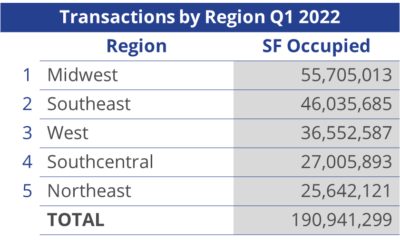

Following a year of record-setting industrial activity, momentum for the U.S. industrial sector continued at the beginning of the year. Increased activity in the bulk industrial market (companies occupying more than 100,000 square feet) was no exception, as demand for industrial space from bulk occupiers remains at unprecedented levels across the U.S. The scarcity of modern, quality space lingers in many markets, prompting a record level of new builds in core and smaller secondary industrial markets. In the first quarter, occupier activity in bulk industrial space doubled over the same time last year and totaled 190.9 million square feet, compared to 2021’s 93.8 million square feet. A total of 628 industrial (warehouse, manufacturing, and flex) new leases, renewals and user sales were transacted in Q1 2022, an 84.7% increase over the 340 transactions recorded at the same time in 2021. Interestingly, the average size of a bulk transaction in the first quarter was 304,000 square feet, just 10% higher than at the beginning of 2021.

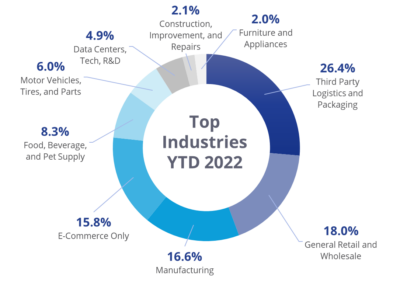

As supply chains continue to be retooled and the need for reliable distribution channels is paramount, third-party logistics (3PLs) and packaging companies accounted for 26.4% of all bulk activity. 3PLs, with many experiencing their highest revenues, remain the top occupier of industrial space, and this will continue as 3PLs play an integral part in many companies’ supply chains. While 3PLs were the top overall occupier, the data centers/tech/R&D industry more than doubled its space occupied in Q1 2021 and occupied 9.3 million square feet in Q1 2022 — marking the highest year-over-year market share increase of 67.3%. The construction, improvement, and repairs sector and the food, beverage, and pet supply sector also marked increased market share, at 61.7% and 50.2%, respectively.

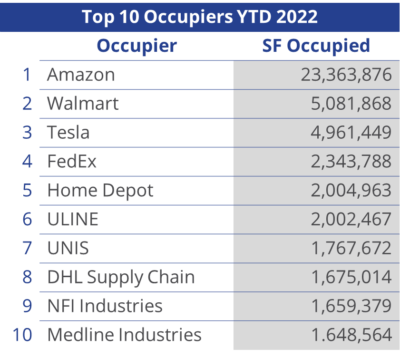

As expected, Amazon captured the top spot of bulk occupiers in the U.S. during the first three months of 2022, occupying 23.4 million square feet. Amazon’s market share, however, should begin to decelerate in the near future as the company has recently acknowledged that they have overbuilt their logistics network. Looking forward, Amazon has pledged to invest $1 billion into the development of supply chain, logistics and fulfillment technologies. Walmart and Tesla rounded out the top three bulk tenants in Q1 2022, occupying 5.1 million square feet and five million square feet, respectively. In addition, the Tesla Gigafactory was recently completed in Austin, TX, contributing to their activity.

Transactions in the Midwest accounted for 30.6% of all bulk occupier activity, followed by the Southeast region responsible for 24.7%. The Southeast region completed nine transactions larger than one million square feet including Amazon in Virginia, Dollar Tree in Florida, UNIS in Georgia and Walmart in Mississippi. Market activity in the Southcentral region was the slowest Q1 2022, accounting for just 8.3% of transactions signed, despite the addition of Tesla’s Gigafactory and four Amazon transactions larger than one million square feet each. Bulk activity in the Midwest continues to attract bulk occupiers who take advantage of its strong labor, transportation and logistics benefits, with 23 transactions in Midwestern states greater than 500,000 square feet.

After two consecutive years of record-shattering activity, bulk transaction volume is expected to moderate over the next few years. Projected headwinds of labor availability, supply chain constraints, land scarcity and increasing interest rates are not expected to diminish in 2022; however, demand for bulk space should remain stable throughout the remainder of the year. A record level of construction projects are scheduled to deliver by year-end, and healthy demand remains to occupy those facilities quickly.

Company Type Description:

Construction, Improvement and Home Repair: Warehousing and distribution of materials used in residential and commercial construction, improvements and repair, could contain some e-commerce components.

Data Centers, Tech and R&D: The use of industrial space for data centers and non-pharmaceutical R&D purposes.

E-Commerce Only: Warehousing and distribution of product that is ordered online and shipped directly to the end consumer only.

Food, Beverage and Pet Supply: Manufacturing, warehousing and/or distribution of food and beverage-related products. It could contain some e-commerce or manufacturing components.

Furniture and Appliances: Warehousing and distribution of retail and/or wholesale furniture and appliance products. It could contain some e-commerce and or manufacturing components.

General Retail and Wholesale: The warehousing and distribution of retail and/or wholesale products not listed in any of the other categories. It could contain some e-commerce or manufacturing components.

Manufacturing: Industrial space used for manufacturing and/or storage of raw materials and equipment used to manufacture non-automobile-related products.

Motor Vehicles, Tires and Parts: The warehousing, manufacturing and/or distribution of motor vehicles, tires and related parts and materials.

Third-Party Logistics (3PL) and Packaging: Third-party logistics and packaging of a wide variety of products, could contain some e-commerce components.

U.S. National Research

U.S. National Research

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka