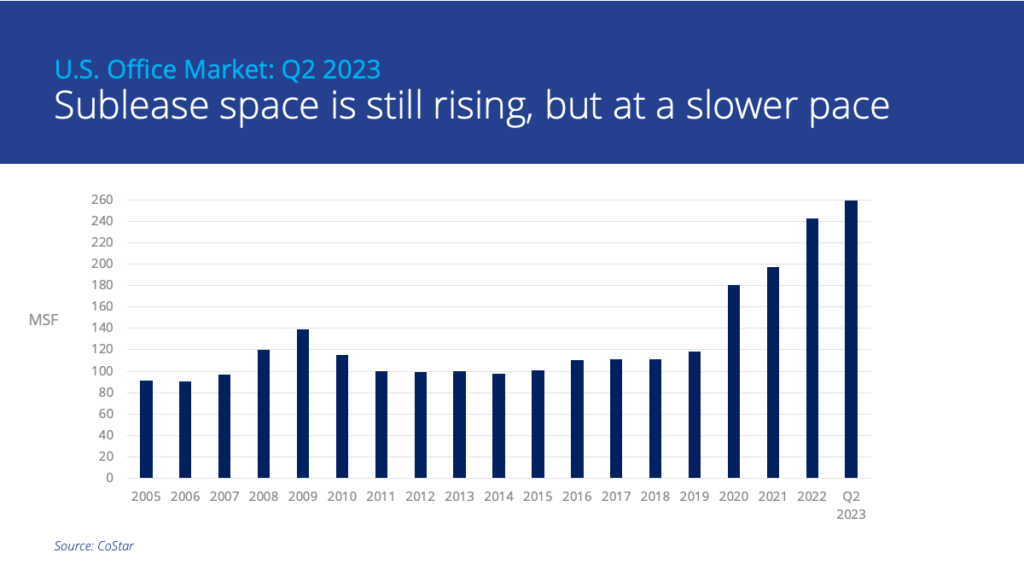

- There is a record 259 million square feet of sublease space available across the U.S. office market, up from 254 million square feet in Q1 2023, and considerably higher than the prior cycle’s peak of 143.3 million square feet seen in Q2 2009.

- The gap between asking and effective rents remains significant. Tenant improvement allowances of $80 to $120 per square foot or more are available in the majority of the leading U.S. office markets when a tenant signs a new 10-year lease on Class A space. In a similar manner, most leading markets are offering 10 months or more of rent abatement on such transactions.

Tenant downsizing has become the norm, with space reductions of at least 20% to 30% being implemented by large occupiers on new leases and renewals. While existing lease obligations will temper the pace of such changes, the net result should be sustained upward pressure on vacancy.

As leases expire, the return of sublease space will create a challenge for landlords in terms of both a drop in revenue and how to position and price such space. Class A downtown sublease space is being offered at a 31% rental discount to direct space across the leading markets.

With repricing taking place on the sales side, it seems imminent in the rental market driven by the triple-hit of downsizing, sublease space and rising vacancy rates, as landlords become increasingly aggressive to secure tenants.

Performance and demand differentials are expected to widen. Bifurcation should be most evident between space class and age, but will also occur between and within markets, and different business sectors. High quality space will win out as firms seek the optimal work experience to retain and attract the best talent and bring employees back to the office.

U.S. National Research

U.S. National Research

Marianne Skorupski

Marianne Skorupski

Anjee Solanki

Anjee Solanki Sheena Gohil

Sheena Gohil