The green transition taking place in the U.S. stands as a core pillar transforming the economy and commercial real estate at large, and it’s one of the five macro trends I’ve identified as shaping the future of the industry.

As Part Four in this five-part series, I’ll take a deeper dive into the influence of the green transition, examining the driving forces and wider ripple effects on manufacturing, investment, and more.

“The energy transition is the most important investment theme across all asset classes.”

-Scott Lebovitz, Co-Head CIO of Infrastructure, Asset Management, Goldman Sachs

Unprecedented Funding Propels the Green Transition

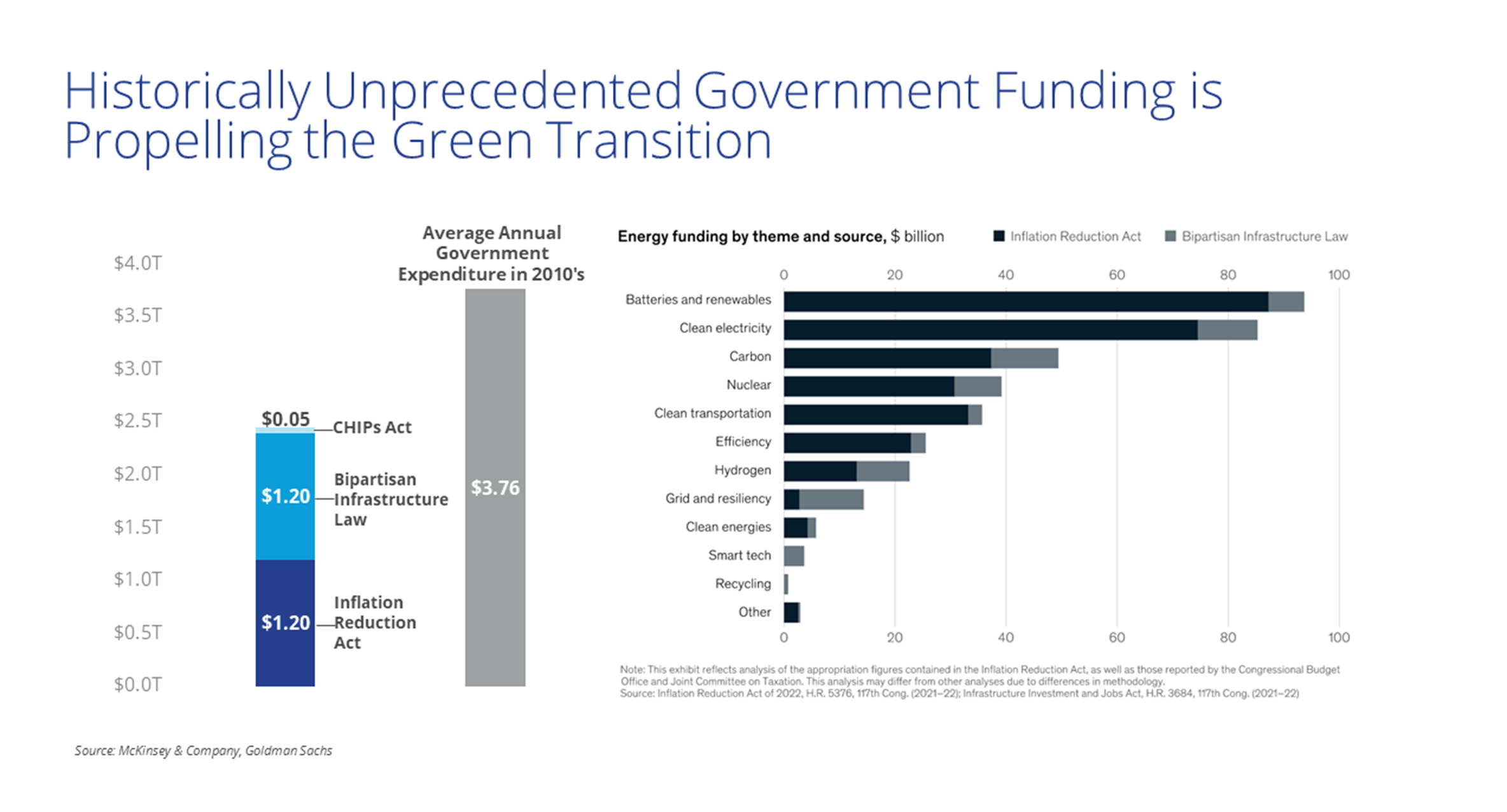

Recently, important legislative moves like the Bipartisan Infrastructure Law (BIL), the CHIPS Act, and the Inflation Reduction Act have gained attention, producing both anticipation and scrutiny. The latter has garnered mixed opinions as some experts I’ve consulted caution that this bill will likely be net-inflationary in the short to medium-term. As we navigate these changes, it becomes crucial to keep a watchful eye, especially amid hopes for declining rates.

The sheer scale of the allocated funds, roughly two and a half to three trillion dollars, places it in perspective when compared with the average annual government budget of the previous decade ($3.7T). It’s like a company earmarking roughly 65% to 80% of its revenue for specific projects. These initiatives primarily revolve around green energy and defense, fueling projects that will shape the landscape of commercial real estate.

Acceleration of Mega Project Activity

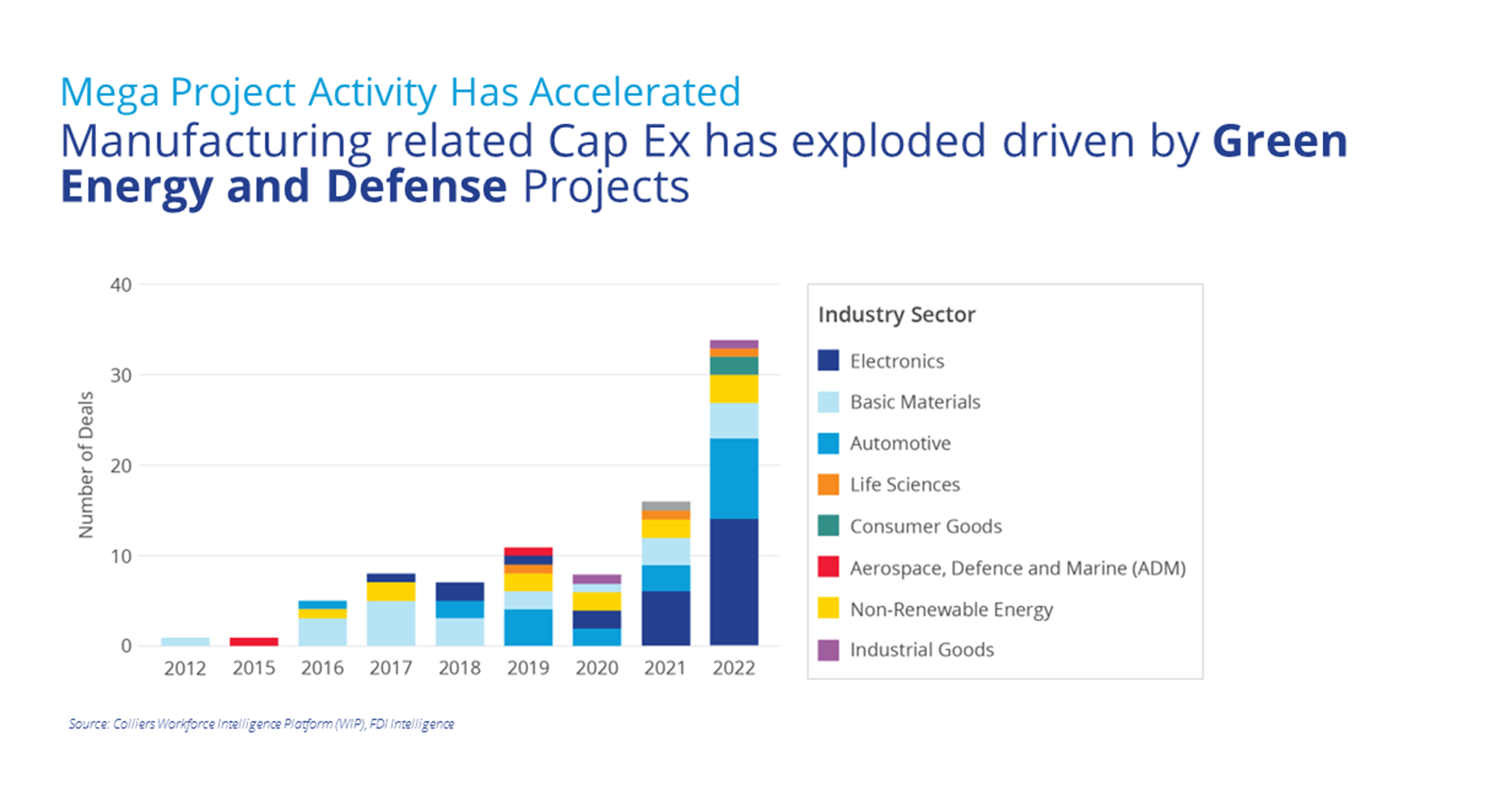

This infusion of funding into green energy initiatives has catalyzed a historic volume of mega-project ($1B+) activity. Zooming in on the green energy spectrum, the rise in electric vehicles, advancements in battery technology, and the proliferation of solar demand underscore a large shift toward sustainability. Simultaneously, the defense sector has experienced a surge, marked by increased investments in aerospace and engineering, driven, in part, by escalating global tensions.

The semiconductor industry has also taken center stage, grabbing headlines and investment dollars alike. This sector’s strength links with various tech-driven facets of real estate, influencing the direction of innovation hubs and data centers.

Furthermore, another notable trend has emerged, which is the reevaluation of the supply chain, especially in domains like chemicals and pharmaceuticals. The disruption caused by the pandemic prompted a rethinking of overseas production and a trend toward domestic manufacturing and reshoring, which I will explore in Part 5 of this series.

Implications for Commercial Real Estate

We’re seeing the ripple effect of these developments manifest in a surge of demand for domestic manufacturing projects. A commonality across all these projects is a demand for heavy power. This manufacturing activity alongside the booming data center sector has put significant strain on our nation’s power grid, making heavy power availability the scarcest element in the value equation of many sites under consideration for such projects. The need for heavy power has driven increased demand for existing manufacturing sites with existing infrastructure and presented challenges for developers hoping to convert new speculative warehouses into manufacturing assets.

Bret Swango, CFA

Bret Swango, CFA

The need for heavy power has driven increased demand for existing manufacturing sites with existing infrastructure and presented challenges for developers hoping to convert new speculative warehouses into manufacturing assets.

This green transition is not just a trend but a force reshaping the dynamics of the industry. For investors, developers, and stakeholders in the commercial real estate ecosystem, it’s imperative to monitor these signals, understand the changing landscape, and harness the opportunities presented by this green transition.

Stay tuned for the final installment of this series, which will cover the topic of Deglobalization. Otherwise, be sure to read Part One, Part Two, and Part Three.

Craig Hurvitz

Craig Hurvitz Justin Smutko

Justin Smutko

Aaron Jodka

Aaron Jodka