The U.S. economy continues to expand in 2022, but at a much slower pace than in previous quarters. While 2021 economic growth was the strongest in nearly 30 years and the impact of COVID-19 is waning, concerns still persist as federal fiscal support has ended, the conflict in Ukraine remains an issue, and interest rate hikes recently began. In March, the Federal Reserve raised interest rates by 25 basis points in a step designed to lower prices that are rising at the highest level since the 1980s. While rising interest rates are not expected to have much of an impact on the industrial real estate market, the full implications of the decisions by the Fed will take several quarters to realize.

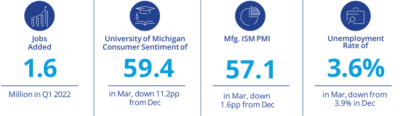

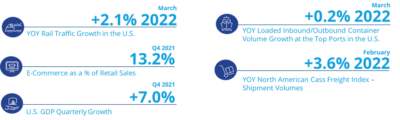

March economic indicators were positive, providing optimism for continued economic expansion. According to the Bureau of Labor Statistics, the economy added another 1.6 million jobs during the first quarter, with 431,000 jobs gained in March, to edge the employment rate down to 3.6%, down just 0.3 percentage points since the close of 2021. Month-over-month notable job gains continued in leisure and hospitality (+112,000), professional and business services (+102,000), retail trade (+49,000) and manufacturing (+38,000). Other sectors directly impacting the industrial market also showed positive momentum as job gains were also seen in construction (+19,000), while transportation and warehousing and wholesale trade showed little change.

Consumer sentiment is beginning to wane as declines have been recorded month over month since December 2021. According to the University of Michigan Consumer Sentiment Index, the consumer sentiment index reached 59.4 in March – an 11.2 percentage point decline from year-end 2021. Inflation, the potential impact of the Russian invasion of Ukraine and rising fuel costs are undoubtedly the greatest sources of uncertainty affecting consumer sentiment; however, the strong labor market could reverse some of the negative sentiment in the coming months.

As the impacts of inflation continue to reach consumers, American retail spending rose just 0.5% in March – lower than the 0.8% gain experienced in February. Furthermore, e-commerce, which experienced unprecedented growth throughout the pandemic, dropped 6.5% in March after declining 3.5% in February. According to the U.S. Department of Commerce, e-commerce accounted for a total of 13.2% in 2021, down from the 14% recorded a year ago. Soaring consumer prices have all but eroded the strong wage gains that Americans have seen thus far in 2022. Average hourly earnings for all employees declined 2.7% in March from the same month a year ago when factoring in the impact of rising consumer prices. As household spending falls, retail figures will likely remain subdued temporarily.

Economic activity in the manufacturing sector grew in March, with the overall economy achieving a 22nd consecutive month of growth, according to the Institute for Supply Chain Management’s Production Manufacturing Index (PMI). March PMI registered 57.1, which, while still positive, is 1.6 percentage points below December’s reading of 58.7. This represents the lowest PMI reading since September 2020. The outlook for the manufacturing sector remains positive, however, as progress is being made to solve the labor shortage issues at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries in the months to come. ISM also reported that 16 of the 18 manufacturing sectors it tracks saw growth in March. The two industries that contracted were wood products and petroleum and coal products.

While most economic readings remain positive, it is clear that a general slowdown of economic expansion is beginning to take hold. Moreover, supply chain challenges, online shopping deceleration, continued staffing shortages and rising costs will further impact demand in the coming quarters. Nevertheless, the outlook for the remainder of 2022 remains positive and demand for warehouse and distribution space remains high, which should keep industrial fundamentals favorable. Overall vacancy remains low in many industrial markets, which should keep the industrial development pipeline full to meet occupiers’ industrial space needs. The U.S. industrial market has been one of the strongest real estate sectors over the last two years, and that is not expected to change in 2022, despite the recent headwinds to the sector.

U.S. National Research

U.S. National Research

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka