As a Valuation Group, we are often asked about the different types of reports we provide and in what scenarios these reports would be justified. When determining this, keep in mind that it is all about the “Scope of Work” that the client and the appraiser decide upon. It is important to know your intended user. Below is a breakdown of the types of typical reports, the intended user as well as typical fees.

Narrative Appraisal Report – A Narrative Appraisal Report is a detailed and comprehensive document that provides an in-depth analysis that explains the appraiser’s methodology, reasoning and supporting data to determine the valuation of a property. The report contains a narrative description of the property being appraised, including its location, physical characteristics, improvements descriptions, full market analysis, a highest and best use analysis, and valuation methodology. The level of detail in the report is based on the scope that is decided upon between the client (lender) and the appraiser. It is common for larger national institutions to require a more detailed report, while local and regional banks are satisfied with a more summarized version. The reports can range from 50-100 pages and typical fees range from $4,000 to $5,000.

This report type is typically utilized for mortgage lending, insurance, taxation, estate planning, and investment analysis.

Restricted Appraisal Report – A Restricted Appraisal Report is a condensed version of a Narrative Appraisal Report that is limited in scope and intended for specific purposes. It is commonly used when a client or intended user has a sufficient level of knowledge about the property being appraised and local market conditions and does not require the level of detail provided in a narrative appraisal report. Much of the data collected for these reports is retained within a work file produced by the appraiser. These types of reports can range from 15-30 pages and typical fees range from $2,500 to $3,000.

Restricted Appraisal Reports are commonly used for internal purposes, such as by property owners, financial institutions or experienced real estate professionals who have a thorough understanding of the property and market. They are generally not intended for distribution to external parties or for use in mortgage lending or other situations where a more comprehensive and detailed report is required.

Evaluation Reports – Numerous lending institutions across the nation are moving towards Evaluation Reports, or “Evals” for certain types of assignments. This option is similar to a Restricted Appraisal Report in the sense that the reporting within the analysis is nominal in comparison to a Narrative Appraisal Report. Evaluation Reports are commonly used in situations where there is a need for a quick estimate of value, such as for portfolio analysis, lenders requiring quarterly, semi-annual or annual updates of an asset, or preliminary assessments. They are less formal than appraisal reports and may not require adherence to specific appraisal standards or regulations. These types of reports can range from 10-15 pages and typical fees range from $800 to $1,500. These reports are new to the industry but starting to pick up momentum. The use of Evaluation Reports should be considered within the context of the specific situation and the intended purpose. These reports are typically utilized by the property owner or someone familiar with the property who does not need an in-depth account of the improvements or operations of the property.

Feasibility Studies / Advanced Market Studies – For potential new construction, we are often asked to provide either a feasibility study or a market study on a potential site to determine if it is feasible for development. Again, the level of detail in this analysis is based on the scope agreed upon between the lender/developer and the appraiser. We complete approximately 40-80 of these assignments nationwide each year. These reports typically range from $3,000 to $5,000.

This report style is typically used by a developer/investor when determining if a property type is appropriate for its surrounding area. The report can provide a developer/investor flexibility when raising funds to start a project or in working with a potential lender. If completing this type of report for a developer, it can often disqualify us from doing the appraisal for the lender. Communication with the lender is important!

Trade Area Studies – A trade area study is a condensed version of the Advanced Market Study. This report includes a verification of the supply in the trade area (typically within a 3-to-5-mile radius), rental rates and demographics. This report can be completed on either a proposed development or an existing development. The level of detail in this analysis can be customized to meet the needs of the lender/developer and is a useful first step in determining the fundamentals in the trade area. The typical fees range between $1,500 to $3,000.

Consulting Assignment – Different than the standard reports above, we also offer consulting services for borrowers, lenders, and brokers. These can consist of sizing up deals, creating proformas and/or providing historical and current market data. Although we are more than willing to help clients out with any information we have, consulting assignments typically take a deeper dive into a market/ property. This can also include litigation assignments.

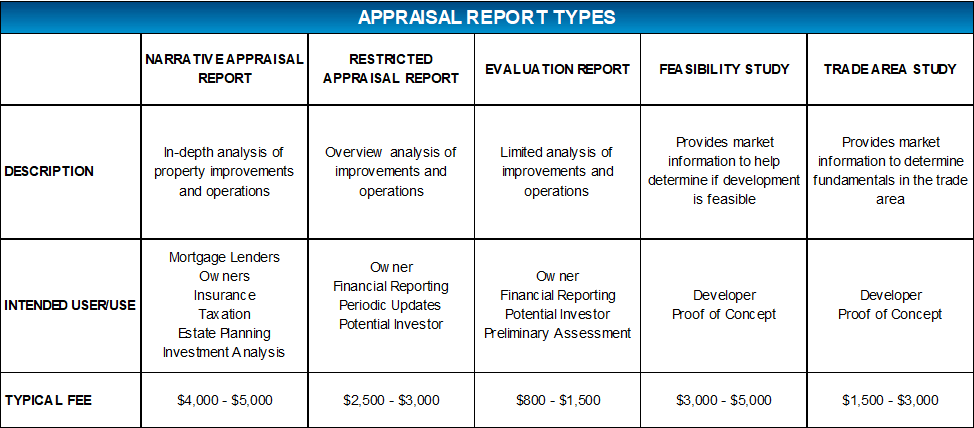

The table below outlines the basic structure of the five appraisal report types.

Robert Allen

Robert Allen

Nick Michael

Nick Michael Matthew Mintier

Matthew Mintier Chris Stickney

Chris Stickney

Nancy Caniff

Nancy Caniff

Justin Butler

Justin Butler