At 555 Capitol Mall in downtown Sacramento, you can spend a full 12-hour day without ever leaving the office. A stabilized Class A office property totaling 389,000 square feet, 555 Capitol Mall has maintained a 94% average occupancy rate over the past four years, compared to downtown Sacramento’s Class A average of 83% during that period. This was achieved by the building’s unmatched amenities, strategic repositioning, and proactive space planning by the ownership group of Buzz Oates, property management of Rubicon Partners and brokerage services by Colliers.

Creating this seamless and amenitized experience is crucial for attracting office tenants. With the backdrop of lower leasing activity and shrinking office footprints across the country, amenities set a building apart from the competition. On-site food and beverage options provide a full experience for tenants. In addition, fitness centers and outdoor spaces, including rooftop decks or even outdoor workspaces, offer appealing choices for employees making the trek into the office. Given current office market dynamics, securing leases requires providing tenants with the means to entice their employees back to the office.

Some well-capitalized landlords are making sizable investments in amenities to reposition their assets and attract new tenants. In the National Landing area of Arlington, Virginia, JBG Smith is launching a $40 million effort to transform 2011 Crystal Drive, a 445,000 square foot building that is 43% vacant. To appeal to companies, the REIT plans to add new amenities, incorporating a grab-and-go market, coffee shop, cocktail bar, upgraded lobby, and first floor conference rooms. New floor-to-ceiling windows will be added to two vacant floors and new outdoor terraces will be constructed. According to JBG Smith’s Chief Strategy Officer Evan Regan-Levine, “… if we were going to capture a bigger piece of a shrinking pie, we wanted to make sure we were programming the elements of our office buildings the right way for how people are using space.”

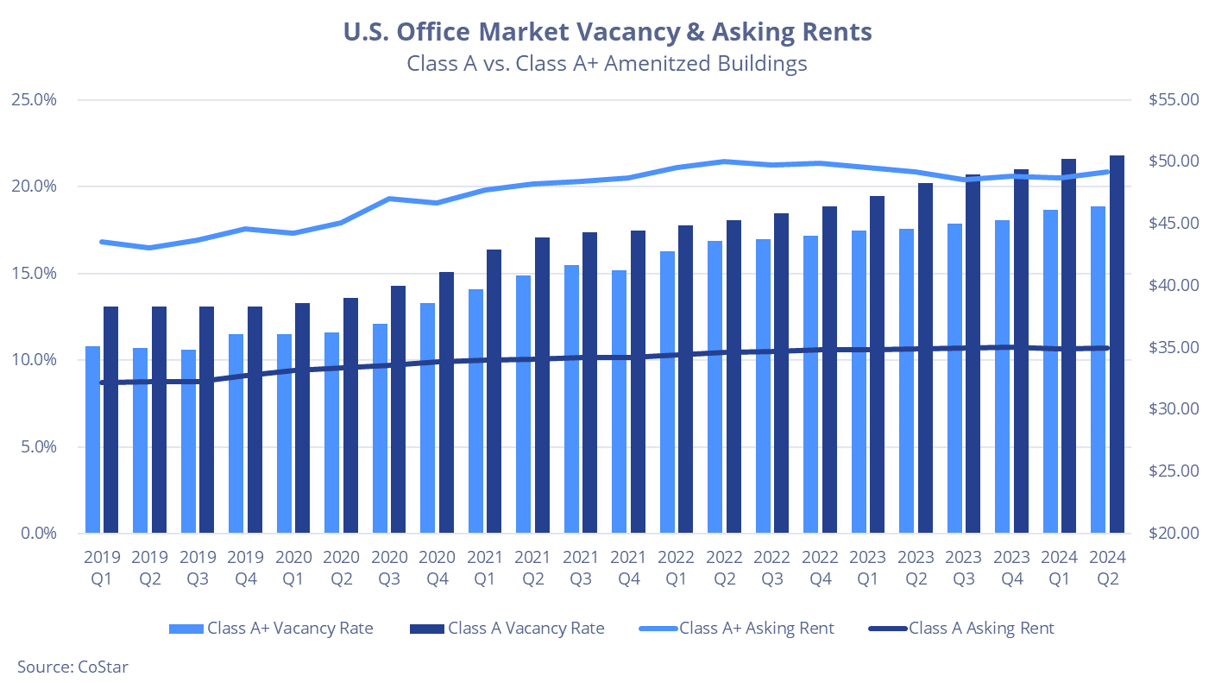

Highly amenitized buildings command higher rents and lower vacancy rates compared to the rest of the Class A market. According to CoStar data, analyzing the top one percent of the market (Class A+), which includes buildings that are LEED certified with restaurant or fitness center amenities and covered parking, the numbers tell the story. The Class A+ vacancy rate as of Q2 2024 was 10.8%, a full 230 basis points below the overall Class A market. In addition, Class A+ asking rents of $43.56 per square foot were 35.3% higher than the Class A asking rent of $32.20.

In Manhattan, the flight to quality trend is in full effect. The newest and amenitized buildings are garnering significantly lower availability rates and higher rental rates. According to Colliers New York Research, the availability rate for buildings completed since 2000 was 12.9% in Q2 2024. For comparison, post-1980 buildings’ availability rate was 19.4%, and market-wide availability was 17.9%. Asking rents for Manhattan’s post-2000 buildings were $106.78 per square foot as of Q2 2024, compared to $80.38 per square foot across Manhattan’s Class A inventory. In the Midtown submarket, availability stands at just 10.0% for post-2000 buildings, with asking rents of $95.17 per square foot. The weighted average taking rent for leases in post-2011 Manhattan office buildings was $112.70 per square foot in Q2 2024, compared to $71.87 per square foot for all other leases. There have been 19 leases with taking rents above $150 per square foot signed in the first half of 2024, compared to 27 all of 2023.

Downtown Chicago has seen a substantial rise in its vacancy rate over the past five years. Despite this shift in the market, Chicago’s Class A CBD asking rents increased to a record high of $50.05 per square foot in Q2 2024. High demand for premium, well-located spaces in trophy Class A assets are pushing overall CBD rents up, even as vacancies remain high in lesser quality buildings. Chicago’s high-rise buildings are $10 to $16 per square foot higher in each submarket than the overall average of Class A buildings. Among high-rise trophy assets in Chicago, which have the highest quality finishes and on-site amenities, asking rents averaged $66.55 per square foot as of Q2 2024, according to Colliers Chicago Research.

In San Francisco, one of the nation’s most dynamic but challenged office markets in the past five years, there has arguably never been a wider spread in rental rates across building classes, submarkets, and space orientation. According to Colliers San Francisco Research, Class A effective rents in the city averaged $73.51 per square foot in Q2 2024, compared to just $55.63 per square foot for Class B spaces. Effective rents for the highest-quality view spaces display a significant premium above market averages. The North Financial District and Jackson Square submarkets command some of the highest effective rents, highlighting the premium tenants are willing to pay for quality views and proximity to amenities.

Across all markets and industries, employers want to create a better experience for employees in the office. Fostering company culture through collaboration and community in the workspace is paramount. Some examples include shared social spaces, task-focused environments, and conference rooms set up with state-of-the-art technology to accommodate video conferencing. The era of low-cost cubicle farms is over as the square footage occupied per employee is notably increasing. The space tenants need today is geared toward collaboration. Conference rooms, huddle rooms, and breakout areas are therefore garnering a larger share of office spaces. Employees need to see the value in coming into the office, as most employers view in-person work as vital to the success of teams across various industries. Elevated tenant improvement allowances, spec suites built out by landlords, and more free rent are helping offset build-out costs, but financing this expense is a stark challenge for landlords.

Tenants need to evaluate their reasoning for returning employees to the office and align their goals with company objectives as opposed to a top-down return to office mandate devoid of purpose. Aligning office space design with organizational purpose requires a deliberate approach focused on activities and intent. For employees engaging in teamwork, space design must prioritize collaboration and social areas over individual work settings. Employees visit the office to interact and socialize, making a people-centric design crucial. Understanding diverse work modes and the shift towards bespoke, human-centric workspaces tailored to each organization’s values is essential for creating a supportive and inspiring work environment.

The way people work has changed dramatically, and the office of the future must be configured to accommodate employees prioritizing work-life balance. High-quality office spaces with desirable amenities can help companies retain and attract talent in a competitive labor market. Landlords can capitalize on this flight to quality and command top of market rents by being proactive in making significant upgrades to their assets to attract tenants. Adding amenities, offering flexible floor plan options, upgrading lobby and lounge areas, collaborating with tenants on space build-outs, and reimagining office spaces for companies adapting to the post-pandemic world are vital strategies to consider.

Presented by Colliers Tenant Advisory Council

The Colliers Tenant Advisory Council (TAC) is a global team of Colliers advisors who help navigate complex business and real estate solutions.

Click this link to view our previous TAC thought leadership post, titled, “Debunking Office Market Myths: Insights from Colliers’ Tenant Advisory Council.”

Sheena Gohil

Sheena Gohil Bobby Shanahan

Bobby Shanahan

Marianne Skorupski

Marianne Skorupski

Anjee Solanki

Anjee Solanki