Earlier this summer, corporate America circled Labor Day on the calendar as the logical timeframe to begin bringing their employees back in earnest. Unfortunately, the Delta variant thwarted those plans, and while some firms have announced strategies for the beginning of the new year, most firms have been reluctant to make a commitment in setting a new date. Nevertheless, employers aren’t waiting to expand their workforce, as more than 130,000 new office jobs were added in October.

Overall, the private sector generated 604,000 new jobs, with the office subsector and the leisure and hospitality sector (164,000 new jobs) leading the way. Government was the only sector in which employment fell. With a net increase of 531,000 new jobs, October nearly doubled the number gained from the upwardly revised September figure of 312,000.

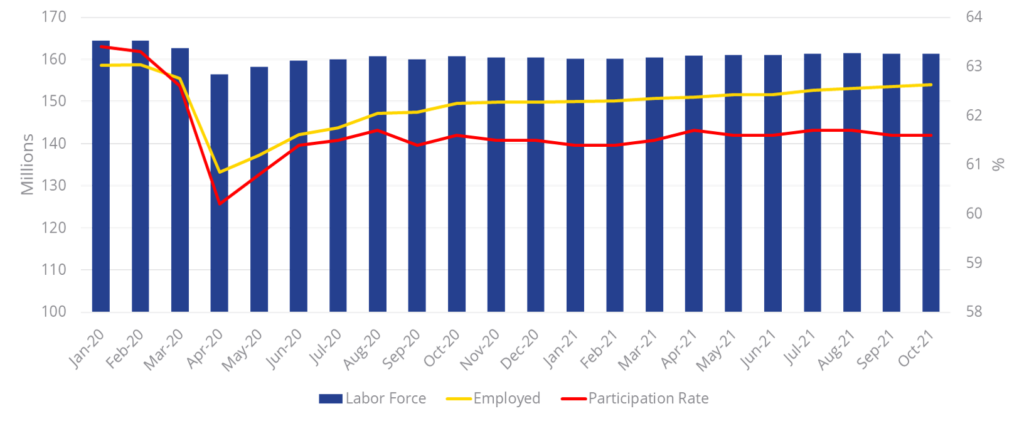

Although October’s job report indicates that the economy is strong and is moving past the latest Delta setback, a rebound in the overall size of the labor force continues to elude the country. A mere 104,000 people joined the labor force, resulting in just over 61% participation rate.

As a result, the unemployment rate fell to 4.6% from 4.8% and reached a new pandemic low. Moreover, with more than 11 million unfilled jobs, employers have pushed wages 4.9% higher over the last 12 months as they compete for a limited pool of candidates.

So, where have all of the employees gone?

During the pandemic, the labor force lost 5 million employees, which normally would have gained about a million in the same time period. While COVID-19 is ultimately to blame, the reasons for the millions of potential employees that have elected not to return to the workforce center around four main categories: Virus Concerns, Child Care, Early Retirement and Federal Support.

Virus Concerns – With just over 58% of the total U.S. population fully vaccinated, many potential employees will remain on the sidelines until they feel it is safe to return to work. The CDC suggested herd immunity could be reached at a 70% vaccination rate, but the number only applied to the initial strain. They have since revised the herd immunity rate to 90+% to account for the contagiousness of the delta variant. While the FDA’s recent approval for children between the ages of 5 to 11 to become vaccinated will help significantly push the overall vaccination rate up, it will likely take years before we see this workforce sector back.

Child Care – During the early stages of the pandemic, when schools were closed to in-person learning, child care issues created a significant strain on the labor force as many families were forced to keep a parent at home to look after their kids. While the re-opening of schools has helped alleviate some of the pressure, child care centers, like other service industries, have their own staffing issues, and as a result, their capacity has been hampered.

Early Retirement – Between August 2020 and August 2021, the pandemic helped spur one of the biggest housing booms on record as prices surged 19.9%. When combined with the performance of the Dow, Nasdaq and S&P 500, which have all posted gains north of 20% in 2021, Oxford Economics estimates that the American household net worth increased 16% from the end of the fourth quarter 2019 through the first quarter of 2021. As a result, the Federal Reserve estimates that 3 million people opted for early retirement.

Federal Benefits – While the additional $300/week federal topper to state unemployment benefits was undoubtedly a lifeline to those in need, many believed this additional support was disincentivizing people to find a new job as these individuals were making more by staying at home. Although the federal subsidy expired in early September, the anticipated lift from the expiration of those benefits has yet to materialize.

Where do we go from here?

Corporate America may not have identified a new universal return-to-work date, yet, but January 4, 2022, has still been circled by companies with more than 100 employees. That is the deadline affecting more than 84 million workers who will be required to have submitted proof of vaccination or be subjected to weekly coronavirus testing.

While corporations will continue to be required to provide paid time off for workers to get vaccinated, OSHA indicated that they do not need to pay for weekly testing. If employers elect to shift testing costs to their employees, many such individuals will likely choose to be vaccinated. In September, Delta Airlines announced that unvaccinated employees would incur a $200/month healthcare surcharge and witnessed its employee vaccination increase from 75% to 90% in less than two months.

With the January 4 mandate, combined with younger children being vaccinated, the overall vaccination rate will rise. This should translate to individuals feeling more confident in returning to the workplace. In addition, now that the personal savings rate has retreated significantly from its peak of 33.8% in April 2020 and is now approaching the 10-year pre-pandemic average of 7.0%, we should begin to see an uptick in labor force participation. Job growth should proceed steadily through the first part of 2022, with employment reaching its pre-pandemic level by mid-year and full employment by year-end 2022. However, until the labor force begins to grow in earnest, look for the unemployment rate to continue to constrict as it feeds job growth, and as a result, upward pressure on labor costs will persist.

Steig Seaward

Steig Seaward

Chris Zlocki

Chris Zlocki

Adam Schindler

Adam Schindler