The rate of change in the world is continuing to accelerate. In the words of world-renowned venture investor and philosopher, Naval Ravikant, “The more complex the system, the faster the rate of change.” While at times unnerving, this rapid change creates a gap between the current state and the optimal, to maximize a firm’s probability for success. In this chasm lies the opportunity.

Every firm is attempting to maximize their risk-adjusted returns for their shareholders. This five-part series will unpack five prevailing macro trends shaping commercial real estate and provide a deeper look at how these forces are driving a chasm between the portfolios and financing structures occupiers currently have, and those that are required to minimize risk while maximizing returns.

In Part 1, we’ll unpack some of the data behind the shifting demographic landscape and the challenges that present employers, followed by a closer look at the AI revolution, Higher for Longer Interest Rates, the Green Transition, and Deglobalization.

The Demographic Time Bomb

Ray Dalio, the founder of Bridgewater, the world’s largest hedge fund stated, “Demographics are the most important factor that will drive the global economy over the next 30 years.”

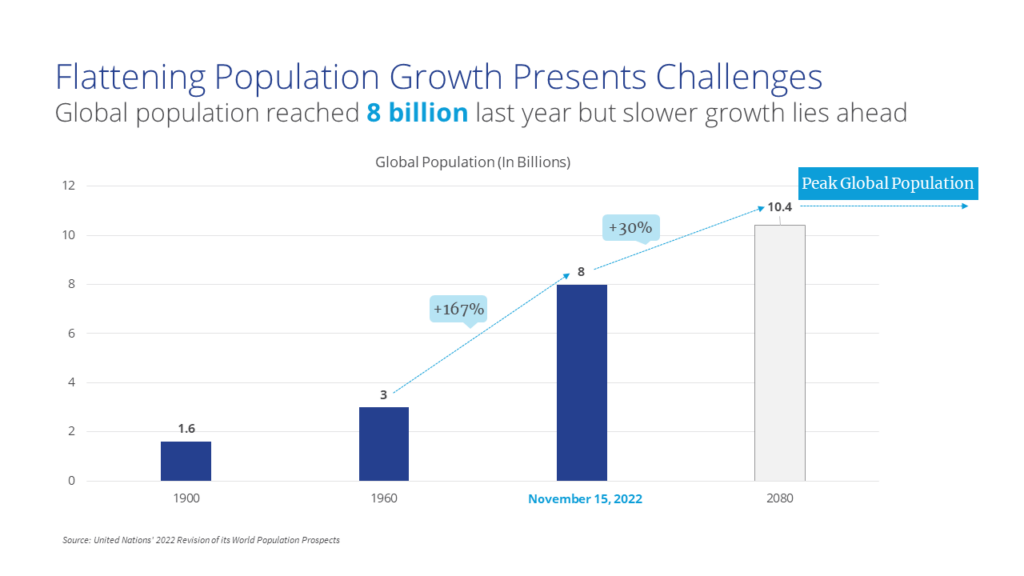

We have a labor shortage here in the United States with more than 1.5 job openings for every unemployed individual and this challenge will only grow in the coming years as global population growth stalls. In 1960, the world’s population stood at three billion. Just over six decades later, in November of last year, it reached eight billion. However, the projection for the next 60 years is far less impressive—an increase of only 2.4 billion people (as many as have been added since 1994) by the late 2080s, a time at which we will have reached peak population.

The striking fact is that this 2.4 billion in population growth is concentrated in Africa, as the rest of the world, has already reached peak population. This is a profound shift from the past, signaling a new operating environment for businesses where growth will be more challenging and access to labor will become even more constrained.

The 20-60 Ratio: Understanding the Labor Crisis

Labor availability has consistently been cited as the top risk to business disruption by CEOs according to Deloitte’s quarterly survey, and it is the top concern for CEOs when onshoring, per Chief Executive Group.

Labor availability has consistently been cited as the top risk to business disruption by CEOs according to Deloitte’s quarterly survey, and it is the top concern for CEOs when onshoring, per Chief Executive Group.

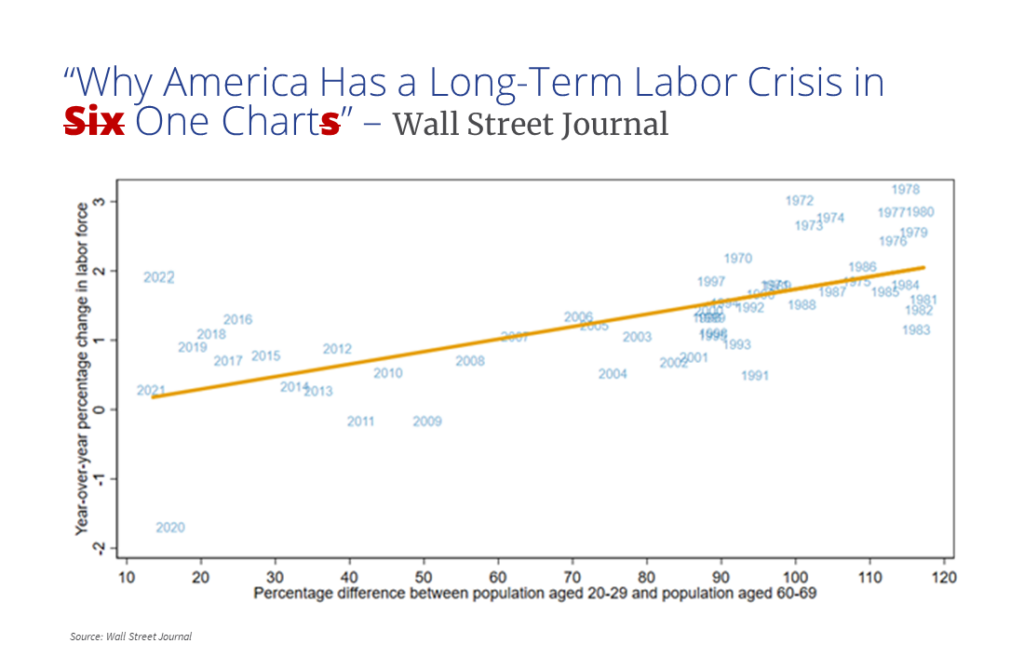

To get a better idea of this ongoing labor crisis, the “20-60 ratio” illustrates the profound impact. This ratio compares the percentage of 20-year-olds to the percentage of 60-year-olds in the United States. In the 1980s, during the last major battle against inflation, there were approximately 2 to 2.2 20-year-olds for every 60-year-old.

Fast forward to today, and the situation has drastically changed. The chart below shows that there are now only 10% to 15% more 20-year-olds relative to 60-year-olds.

This is because there were fewer people born in the United States between 1992 and 2001 than there were between 1952 and 1961, driving the flat demographic environment we are now in. This demographic shift has a direct impact on the labor force growth and sets up a persistent labor shortage.

Flattening Demographics Reshape Business Paradigms

In a world that is changing faster than ever before, awareness of shifting demographics is crucial for business leaders as they think about future-proofing their real estate portfolio. Locating in markets with favorable population growth characteristics such as Florida, Texas, the Carolinas and other pockets of the Sun Belt will give employers a leg up in the war for talent.

We’re already seeing this play out as occupiers cite that the top three criteria when thinking about a new location are all directly linked to labor, according to the 2023 Annual Area Development survey.

Businesses that understand and adapt to these demographic changes will be better poised to navigate the uncertainty that lies ahead. In the words of the late Sam Zell, “Investors (and occupiers) who ignore demographics are doing so at their own peril.”

Bret Swango, CFA

Bret Swango, CFA

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka