In the first in a series of pieces on the niche Industrial Outdoor Storage (IOS) market, we focus on characteristics of an IOS property, institutionalization of the asset type, sophistication of the sector, and rental rate trends.

The industrial outdoor storage (IOS) sector has become one of the most sought-after niches within industrial real estate in the past five years, with increasingly more institutional investors allocating funds to invest in the niche. According to the 2024 2Q PwC Investor Survey, the overall IOS market is a $200 billion market, with over $1.7 billion in institutional capital raised in the past year.

With the increased institutionalization, the sector has become more sophisticated, with more specific IOS uses being identified and as a result, distinct trends across IOS subtypes are beginning to influence real estate decisions for buyers, sellers, and users.

What Is IOS?

IOS properties are industrial properties that often have a large outdoor component, which are used for storage, heavy industrial uses, or truck and vehicle parking. Some facilities have little or no building improvements, while others have equipment service or warehousing facilities, and a small business or administrative office component. The functionality of outdoor storage facilities is related to their location and improved land area, rather than the building improvements. The outdoor storage component of the property is best suited for vehicle and equipment storage, bulk goods and containers, or finished goods.

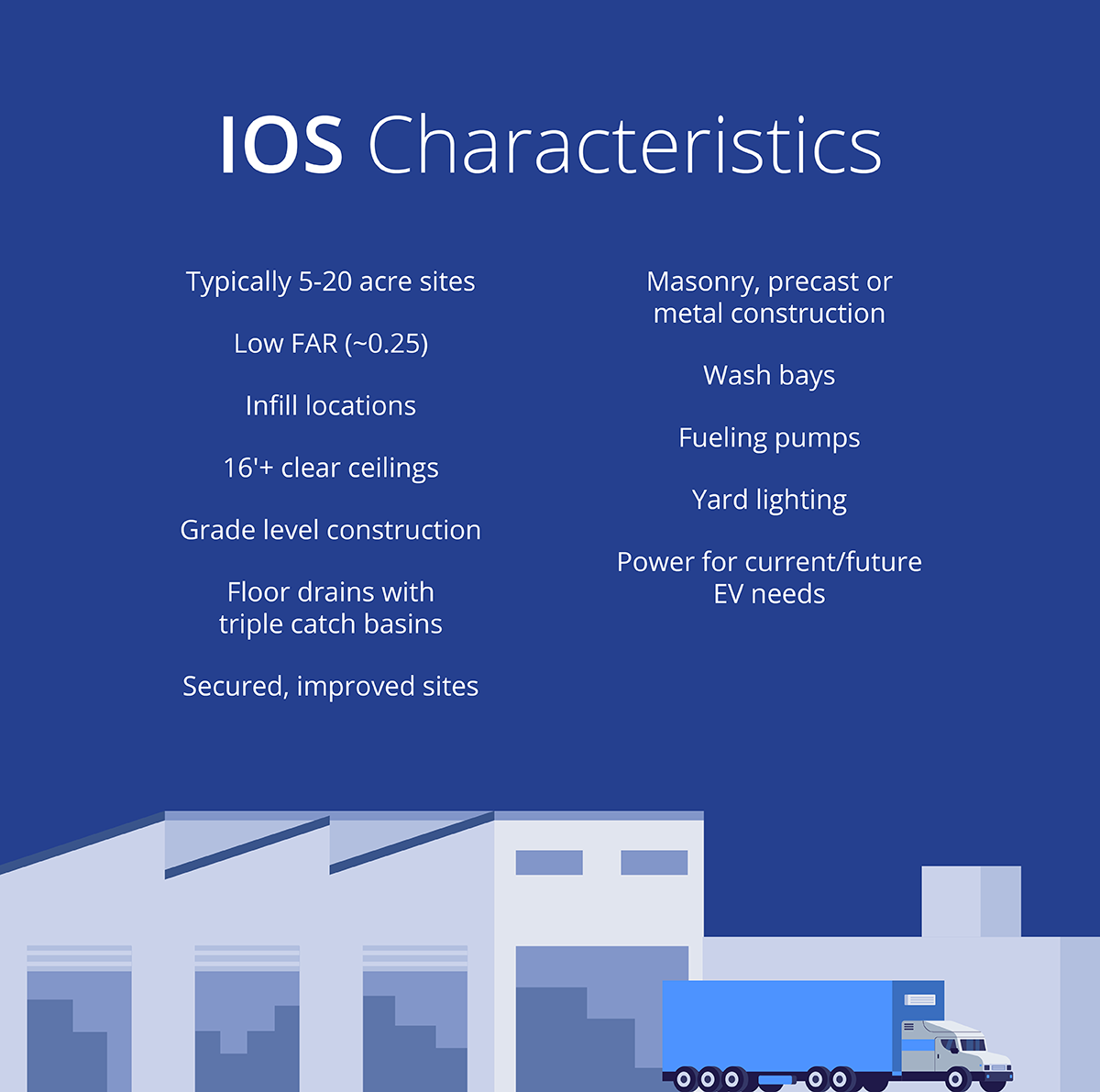

At their most basic, common characteristics of an IOS site are:

- Low building coverage area (<20%)

- Non-specialized improvements

- Near logistics or transportation infrastructure

IOS sites vary in size, as infill properties may only be from 0.5 to 3 acres, while IOS “mega-developments” may reach sizes of 50+ acres in more outlying areas. The largest factor in a successful IOS site is having a variety of outdoor storage uses as allowable by right in the zoning classification for the site. Municipalities are increasingly hesitant to approve new IOS uses, which limits new development in prime locations.

Typical IOS users range from logistics companies like XPO, FedEx, UPS, and Amazon, to local landscaping and building supply companies, as well as utility and school bus companies. The diverse tenant base for IOS is discussed in detail in the Colliers article, “Non-Trucking Industrial Outdoor Storage Tenants: A Counter-Cyclical Asset Class?”

Continued Institutionalization of the Asset Type

The IOS market has boomed in the past five years, as investors have flocked to the sector chasing yield in an increasingly competitive industrial market. The first movers in the institutionalization of the niche were considered aggregators; that is, smaller investment firms that would purchase IOS properties on a one-off basis and build larger portfolios. These firms include Industrial Outdoor Ventures, Alterra Group, Transport Properties, Zenith, Triten IOS, among others. At the onset, these investments were typically $1-$5 million acquisitions of properties that were owned by local operators or owner-users and offered a value-add opportunity, whether through capital expenditures or re-leasing at market rents with triple net reimbursement structures that are more typical of institutional-quality properties.

The next phase of the IOS market began when the aggregators began recapitalizing their portfolios with institutional backing. Fund managers were brought in as capital partners, which provided the operating partners with additional capital to continue building their portfolios. The IOS sector was attractive to the fund managers due to the relatively low capital outlay for outsized returns, and the opacity of the investment market as only seasoned operators had the quantities of data necessary to understand meaningful market trends.

The IOS market is currently in a transitional phase, where early investors are looking to exit their initial investments as pricing has continued to increase due to robust demand in the sector. As an example, international capital that previously targeted core industrial real estate has recently entered the IOS market, as GFH Partners recently launched and closed a $300 million fund focused on industrial and transportation logistics in partnership with Transport Properties. The addition of international capital in the market brings investors with a lower cost of capital than traditional capital sources. As this transaction only recently closed, its impact on the broader market is yet to be seen; however, increased allocations from pension funds and other institutions is expected to continue to increase pricing within this niche.

Changing Tenant Needs

As the sector becomes more sophisticated, tenants that previously negotiated with local ownership groups for leasing space have begun seeing more regional and national groups controlling more properties across their markets. While the sector is still largely fragmented, these larger ownership groups can offer more capital investments into their properties, providing better security, quality storage yards, and generally more specialized improvements to meet the tenant’s needs on a deal by deal basis. This has led discussions about how to “future proof” IOS sites as the electrification of the vehicle fleet becomes more prevalent. In our article Electrifying Commercial Real Estate, we note that DHL, UPS, and FedEx all have varying levels of carbon neutrality goals. As they are heavy users of IOS sites, the trend towards running conduit to support EV delivery van charging on for newly developed sites is one that we expect to continue going forward.

As IOS sites are increasingly harder to entitle across the country, several developers have turned to a “mega site” development model. Several 50+ acre sites are slated to be developed with IOS uses (primarily trailer parking), and with these larger developments comes a new set of amenities that tenants are requiring. A site of this size would typically be used as a regional hub as opposed to a daily place to park trucks. As such, many of these sites are building out truck repair facilities to allow for a trucking company to maintain their fleet in-house, as increasingly the cost of contracts with other providers and the timeliness of their service has become a challenge for trucking companies. We recently spoke with the CFO of a trucking company who indicated that it is imperative that a company like theirs has the ability to maintain their own fleet, as the outsourced model is no longer functional. In addition to the repair facilities, as truckers will typically need to stop at one of these hubs on a regular basis, driver amenities are increasing as well. Rather than having drivers stop at a truck stop for mandatory rest periods or repairs, trucking companies will have facilities in intermediate locations along their routes that have driver lounges, restroom and shower facilities, as well as dispatch offices. While some companies may choose to own their facilities, investors who can partner with a trucking company to manage the site selection, development process, and lease the property to the trucking company can have a significant opportunity to capitalize on the shortcomings of the outsourced model.

Rental Rate Trends

The IOS sector has seen many of the same headlines as the broader industrial sector, with rent growth since the pandemic being the biggest story as the e-commerce boom pushed rent levels to new heights. With IOS, the rental rate growth has been even more stark as supply constraints are even tighter due to the lack of available sites with zoning that allows for outdoor storage uses. While rental rates have more than doubled in most IOS markets, investors are now facing an inflection point: With the nationwide slowdown in freight volumes, the predominant user type for IOS, trucking related users, are seeing business revenues decline. With the decline in revenues, users cannot afford to pay the new “market” rates for the real estate that they occupy. The decision that investors are currently facing is whether a proverbial bird in the hand is worth two in the bush; that is, is it better to renew an in-place tenant at a 10-15% increase over their current rent, or risk vacancy and re-tenanting costs to achieve a 30%+ increase in rents. Pushback on the rental increases isn’t unique to trucking tenants. For building supply users, another large category of IOS tenants, in some cases it makes more financial sense to rent a larger building with ample drive-in doors instead of having a traditional supply yard. The aforementioned institutionalization of the asset type has pushed this issue to the foreground, as each investor has different investment criteria/asset management strategies to maximize returns over the life of the investment. Whereas the operators of these properties could formerly be more nimble and flexible with their asset management strategies, the involvement of more formalized/rigid focus on maximizing returns can limit the creativity that has long been a hallmark of the asset class.

Conclusion

The IOS asset class is one that has received a great deal of attention from all investor types over the last several years, from local operators to sovereign wealth funds. As the asset type continues to mature, opportunities for new strategies and entrants into the market will continue to evolve, and the historical informational asymmetry between participants with begin to dissipate. Until the market reaches point of transparency similar to traditional property types, the access to real-time data sets the largest operators apart from their competition.

Vytas Norusis

Vytas Norusis Andy Gooliak

Andy Gooliak Craig Hurvitz

Craig Hurvitz

Michael Golarz

Michael Golarz Tom Golarz

Tom Golarz

Lauren Pace

Lauren Pace Ronna Larsen

Ronna Larsen