As value retail evolves from bargain hunting into a strategic necessity, shoppers demanding price flexibility without sacrificing brand legitimacy or quality are prioritizing off-price retailers. One of the strongest beneficiaries of this behavioral shift is The TJX Companies (TJX), a global off-price leader with a highly diversified portfolio.

In fiscal 2025, TJX reported net sales of $56.4 billion, up 4% year-over-year, alongside consolidated comparable-store sales growth of 4%. At a time when many traditional department stores continue to struggle with relevance, traffic erosion, and margin pressure, TJX is capturing outsized market share by delivering consistent value at scale.

When Performance Fuels Physical Growth

TJX’s financial performance is directly reinforcing one of the most aggressive real estate strategies in modern retail. While many legacy brands reduced footprints or shuttered stores in 2025, The TJX Companies moved in the opposite direction, advancing plans to expand its global reach with 7,000 stores across its existing banners in North America, Europe (Spain in particular), and Australia.

In the U.S., TJX’s expansion strategy targets its three domestic business segments: Marmaxx, HomeGoods, and Sierra, with the continued success of the off-price model across all consumer segments and income levels driving this growth. A key component of this strategy is the rollout of smaller-format stores in untapped, rural, and semi-rural markets, extending reach while maintaining capital efficiency.

A Portfolio Built for Segmentation

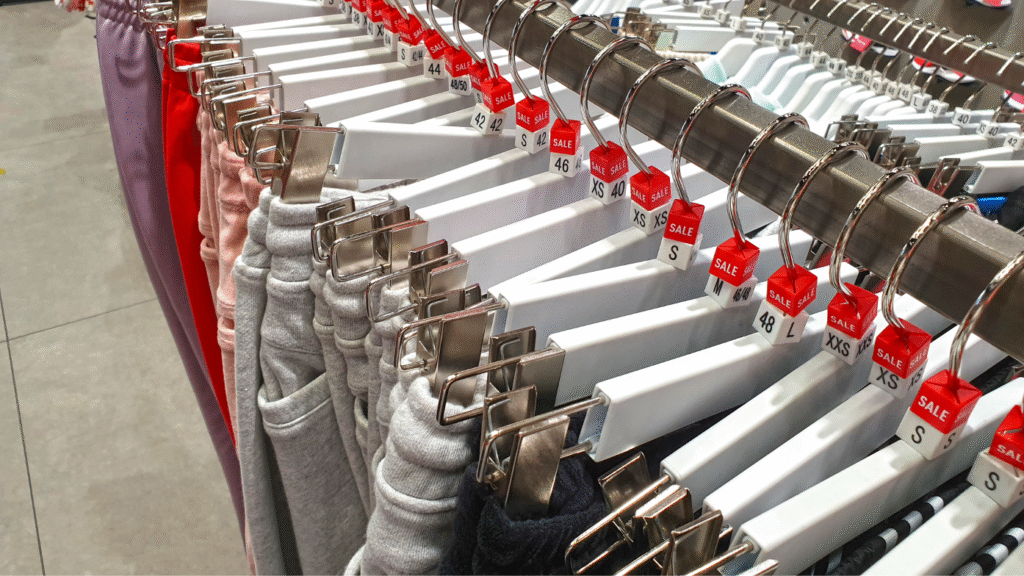

TJ Maxx is one of five retail brands within The TJX Companies portfolio — and arguably the one with the greatest cultural cachet. The brand offers a constantly rotating mix of recognized luxury and premium designer labels (including Gucci, Prada, and Zara), alongside contemporary brands and merchandise developed exclusively for its stores, all delivered at compelling price points.

Its sister brand Marshalls caters to mid-market consumers, earning a reputation as the place to “get the good stuff” — family-focused apparel, footwear, and home essentials at accessible prices. TJX also features two home and furnishings retailers: Homesense, which sells modern, large-scale furniture and décor, and HomeGoods, where shoppers “go finding” the best deals on home accessories, kitchenware, and linens. Completing the portfolio with Sierra (formerly Sierra Trading Post, acquired in 2012) positions TJX to capture outdoor and active consumers who might otherwise shop specialty retailers like REI but are seeking more value for their dollars.

The TJX Companies strategically targets different consumer segments, enabling it to operate multiple stores in the same market, each serving distinct audiences.

TJX Treasure Hunt Goes Social

Gamifying shopping in the pursuit of deals is one of the oldest retail strategies. From big-box chains to off-price discounters, nearly every format has its own variation — but few execute it as consistently as The TJX Companies. What’s changed in today’s retail landscape isn’t the strategy itself, but how a decentralized ecosystem of creators has expanded who does the hunting — effectively crowdsourcing the “treasure hunt” and turning TJ Maxx into a live, participatory event for millions.

Vloggers, creators, and resellers acting as personal shoppers livestream their in-store discoveries while audiences watch, react, and claim items in real time. This “Instacartization” of off-price retail transforms the physical store into both a fulfillment center and a content studio, collapsing discovery, entertainment, and transaction into a single, time-sensitive moment. Creators cultivate a captive remote audience willing to pay a premium, often including a finders fee and shipping, for the convenience and thrill of securing highly desirable, limited-stock items, effectively making each transaction part of a crowdsourced treasure-hunt experience.

However, this cultural explosion introduces a subtle tension at the store level. While TJX’s official Code of Conduct places limits on filming for commercial purposes, the reality is a nuanced “don’t ask, don’t tell” environment. Store teams may exercise discretion, recognizing that these creator-led “proxy shopping” moments often lead to incremental sales, contributing to the strong comparable-store performance the company is currently delivering.

At the same time, TJX is amplifying this dynamic through aggressive U.S. store growth, adding thousands of TJ Maxx, Marshalls, and HomeGoods locations nationwide – an expansion that essentially increases the “supply” of treasure-hunt moments. In this way, TJ Maxx has become one of retail’s most compelling experiential-adjacent store experiences: its ever-changing inventory and unpredictable timing create high-stakes watchable moments, where a $300 designer sandal spotted at $79 isn’t just a deal, it’s a viral event that reinforces the company’s status as a consumer anchor for 2026.

Anjee Solanki

Anjee Solanki

Nicole Larson

Nicole Larson