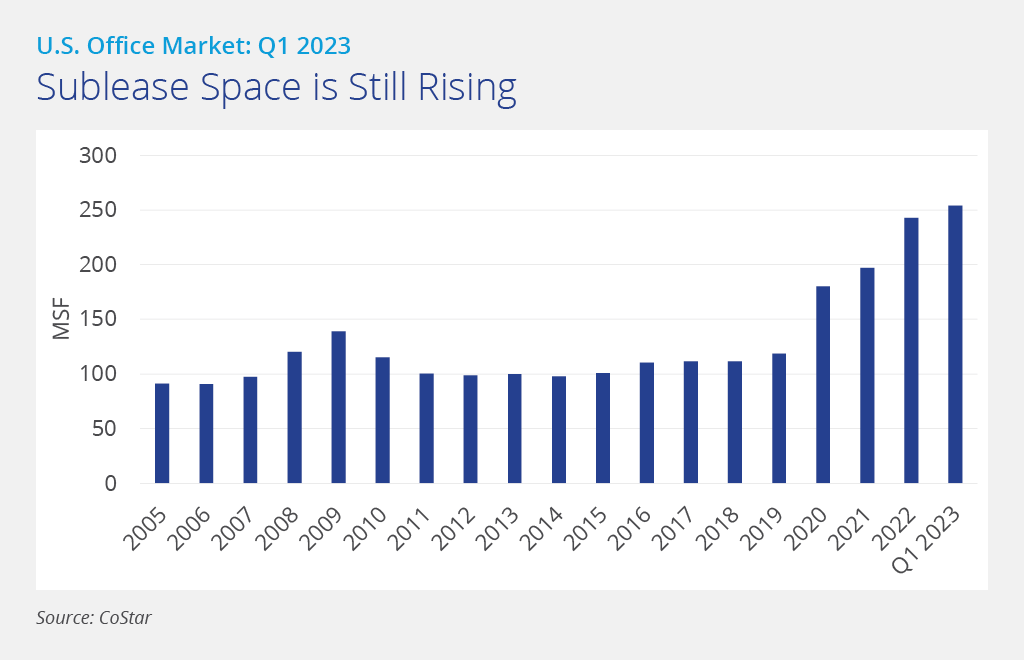

The softening in key U.S. office market fundamentals, seen in Q4 2022, accelerated in the first quarter of 2023. As a result, net absorption remained negative and occupancy losses increased, while vacancy rose at a faster pace, and sublease space hit a new record high.

The U.S. office vacancy rate stands at 16.1%, an increase of 40 basis points in the first quarter. Vacancy is still slightly below the prior peak of 16.3%, seen at the height of the Global Financial Crisis, but looks set to equal, or exceed, this level by mid-2023 with further upward pressure to follow.

Net absorption, which measures the change in occupied office inventory, was positive in only 24% of the metro office markets tracked in our national survey, down from 43% in the fourth quarter. National office absorption totaled negative 25.4 million square feet, having turned negative in the fourth quarter to the tune of 14.1 million square feet.

Reflecting this shift in fortunes, 17 metro markets posted negative absorption above 500,000 square feet in Q1 2023, up from 12 markets in Q4 2022. Metro occupancy losses in the first quarter were led by Boston (negative 3.3 million square feet), New York City (negative 2.7 million square feet) and Chicago (negative 2.3 million square feet). Positive absorption was modest and led by Birmingham, Charleston, and Las Vegas.

There is a record 254 million square feet of sublease space available across the U.S. office market, up from 242.7 million square feet in Q4 2022, and significantly higher than the prior cycle’s peak of 143.3 million square feet seen in Q2 2009. As firms continue to evaluate their post-Covid real estate needs, sublease space will remain a cost competitive, short-term option until there is greater clarity on economic and business direction.

Construction activity continues to slow. Currently, 93.5 million square feet are underway, down 43% from this cycle’s peak of 164 million square feet in Q3 2020. The New York metro area has by far the largest amount of ongoing construction, at 15.5 million square feet, followed by the San Francisco Bay Area with 9.5 million square feet, which is mostly focused on Silicon Valley, and Seattle with 7.9 million square feet.

Asking rates are, by and large, showing little change. However, the gap between asking and effective rents remains significant, with generous concessions on offer. For example, tenant improvement allowances of $100 per square foot or more are available in 10 of the 15 leading U.S. office markets when a tenant signs a new 10-year lease on Class A space. In a similar manner, two-thirds of the leading markets are offering 10 months or more of rent abatement on such transactions.

There is considerable debate and speculation regarding the future of the U.S. office sector. Unfortunately, the return to the office remains slow. Most tenants are adopting hybrid working with a minimum of three days in the office per week emerging as the common standard. However, some employers are mandating a full-time return to the office.

Is a market correction ahead? Firms continue to recast their property strategies, focusing on how much space will be needed going forward, how it should be utilized, and where it should be located. Tenant downsizing has become the norm, with space reductions of at least 20% to 30% being implemented by large occupiers. While existing lease obligations will temper the pace of such changes, the net result will be sustained upward pressure on vacancy.

Pending a resurgence in demand, vacancy rates and sublease availability are set to continue to rise over the rest of 2023, placing increased pressure on rents. In addition, retrenchment in the finance, government and tech sectors, which had been key drivers of leasing volume pre-Covid, could compound this trend.

The return of sublease space, as leases expire, will also create a challenge for landlords in terms of both a drop in revenue and how to position and price such space. Class A downtown sublease space is being offered at a 30% rental discount to direct space across the leading markets.

With repricing already occurring on the sales side, it seems only a matter of time before it occurs in the rental market driven by the triple-hit of downsizing, sublease space and rising vacancy rates, as landlords become increasingly aggressive to secure tenants.

Where’s the upside? Performance and demand differentials are expected to widen. Bifurcation should be most evident between space class and age, but will also occur between and within markets, and different business sectors. Opportunities should become more selective, but quality will win out as firms seek the optimal work experience to retain and attract the best talent and bring employees back to the office. ESG initiatives offer owners an additional opportunity to differentiate their assets from the pack.

U.S. National Research

U.S. National Research

Bret Swango, CFA

Bret Swango, CFA Michelle Cleverdon

Michelle Cleverdon Kai Shane

Kai Shane

Aaron Jodka

Aaron Jodka

Sandy McDonald

Sandy McDonald Ronna Larsen

Ronna Larsen