Key Takeaways

- The IOS market is undergoing a pivotal transformation, driven by rising capital and rapid expansion. However, rushed investments could lead to potential distress, with zoning regulations remaining the primary barrier to entry.

- The equipment rental sector has become a common entry point for IOS investors, with revenue trends closely following construction spending patterns. The industry remains highly fragmented, and major companies are aggressively acquiring smaller competitors.

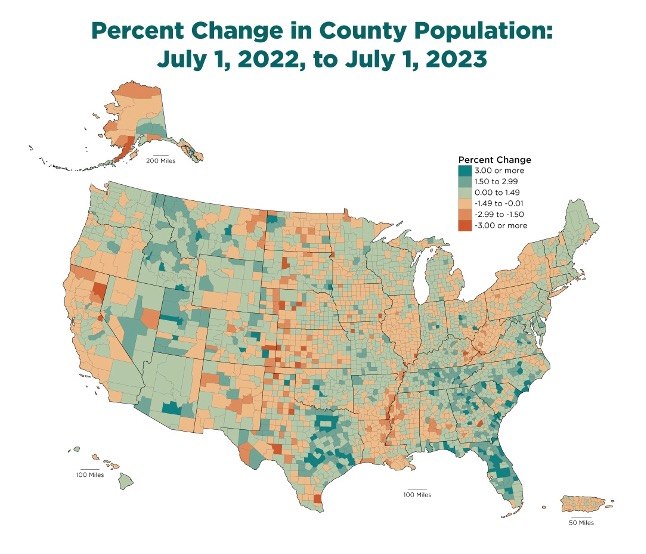

- Companies are strategically expanding in high-growth population areas, particularly in the Sunbelt region, while limiting their presence in the Midwest.

- In the recent acquisition battle for H&E Equipment Services, Herc appears better positioned than United Rentals due to less location overlap.

In the previous installment of our outdoor storage series, we explored the definition of industrial outdoor storage (IOS) and highlighted key macro trends shaping this niche property type. This edition will focus on the equipment rental market, which has been making headlines recently with the impending sale of H&E Equipment Services.

Because of a surge of capital and expansion, the IOS market is approaching a critical juncture in its evolution. While growth has been largely positive, rushed investment decisions may soon lead to distress. Zoning is the biggest barrier to entry, impacting both current use and future leasing potential. When aggregators pursue the volume necessary for eventual recapitalization, they may underestimate zoning risks, posing challenges down the line.

As the market matures, a distinct separation is emerging between net lease investments and operational real estate assets. Net lease properties with national tenants attract retail investors seeking stable, low-maintenance income, while operational assets require hands-on management and regular capital expenditures. Most IOS transactions remain “mark-to-market” opportunities, pitched as ways to increase yield by extending or replacing leases at market rates. However, investors must carefully consider how tax reassessments and insurance costs may affect projected rents, particularly in jurisdictions like Florida and California. Despite the sector’s continued strong performance, thorough due diligence remains essential in all aspects of potential investments.

Equipment Rental Market

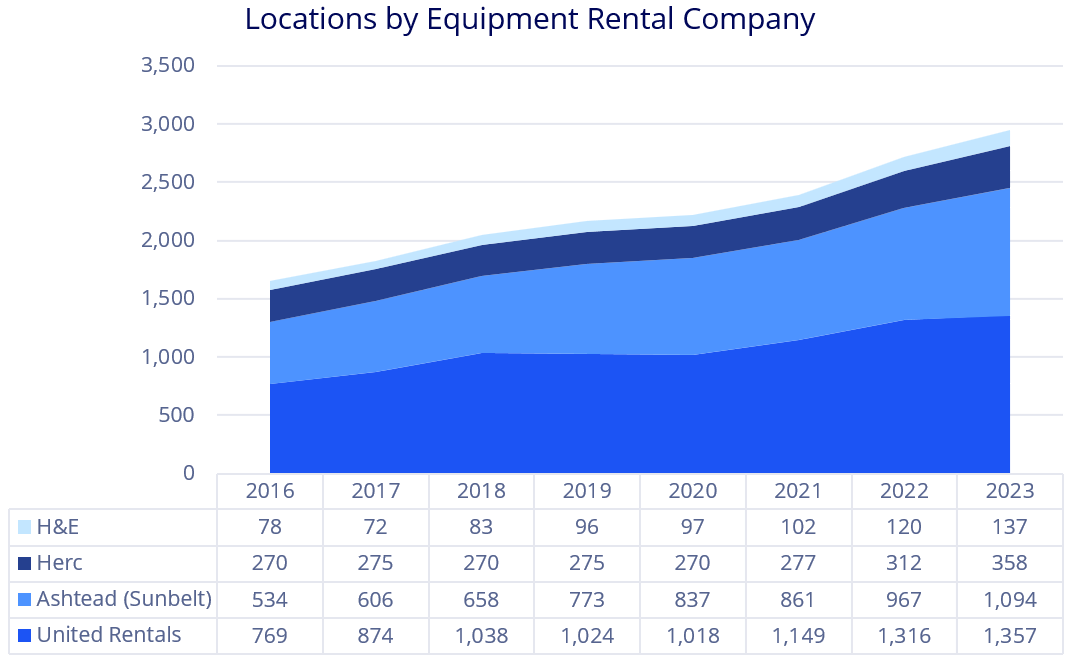

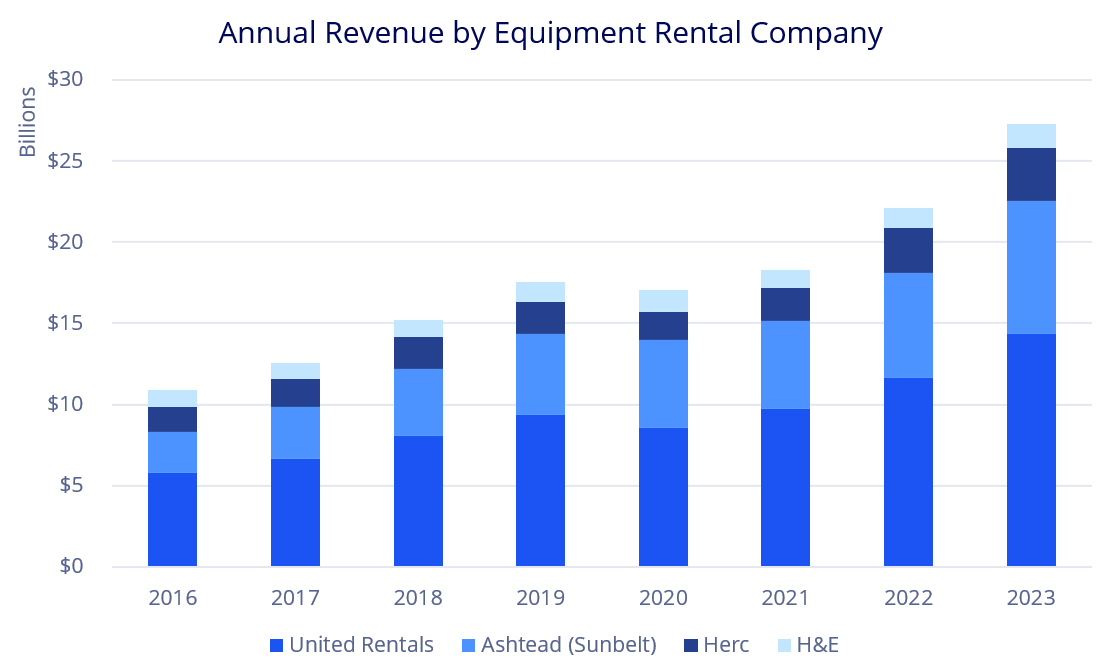

As the IOS market grows, the equipment rental sector has become one of investors’ most common entry points. These properties are widely available and often appeal to investment committees. The annual reports of the four largest publicly traded players in the equipment rental niche (United Rentals, Ashtead [Sunbelt Rentals], Herc, and H&E Equipment Services) demonstrate what has happened in the industry over the past five years.

For all four companies, the primary demand for equipment rentals comes from contractors and industrial users, while residential/DIY renters contribute only a small portion of total revenue.

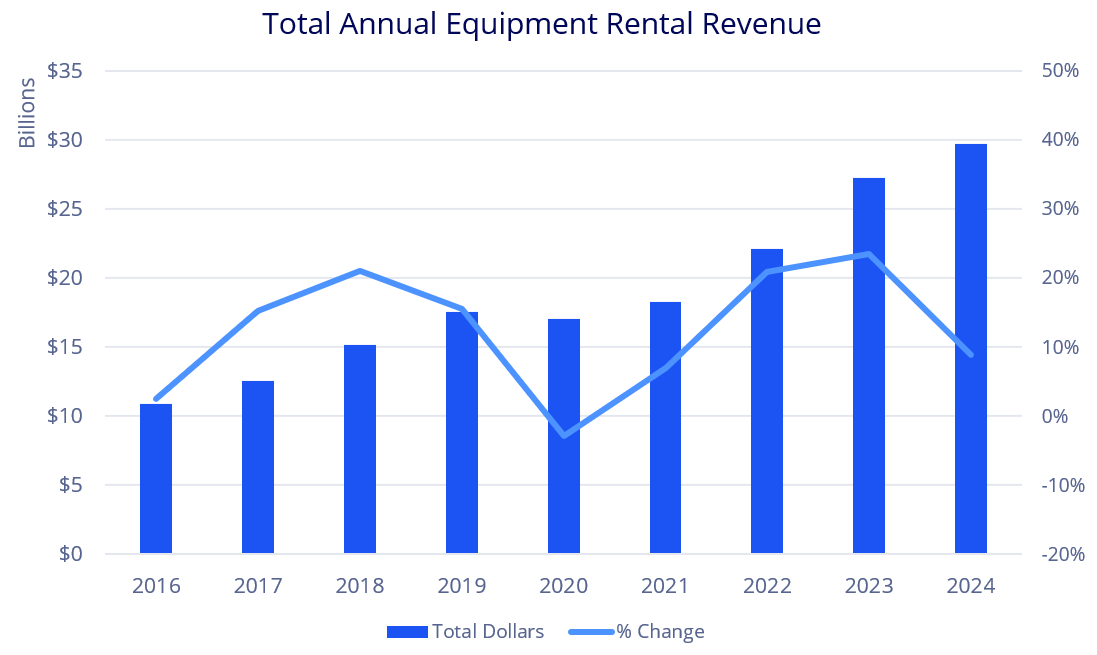

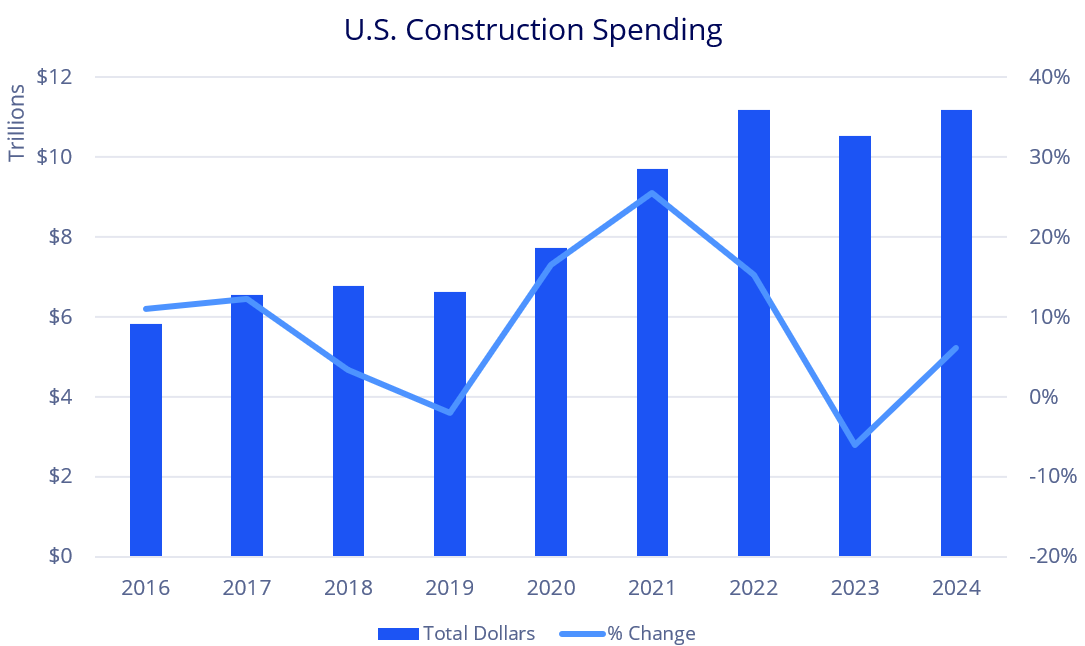

The charts above compare total equipment rental revenue, construction spending, and year-over-year growth. Given the proportion of revenue tied to construction activity, the two indicators move in tandem, with about a one-year lag — as construction spending declines, equipment rental revenue follows suit —good predictors of demand for equipment rental properties.

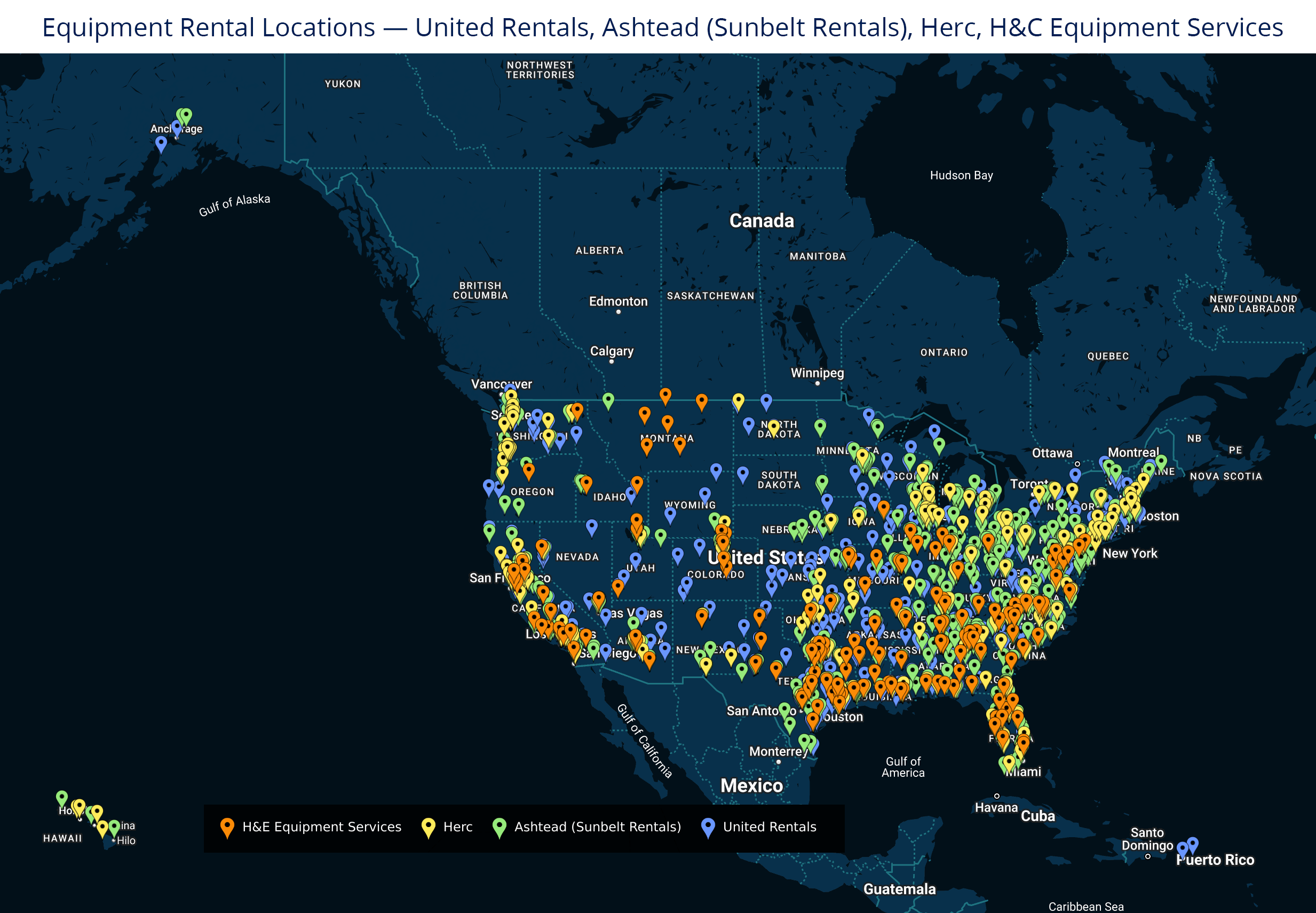

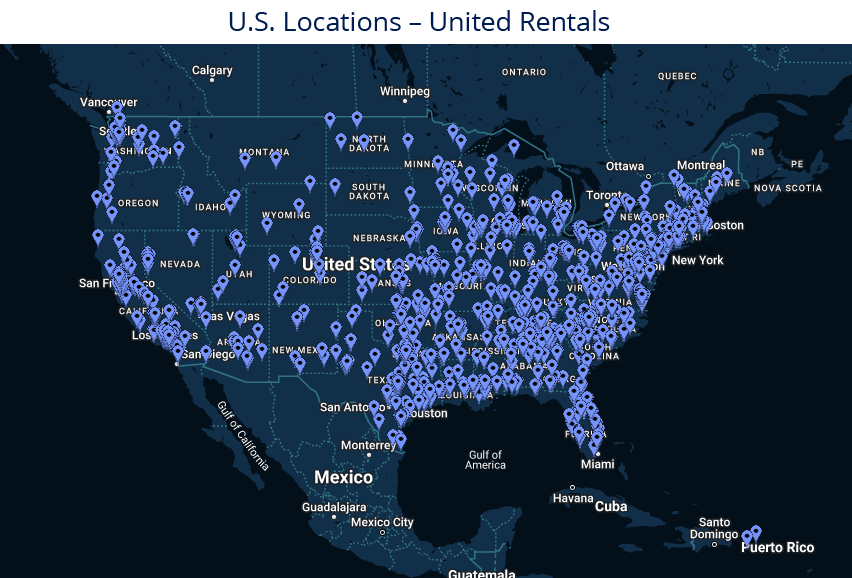

According to annual reports, the industry is highly fragmented, with United Rentals and Ashtead (Sunbelt Rentals) as the only players with a market share greater than 10%.The map above shows the number of the U.S. locations of the four largest publicly traded companies. Comparing it to the population growth map from the U.S. Census Bureau, equipment rental companies are focusing on areas of population growth, largely in the Sunbelt, and limiting locations in the Midwest.

While all four companies have expanded their locations since 2017, understanding the key drivers of this growth is essential. As with most IOS uses, the equipment rental industry remains highly fragmented and is consolidating. Since 2021, each company has been in acquisition mode, with Ashtead leading by buying 20-plus+ companies in each of the past three years, while United Rentals has made the largest acquisitions with more than 100 branches in both the Ahern Rentals and General Finance transactions. While location growth has been consistent, a significant rightsizing occurs with each acquisition. For example, when United Rentals in 2021 bought Ahern Rentals and General Finance, it added 212 locations; however, the total only increased by 167 in 2022. Investors need to consider the industry’s acquisitive nature when underwriting the renewal probability for any given investment. While a short weighted average lease term (WALT) United Rentals location might be an opportunity to mark the current rent to market, investors should first understand the competitive landscape and the likelihood of that branch closing, causing unexpected downtime and re-leasing expenses.

The firms keep growing and so does their revenue. United Rentals has remained dominant, though Sunbelt Rentals has grown significantly since the pandemic. While this competition hasn’t slowed the growth of United Rentals, Sunbelt’s outsized rate of growth makes it a more attractive investment.

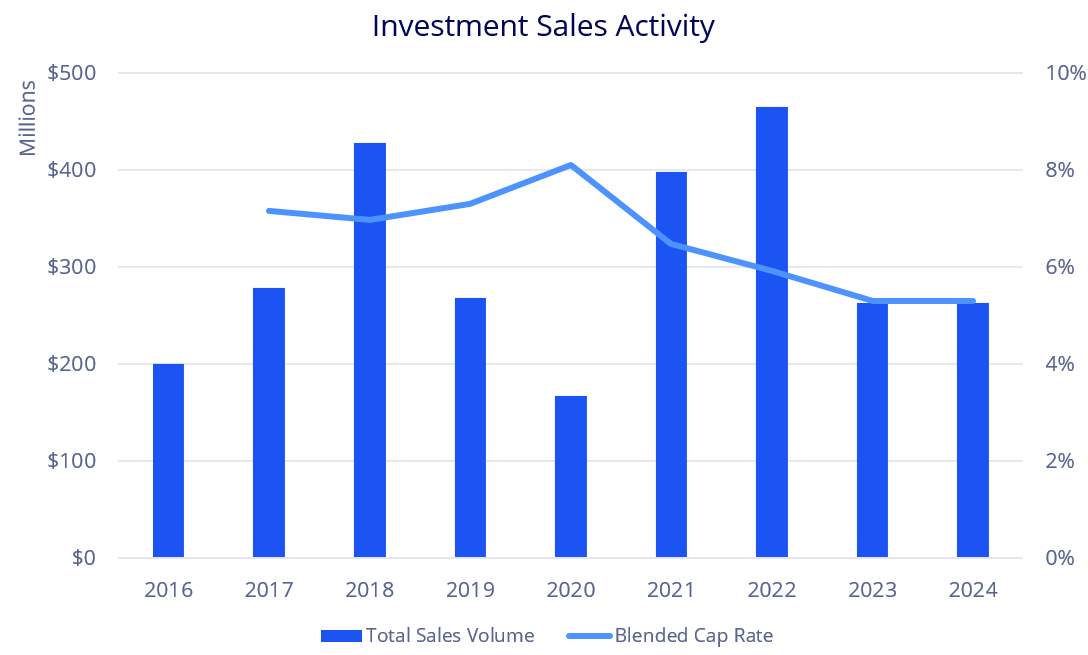

From an investment perspective, cap rates for equipment rental properties have decreased since the pandemic, going along with the rise of the IOS sector overall. The steady rise in market rents within the IOS sector has driven cap rates lower for equipment rental properties. As market rents surpass in-place rents, buyers are adopting a more aggressive approach, underwriting higher renewal rents to capitalize on future growth.

Buyers of equipment rental facilities must understand the performance of individual store locations, the remaining lease term, and the competitive landscape in the surrounding area. Understanding the market rent potential for these assets is critical, not only for a potential renewal when the base lease term expires but also for a re-tenanting if the continued consolidation of the industry leads to the closing of the equipment rental store.

Transaction Analysis – H&E Equipment Services

In January, United Rentals presented a tender offer to purchase H&E Equipment Services, only to be rebuffed and have Herc step in during the “go-shop” period with a higher offer.

H&E Equipment, with more than 160 U.S. locations, leases approximately 91% of its properties, owning only 12, according to its annual report. With a weighted average remaining lease term of 7.5 years, H&E’s leases typically offer varying terms and renewal options. The lease expiration schedule is based on the dollar amount of the lease obligations, and given the trajectory of IOS rents over the past five years, many of those leases would be considered below the market rate.

Submitting the original offer to purchase H&E Equipment Services, United Rentals has 1,443 U.S. locations, leasing approximately 92%, and owning 127. The weighted average remaining lease term is 5.8 years.

Submitting the higher offer to acquire H&E Equipment Services, Herc leases about 95% of its 453 locations in the U.S. and Canada. Typically triple-net, the leases have a weighted average remaining term of 17.1 years, but most leases have renewal options that are not incorporated into this analysis.

Comparing the two bids, all three firms have locations in many of the same areas, overlapping the most in the Sunbelt and Southwest. In a merger such as this one, cost synergies for the transaction are crucially important. With United Rentals as the buyer, annualized savings within 24 months of closing would be $130 million, primarily by exiting duplicate real estate properties and reducing corporate jobs and overhead. With Herc as the buyer, annualized savings within 24 months of closing would be $125 million, as along with $175 million of EBITDA impact from revenue synergies. The footprint of Herc and H&E is largely complementary, leading to increased revenues from the merger.

Our analysis reveals 82 places where United Rentals and H&E Equipment Services locations are within a three-mile radius, and half of them are within one mile of each other. Several are adjacent and could be operated jointly as a single location. Properties that are proximate but not adjacent can be more problematic to operate, depending on whether the property is owned or the term left on the lease. Herc and H&E Equipment Services have 47 locations within a three-mile radius. Therefore, Herc appears to be in a better position than United Rentals, because more of the operating assets acquired by Herc can maintain operations without impacting existing business. While there are 10 instances of properties within a one-mile radius, they are exclusively in high-growth markets, which can likely maintain demand for multiple locations with such proximity.

Conclusion

As the IOS market transforms, due diligence about potential acquisitions isi more important than ever for investors given the acquisitive nature of the tenant pools that occupy IOS sites, the continuously shifting zoning landscape, and rising costs of real estate taxes and property insurance. IOS professionals emphasized one recurring theme in our conversations: It is paramount for investors to consult local market professionals before going forward with an IOS acquisition.

Vytas Norusis

Vytas Norusis Craig Hurvitz

Craig Hurvitz

Stephanie Rodriguez

Stephanie Rodriguez

Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka