While core industrial markets continue to thrive, Colliers’ latest research report—10 Emerging U.S. Industrial Markets to Watch in 2022—explores the markets positioned to experience the most robust increases in demand from occupiers and owners. Learn more about one of these markets: Savannah.

“Between existing market tenants discussing expanding and newcomers circling, 2022 should be another strong year for the Savannah industrial market. There is currently a total of 21.2 million square feet under construction at midyear, and 2.2 million square feet has been delivered year-to-date. How quickly the market can absorb the speculative space under construction will determine the next wave of development, but if the Port of Savannah continues to expand at the rate it has, the Savannah industrial market won’t be far behind it.” – Paul Sweetland, Senior Vice President | Las Vegas

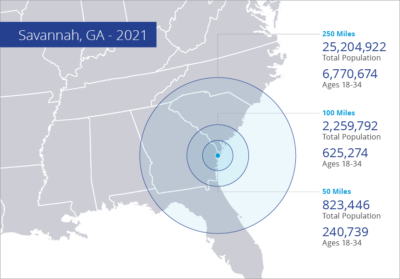

KEY STRENGTHS: Savannah is home to the largest single-terminal container port in North America which is also the fastest growing and third busiest port in the United States. With pricing high in NY/NJ, LA and Long Beach, many groups have expanded or relocated entirely to Savannah in favor of the cheaper rents and access to the explosive population growth in the Southeast over the last decade. The shift to e-commerce purchasing by consumers has accelerated market growth resulting in Savannah ranking #1 nationally in total industrial space under construction as a percentage of total inventory, among markets with over 75 million square feet of industrial space.

LOGISTICS DRIVER: The major driver of the Savannah market remains the Georgia Ports Authority, the third largest and fastest-growing port in the United States. The Port of Savannah has moved a record amount of cargo in 2021, seeing containers up 20% when compared to the previous year. Overall, the port processed a total of 5.6 million TEUs for the year. The port experienced 12 consecutive months of record container growth for 2021. With $3.2 billion planned for expansion and infrastructure improvements over the next 10 years, Georgia Ports Authority shows no signs of slowing down.

VACANCY: Overall vacancy dropped dramatically in year-over-year and measured just 0.6% at midyear, down from the 4.2% measured during the same period in 2021. With many spec projects leased prior to delivery, midyear vacancy is the lowest it has been. Ongoing leasing activity in 2022 will cause more pressure on vacancy and could push vacancy even lower by year-end.

ABSORPTION: Overall net absorption totaled 5.9 million square feet at midyear, more than double over the 2.3 million square feet absorbed at midyear 2021. Total absorption, as a percentage of total inventory, was 6.1% year-to-date which will surely make Savannah one of the top markets in the country once again.

DEVELOPMENT: Industrial development activity is strong and varied in the Savannah area. At midyear, 21.2 million square feet were under construction in the Savannah market in a wide range of sizes from 100,000 square feet to three million square feet. With more projects under development, investors are taking a harder look at Savannah. More than 7 million square feet has either been leased or has a lease pending within spec buildings that are still under construction and slated to deliver by year-end.

ASKING RENTS & SALES ACTIVITY: Overall rental rates are expected to increase as new quality developments are added to the inventory and demand continues rising. Rental rates for warehouse/distribution space measured $5.14 per square foot and investment cap rates have risen slightly, but remain lower than the national average.

To learn more, explore the 10 Emerging U.S. Industrial Markets to Watch in 2022.

U.S. National Research

U.S. National Research

Craig Hurvitz

Craig Hurvitz

Aaron Jodka

Aaron Jodka